-

Banks, thrifts and credit unions brought in $32 billion in overdraft revenue last year, a 1% increase from 2011, according a new study.

March 18 -

Susquehanna Bancshares (SUSQ) in Lititz, Pa., has settled a lawsuit with customers who challenged the $18 billion-asset company's overdraft fees.

February 27 -

The Office of the Comptroller of the Currency assessed a $33 million enforcement order against Woodforest National Bank of The Woodlands, Texas, for unfair and deceptive practices in its overdraft program.

October 11 -

Reps. Maxine Waters, Carolyn Maloney and 44 other lawmakers introduced a bill Wednesday to address numerous concerns about overdraft fees.

March 20 -

The San Francisco startup creates software that connects banks and lenders to consumers, helping people gain credit to pay bills.

January 22

More community banks are preparing to fight payday lenders and technology upstarts for a bigger share of short-term, small-dollar loans.

For smaller institutions such One PacificCoast Bank in Oakland, Calif., and National Bank & Trust of Sycamore in Illinois, the battle isn't about booking loans. Rather, the goal is to win back fee income that community banks have ceded to others in recent years.

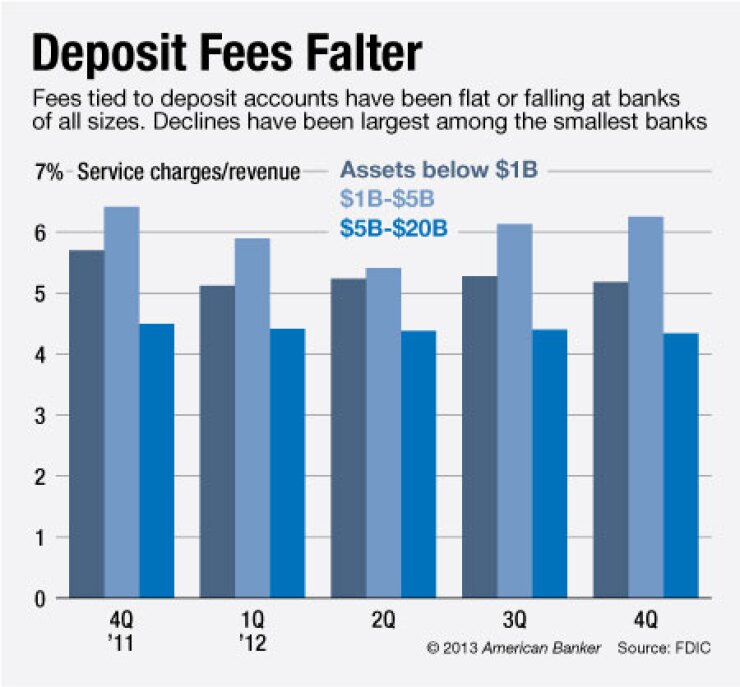

During the fourth quarter, service charges at banks with less than $20 billion in assets fell 3% from a year earlier, to $1.96 billion, according to the Federal Deposit Insurance Corp.

Payday lending is a factor, says Brad Brown, senior vice president of retail banking at National Bank & Trust. He found out how pervasive payday loans were among his customers after the $592 million-asset bank bought a software program to assess its overdraft fees.

"There were so many [automated] debits coming through for payments on payday loans," Brown says. "I wasn't aware of the volume of our clients using" payday lenders.

National Bank is looking into offering individual clients credit lines for up to $1,000. It is also planning a tiered overdraft system, where only a small number of customers pay higher fees.

Tiered overdraft could add $80,000 to $120,000 in annual revenue at National Bank, Brown says. "We think it will be a way to compete with payday lenders, largely for people who want to avoid overdrafts," he says.

First Financial Service (FFKY) in Elizabethtown, Ky., also charges a variable overdraft fee, based on how often a customer bounces a check. The system offered a way to enter the short-term liquidity market, because many of First Financial's clients were already using overdrafts, says Greg Schreacke, the $1 billion-asset company's president. "They just assume we cover their checks, so they don't have to worry about it," he says.

One PacificCoast also has an alternative to paycheck advances. The $282 million-asset bank offers a service to employers that lets workers take out small-dollar loans. Executives at the bank could not be reached for comment.

Payday lenders, for their part, wonder why it took community banks so long to realize the need to go on the offensive.

"The traditional banking market hasn't worked for the middle class, but there's an absolute need" for these products, says Amy Cantu, a spokeswoman for the Community Financial Services Association of America, the trade association for payday lenders.

There are potential pitfalls for banks that raise their overdraft fees. Consumers have

Legislative concerns also exist. Earlier this month, House Democrats

Still, small banks are ignoring demand for short-term liquidity services at their own risk, says Robert Giltner, a consultant at Velocity Solutions who advises banks on retail products. Bigger banks like Fifth Third (FITB) and Regions Financial (RF), along with credit unions and other nonbanks, are developing small-dollar loan products, he says.

"So many community banks are defensive about their overdraft fees, but overdrafts are a service and people ought to be able to do what they want," Giltner says. "We're losing the battle against other companies that are servicing customers better than we are."

Technology-oriented firms also want a bigger piece of the action. BillFloat, which raised $21 million in venture capital in January, already

BillFloat will soon launch a product to partner with small banks to offer loans, says Ryan Gilbert, the San Francisco company's chief executive. "Banks are in an extremely powerful spot in terms of the data they have on" customers, he says. "We can use that data to make better decisions on approving loans."