-

Borrowers with a first-lien modification and home equity line of credit could face a spike in their monthly mortgage obligations when the interest rates on both loans reset next year.

July 16 -

A down payment remains a high hurdle for consumers seeking mortgages. Lowering this hurdle increasingly seems in line with industry and regulatory goals-assuming borrowers don't default. There's the rub.

June 12

There is a Phil Rizzuto in the home lending business again, and that's appropriate, because home equity is making a comeback.

Rizzuto, a third cousin and namesake of the baseball player and 1980 celebrity

It is sheer coincidence that he and his distant relative both have a connection to the business, Rizzuto said. "It's kind of ironic," he said. "He was the spokesman for The Money Store, which was all about home equity."

It's been tougher to originate a first lien loan since rates jumped above record lows in 2013. But as higher rates reduced refinancing opportunities and the attractiveness of home purchases, gains in home values occurred in many areas. So homeowners with existing loans who wanted to access more cash for home improvements or other needs began to look to second liens instead, said Rizzuto.

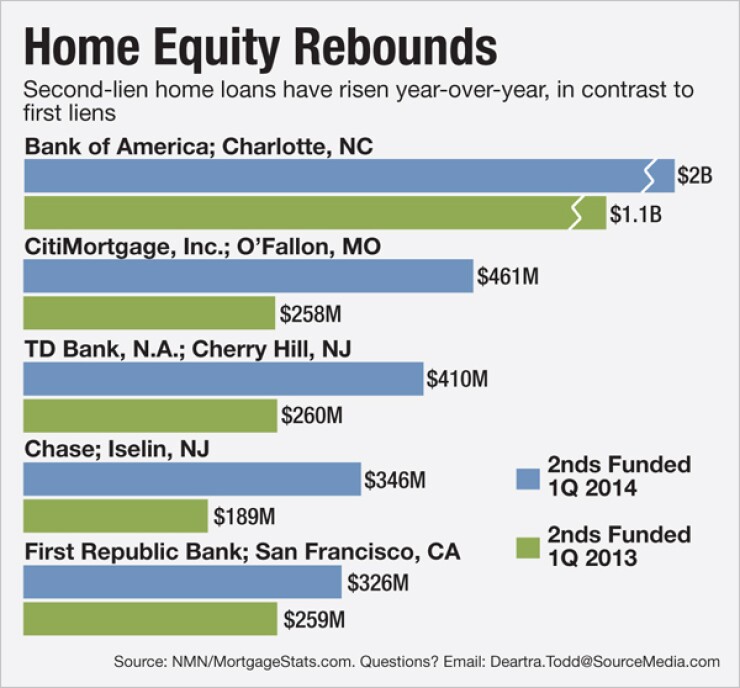

The top 10 funders of second lien mortgages wrote $4.6 billion of such loans in the first quarter, up 44% from a year earlier, according to MortgageStats.com.

The big question about open-ended home equity lines of credit and closed-end loans is whether they are worth the risk. Second liens proved particularly tough to work out in the midst of massive defaults on many types of home loans originated between 2005 and 2007. The concern still haunts the market today, as a

Underwriting criteria like loan-to-value ratios are much stricter than during the boom-bust period, and there is careful consideration of differences in regional housing markets and layers of risk in underwriting now that didn't exist when those lines were originated, said Rizzuto.

"Back in the 2000s, folks were comfortable going up to 100% financing on the LTV. They started to pull that back down to 70, 80, or 90. There's been some due diligence to make sure that credit is available, keeping in mind all [risk] attributes like FICO score and LTV," he said.

Among the loan performance risks in seconds is the one implicit in their name. They are second in line for repayment, so they are more likely to be wiped out by distress than first-lien holders are. But they have other attractions for investors.

Second-lien holders have some leverage in distressed situations. Short sales, for example, can't go forward without their blessing. And borrowers are often more likely to make second lien payments than first lien payments simply because they seem more manageable, some observers say.

"Even though, from a waterfall standpoint, you're sort of in the back of the line as an investor, borrowers are making second lien payments almost primarily because they are smaller loans and they're smaller payments," said Frank Pallotta, CEO of CMF Management in Ramsey, N.J. Pallotta is working on a Canadian mortgage finance project, but previously worked in the U.S. with distressed collateral and nonconforming securitizations.

New second liens are generally not securitized today.

"There really is not a secondary market that exists right now for [new] home equity loans," said Rick Seehausen, the CEO of LenderLive Network, an outsourced fulfillment services provider in Glendale, Colo. Citizens holds most of its new second liens in portfolio, Rizzuto said.

Among the implications for some banks in second lien lending's return has been a change in the product's regulatory treatment under ability-to-repay rules that went into effect in January, Seehausen said.

The ability to repay rule

Others have had to cross departmental lines. At Citizens, Rizzuto said, "home lending handles both mortgage and home equity, so we had our mortgage team to help with change on the home equity loan, and our equity team continues to originate and process our HELOCs."

Like Seehausen, Rizzuto said that the difference in regulatory treatment does not affect the home equity product mix. "There are a few other things that we need to get from the customer because of that requirement but I don't know if that necessarily slows [origination] down," said Rizzuto.

The ATR rules give second liens some advantages over

The smaller size of second liens helps lenders avoid making higher-priced loans that receive a lesser degree of liability protection, she said, because the rules give smaller loans more leeway in determining whether a loan is high-cost.