WASHINGTON — The Senate Small Business and Entrepreneurship Committee voted 18-1 in favor of a bill aimed at curbing the

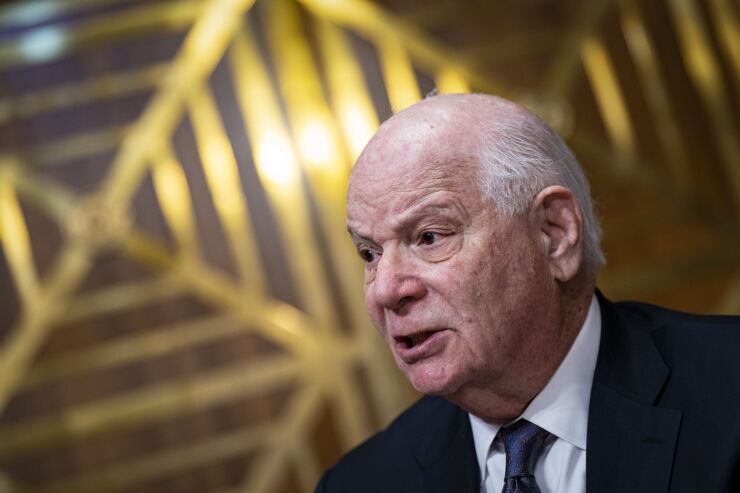

The legislation, from Small Business Committee Chairman Sen. Ben Cardin, D-Md., and ranking member Sen. Joni Ernst, R-Iowa, was passed as part of a broader small business package and comes in response to

Sen. Rand Paul, (R-Ky.), cast the sole opposing vote against the bill.

At issue is an SBA rule that would eliminate a moratorium that has limited the number of nondepository institutions that qualify as small-business lending companies, or SBLCs. The rule would allow new for-profit SBLCs — including potentially fintechs — to offer 7(a) loans and would create a new category of nonprofit mission-based SBLCs that would focus on serving underserved markets and demographic groups.

But lawmakers are increasingly interested in overseeing the SBA's lending program, particularly as it relates to the fintech intermediaries that want to disburse funds from the SBA's lending programs. Those fintechs, critics say, were part of

Critics of the Biden administration's SBA changes, including traditional banks, have raised concerns over potential risks associated with these modifications. They argue that an increase in riskier loans, as a result of the proposed changes, could place a heavy financial burden on the program.

The bill now proceeds to the full Senate.