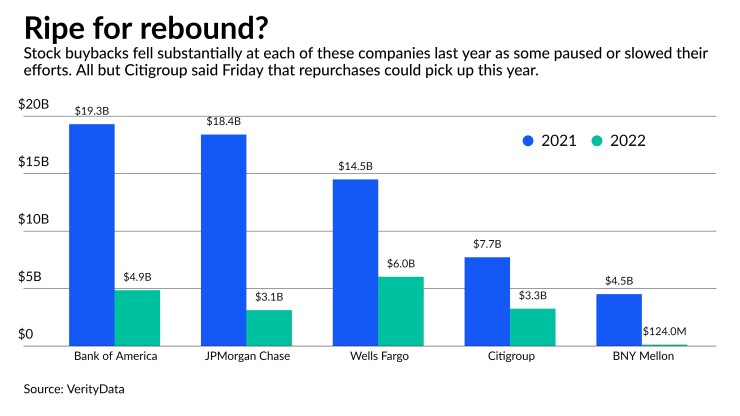

Big banks are revisiting their share buyback programs as they start the new year, with several laying out plans to step up shareholder payouts after a cautious 2022.

Executives at JPMorgan Chase and Wells Fargo, which had paused buybacks in the second half of the year, said on their latest earnings calls that they expect to resume buybacks this quarter. Bank of New York Mellon announced a $5 billion repurchase plan after dramatically pulling back last year.

And at Bank of America — whose 2022 slowdown in buybacks was less pronounced than at its competitors — CEO Brian Moynihan said capital is "well above" regulators' required minimums and gives it flexibility for buybacks.

"We're back in the game," Moynihan said on the Charlotte, North Carolina, company's earnings conference call Friday.

The revival of big banks' buybacks is a boon for investors. Though they continued paying dividends last year, banks scaled back their buybacks programs for a variety of reasons. Some faced higher capital requirements after the Federal Reserve's stress tests at the same time that worries over the economy grew and sharply higher interest rates

The rate picture has stabilized as the Federal Reserve begins

"The gloom and doom scenarios, I think, are being taken off the table," Leon said.

The exception in the buyback comeback on Friday was New York-based Citigroup. Chief Financial Officer Mark Mason told investors that Citi "will remain on pause and continue to make that decision quarter by quarter."

The bank has been bolstering its capital buffers after the Fed raised its required minimums by 1 percentage point. Citi hit its 13% target for its common equity tier 1 ratio during the fourth quarter, but the company's expectations of a temporary impact from its ongoing international

"As soon as we're able to do buybacks, we will," Mason said. "I mean, that is part of the way we deliver value for our shareholders."

BNY Mellon had a steep drop-off in repurchases last year, buying back just $124 million in stock in 2022 compared with $4.5 billion a year earlier, according to the analytics firm VerityData. The trust bank's bond portfolio suffered last year as a result of the Fed's inflation-fighting efforts, with rate hikes that prompted losses across the bond market.

BNY Mellon ended the year "comfortably above our capital management targets," giving it flexibility to return to buying back shares, CEO Robin Vince said.

The bank's board approved the $5 billion program, though its timing and amount of activity "is subject to various factors, including our capital position and prevailing market conditions," CFO Emily Portney said.

JPMorgan Chase, which also faced higher capital requirements after the Fed's stress tests, said its strong earnings helped it meet its internal target a quarter earlier than expected. CFO Jeremy Barnum said analysts should expect about $12 billion in buybacks this year, but noted that repurchases "are always at the end of our capital hierarchy" as it thinks about how to deploy excess capital.

"If we have better uses for the money, those will come first, and the timing and the conditions of how much we do when is entirely at our discretion," Barnum said.

Wells Fargo also expects to resume its buybacks after taking a breather last year and has "substantial capacity," CEO Charlie Scharf told analysts, though he also noted any decisions will be based on market conditions.

Banks are also preparing for potential increases in capital under the Fed's new vice chair for supervision, Michael Barr,

But Wells Fargo CFO Michael Santomassimo noted any changes to capital rules are "not going to happen in a day" and that the bank has a sizable cushion compared with its current standards.

"We're well above our current regulatory minimum and the buffers that are included there," Santomassimo said. "So we have plenty of flexibility regardless of any outcome."