-

An increase in fee income fueled StellarOne (STEL) in Charlottesville, Va., in the fourth quarter.

January 24 -

Bank of the Ozarks (OZRK) of Little Rock, Ark., posted a fourth-quarter profit gain despite sliding interest income, thanks in part to an acquisition that closed late in the year.

January 17 -

Community banks are likely to look at trimming more costs in 2013 as investors insist on improved efficiency.

January 10

Community banks are managing to wring out higher profits, but a number of fourth-quarter trends indicate they are running out of options to pad the bottom line.

Average fourth-quarter net income rose 2% from the third quarter and 32% from a year earlier, based on American Banker analysis of more than 150 banks and thrifts with assets of $35 billion or less. But much of that improvement has come from

Small banks struggled in the fourth quarter to post meaningful net interest income growth, given soft loan demand and interest rates that remain at or near historic lows. That narrative will likely continue throughout this year, industry experts say.

"It's a pretty good storm, maybe not a perfect storm," Randy Dennis, president of DD&F Consulting Group, says of small banks' challenges. "I just don't see a lot of upside. Generally there is a sense that markets are improving across the country, but that's not translating into a lot of new loan growth."

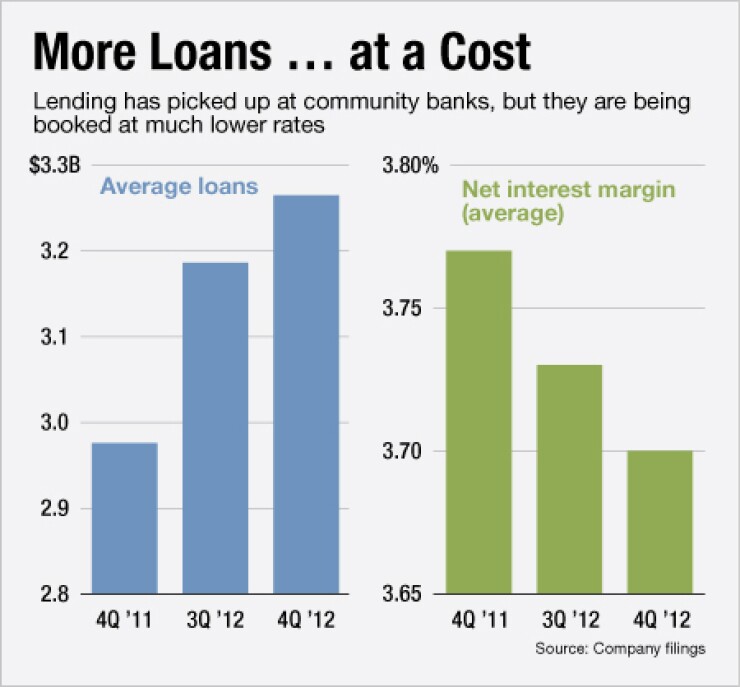

A critical tug-of-war existed in the fourth quarter between loan growth and shrinking net interest margins. When the dust settled, net interest income, on average, was flat from the third quarter and up just 3% from a year earlier.

Loan portfolios are expanding; the average book increased 2.5% from the third quarter and nearly 10% from a year earlier, indicating to industry observers that loan demand slightly exceeded expectations.

Some borrowing likely involved companies taking out loans late last year to pay accelerated dividends as the fiscal cliff loomed, says Jeff Davis, managing director of the financial institutions group at Mercer Capital. That phenomenon might lead to lower loan volume in the first quarter, which typically has soft demand anyway, Davis says.

Pricing continues to work against small banks as they chase a shrinking number of qualified borrowers, industry experts say. Net interest margins continued to compress in the fourth quarter. Net interest margins, on average, have compressed 3 basis points from the third quarter and 7 basis points from a year earlier, according to American Banker research.

Margins are expected to keep shrinking as the year wears on, industry observers say.

To combat margin troubles, community banks are focusing on fee revenue and expense control. Average noninterest income rose 5% from the third quarter and 29% from a year earlier, based on the banks that have reported quarterly results.

A large portion of fee revenue has come from refinancing activity, an earnings stream that could all but disappear by mid-2013. Still, community banks are looking at other ways to generate fees, including check-cashing fees for noncustomers and higher fees for ATM use. They are also trying to expand wealth management operations and investment services, industry experts say.

Smaller banks must study "every service they provide and ensure that they are being fairly compensated by their customers for providing those services," says Lynn David, president of Community Bank Consulting Services in St. Louis.

Banks historically have completed a formal account analysis for the top 10% of their biggest business customers, David says. Today, they should examine 70% of their business customers to see if there are services that merit charges, he says.

Banks are also

A number of banks are scrutinizing everything from traffic patterns, to see where they can cut branch hours and staffing levels, industry observers says. Others are

"Banks are continuing to cut costs, but you can't save yourself into prosperity," Dennis says.

StellarOne (STEL) in Charlottesville, Va., was among the companies that

The company's noninterest expenses fell almost 3% from a year earlier, to $23.8 million, because of decreased costs tied to compensation and benefits.

"One of the areas that has benefited from this low-rate environment has been" mortgage lending, Ed Barham, StellarOne's president and chief executive, said during its quarterly earnings call. "We realize that a heavy reliance on mortgage lending for sustainable revenue growth can become a problem at the point that rates again begin to rise, and especially if you have built a business model around refinances."

But refi revenue and cost cutting only provide short-term benefits, industry experts say. Investors will get anxious for banks to display sustainable revenue growth, Davis says. This pressure, paired with the costs of new regulation, could trigger the long-anticipated consolidation boom.

So far, aspiring buyers have claimed that sellers' pricing expectations

"It doesn't cost buyers much to take a very long view, particularly if they are sitting on healthy capital levels," Reider says. "Yes, they would be thrilled if they can take their money and buy a bank, but it's not the end of the world to say, 'I will sit with this money in my war chest and just wait you out.' "

The fate of small banks may also be tied to geography. Regions such as the Midwest and the Northeast are generating better growth than other areas, industry experts say.

Large-scale banking consolidation will likely remain sluggish, industry experts say. Davis says mergers will likely to rev up in 2014 after the industry struggles through another tough year of declining net interest margins.

"It's not like we have a huge group of banks" in dire straits, Reider says. Banks "can linger for a lot of years in this condition. They won't thrive, but they are not on the verge of unsound capital levels."