After paying higher deposit insurance assessment fees since the financial crisis, community banks are poised to get a break.

The Deposit Insurance Fund's ratio of reserves to insured deposits is nearing a threshold it is expected to hit later this year that will trigger a temporary

It could equal a nice chunk of change for some institutions. The $9.7 billion-asset Provident Financial Services in Iselin, N.J., for example, paid $3.5 million in Federal Deposit Insurance Corp. assessment fees in 2018.

It's unclear how many banks will find the result financially material enough to improve earnings, said Kevin Fitzsimmons, an analyst at FIG Partners. But it’s certain to lower costs at least somewhat, which “could be another victory for community banks,” he said.

Moreover, each bank gets a chance to decide how it will use the extra funds, Fitzsimmons said.

“Will it flow to the bottom line, simply be used to offset increased spending else, such as technology or mobile” banking apps? Fitzsimmons said.

An FDIC spokeswoman declined to comment.

The idea to give small banks a break was part of the Dodd-Frank Act’s plan to replenish the DIF after the financial crisis. The 2010 financial reform law mandated that once the ratio of reserves to insured deposits hit 1.15%, big banks — and not community institutions — should be largely responsible for boosting the fund to a statutory target of 1.35%.

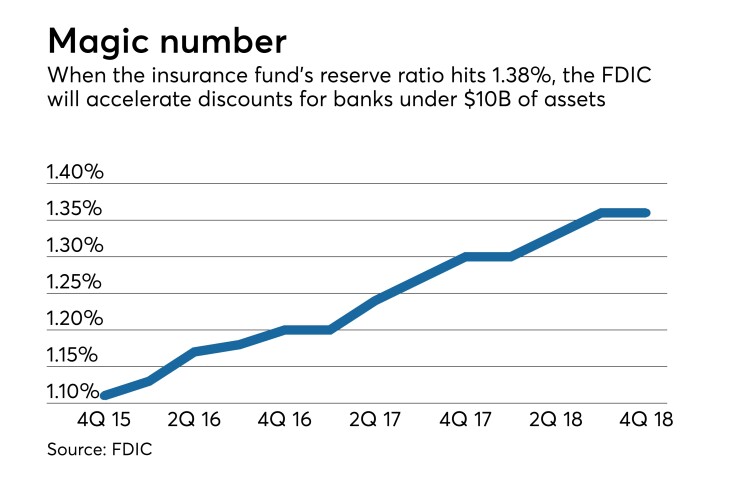

Large banks began paying a surcharge on assessments in the third quarter of 2016, which ended when the fund hit 1.36% in the third quarter of last year. Small banks, meanwhile, continued to pay premiums when the fund hit 1.15% but racked up credits for their portion of assessments responsible for getting the fund to 1.35%. Once the fund reaches 1.38%, the FDIC will automatically apply those credits to reduce a small bank’s regular premium. That discount can total the entire amount of an assessment.

Once that happens, about $765 million in credits will be distributed to 5,269 banks with assets of less than $10 billion. The amount each bank receives will be determined by a formula based on asset size. The credits will be distributed as long as the DIF reserve ratio is at 1.38% or higher and will last until each bank has exhausted all of its credits. The credits are expected to last between three and four quarters for each bank.

Although privately held banks are not required to break out their FDIC insurance assessment costs, many publicly traded banks provide that detail in quarterly earnings reports. That has allowed insight into the breaks that big banks have received after the end of the surcharge.

At the $14.7 billion-asset South State in Columbia, S.C., for example, FDIC assessment fees dropped $1.2 million from the third quarter to the fourth thanks to the elimination of the surcharge.

CIT Group’s fourth-quarter deposit insurance costs fell 12% to $14 million from the previous quarter, “primarily" as a result of the reduction in the DIF surcharge, John Fawcett, CIT's chief financial officer, said during the $49 billion-asset company’s earnings conference call.

The DIF reserve ratio has been steadily climbing over the past few quarters as reserves have grown. The ratio jumped from 1.11% in the fourth quarter of 2015 and reached 1.36% in the third quarter of last year.

Jason Goldberg, an analyst at Barclays, estimated that for the primarily large banks he covers, the elimination of the DIF surcharge reduced expenses by a total of $900 million, or 1.2%.

At Dec. 31 the deposit insurance reserve fund held $102.6 billion, compared with a total of $7.5 trillion in outstanding insured deposits.

Banks could receive even more good news in the coming years. If the DIF reserve ratio passes 2%, assessment rates will be lowered. Until then, the assessment rates will remain the same.