-

Bank regulators on Thursday sent banks revised instructions on managinge potential risks from leveraged lending.

March 21 -

Insurers, private-equity firms and others could swoop in and take underwriting and syndication business (and employees) from banks held back by new capital requirements.

March 19 -

Bonds are poised to widen their advantage in yield over leveraged loans again after three years of narrowing. Higher demand for leveraged loans and interest-rate concerns are major reasons.

March 4

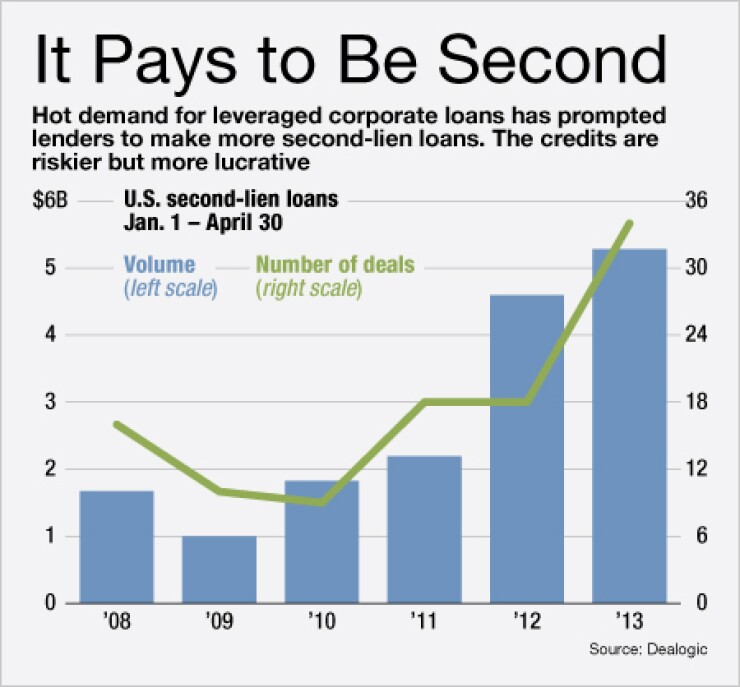

Leveraged loans are in such high demand that lenders are increasingly willing to stand further back in line to be repaid.

The volume of U.S. loans with a second lien on a company's assets reached $5.3 billion in the first four months of the year, according to Dealogic. That's an 15% increase from the $4.6 billion over the same period last year. It is the highest volume through April 30 since $18 billion in 2007.

Second-lien loans are sandwiched in the capital stack between first-lien loans and unsecured bonds. Borrowers use them to fill small gaps between their funding needs and the maximum amount they can borrow from senior lenders against their collateral. If senior lenders will only lend 80% of the value of the collateral, for example, second-lien lenders might advance against the remaining 20%.

In exchange second-lien lenders typically get a higher interest rate than they would on senior debt that is also secured.

Second-lien loans have increased along with overall new issues in the leveraged loan market this year. U.S. companies closed on $130 billion in loans through April 30, an increase from approximately $90 billion at this point in 2012, according to Dealogic.

Money has been pouring into the loan market via mutual funds, exchange-traded funds and collateralized loan obligations. Leveraged loan mutual funds and ETFs have taken in more than $17 billion year-to-date, net of withdrawals, according to Lipper FMI.

"In general, it's a reach for yield in a supportive credit environment," said a Boston-based portfolio manager in an email. "Yields that high are very rare even in the bond world these days. I suspect it's also a broadening of the base from mostly CLOs and hedge funds in 2007."

Risks come with the rewards. Experts have warned banks — which play several roles in the leveraged-lending market, including making the loans and investing in deals — to adhere to prudent underwriting standards.

"Regulators are concerned that leveraged loans' high nominal yields may cause inappropriate growth in the activity by banks," banking consultant J.V. Rizzi wrote in a

The Federal Reserve Board, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency in March

The revised guidelines focused on several areas, including establishing a sound risk management framework; and realistic risk-rating of leverage loans.

NFR Energy completed the largest second-lien tranche this year with a $775 million loan marketed by Bank of America Merrill Lynch (BAC), Citibank (NYSE:C) and Natixis in January. Proceeds, along with new equity from sponsor First Reserve and revolver borrowings, were used to fund the acquisition of TLP Energy and certain Eagle Ford Shale assets from two independent oil and gas companies for $736 million.

Drug store chain Rite Aid issued the second-largest second-lien tranche of 2013, a $470 million loan completed in February. It was part of a larger refinancing transaction.

Second-liens currently on the market include Coinmach Services, which is seeking a $325 million second-lien along with a $770 million first-lien loan, according to KDP Investment Advisors. Lead underwriter Deutsche Bank (DB) is talking the first-lien loan at Libor plus 350-375 bps; price talk on the second-lien loan was not available at press time. Lender Commitments are due May 10.

Electric utility PowerTeam Services also has a $140 million first-lien loan and a $385 million first-lien loan on the market. It is offering to pay Libor plus 725 bps on the second lien, more than double the Libor plus 325 bps on the first lien.

The lowest yielding second-lien loan that closed in the month of April had a spread of Libor plus 750 bps. By comparison, the average high yield bond yielded 5.29% as of May 1, according to the JPMorgan Chase (JPM) high-yield monitor.

Bank of America Merrill Lynch leads the second-lien bookrunner ranking in 2013 year-to-date with a 17.6% market share. JPMorgan follows with an 8.7% share and Morgan Stanley (MS) is a close third with an 8.5% market share, according to Dealogic.