Charles Shaffer quickly followed in the footsteps of his predecessor at Seacoast Banking Corp. of Florida.

Shaffer succeeded Dennis Hudson III as the company’s president and CEO

More deals could follow for Seacoast over the rest of year, and South Florida remains fertile ground.

“We certainly could accommodate another acquisition if something came up that made sense,” Shaffer said during a Wednesday conference call to discuss the Legacy deal.

“We've done three deals in a year — back in 2017 — so if we found the right opportunity, we certainly would look at it,” Shaffer added. “I think there will be a fair amount more opportunities for us. There's a lot of deal conversations occurring in the marketplace.”

Shaffer, who had been Seacoast’s chief operating officer, made clear that the company’s M&A strategy remains intact. The company remains focused on high-growth and affluent markets such as Broward and Palm Beach counties where it already is a major player. The Gulf Coast area that includes Naples and Tampa also holds appeal.

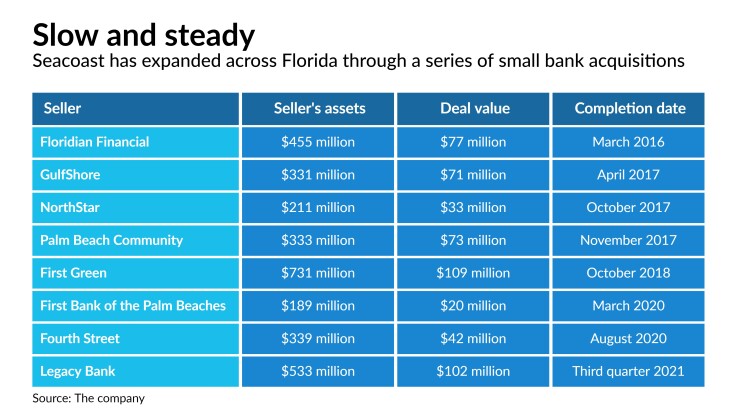

Most of the company’s growth in those markets has come from acquisitions. In the last six years, it expanded in South Florida with the purchases of Grand Bankshares, Palm Beach Community Bank, First Green Bancorp and First Bank of the Palm Beaches.

Shaffer said South Florida is recovering faster from the pandemic than most states because of fewer government-imposed business restrictions in Florida, along with a surging influx of businesses, capital and new residents from northern states.

“What’s happening in South Florida is remarkable, with an impressive migration from the Northeast, bringing affluence, corporate relocations and meaningful population growth,” he said during the call. “This transaction further positions Seacoast to capture this significant market transformation.”

With the Legacy acquisition, Seacoast, which is based in Stuart, Fla., would have the eighth-biggest deposit market share in the Miami area among community banks and the top share in Palm Beach County, according to the Federal Deposit Insurance Corp.

“Post-pandemic, the demographics in South Florida are stronger than ever, and banking services' demand and underlying franchise values are rising,” said Christopher Marinac, an analyst at Janney Montgomery Scott.

While Seacoast has been viewed by some as a possible seller, Shaffer’s promotion and an immediate return to M&A indicate that the company plans to remain independent for the foreseeable future, said Stephen Scouten, an analyst at Piper Sandler.

“If they were for sale, I think they’d attract a lot of eyeballs,” Scouten said. “But I don’t think they are.”

Seacoast has room to grow over several years in South Florida on its way to about $15 billion of assets. At that point, Scouten said it likely would have to decide whether to expand into neighboring states or sell.

Legacy fits the blueprint for previous Seacoast deals.

It provides Seacoast with a digestible balance sheet — $432 million of deposits and $482 million of loans — and the change to cut about 45% of Legacy’s annual operating expenses. With that in mind, Seacoast said the deal should be 6% accretive to its 2022 earnings per share.

Seacoast’s executives said they can earn back any dilution to the company’s tangible book value in a matter of months.

Shaffer said he projects mid- to high-single-digit loan growth for Seacoast and Legacy over the second half of 2021. After the deal closes, likely in the third quarter, Seacoast would offer more products and services to Legacy customers, including wealth management, mortgage banking, Small Business Administration loans and various consumer products.

While Seacoast would first consider smaller deals to stay below $10 billion of assets, the threshold where banks give up interchange income and draw more regulatory scrutiny, Shaffer said the company has the wherewithal to pursue $2 billion-asset targets.

“We prefer the smaller deals; the execution risk is lower,” Shaffer said.

“We prefer the infill-type situations where we find them,” he added. “If we were to cross $10 billion, the deal would have to deliver in a way that keeps our shareholder returns where they are today. We're very cognizant of valuation and what drives valuation, and it's something that we'll remain very focused on as we get near the $10 billion” level.

Scouten said that, after Paycheck Protection Program loans roll off each bank’s books, Seacoast will likely have about $8.5 billion of assets. That would leave it room to do two more deals relatively soon like the one for Legacy before worrying about the $10 billion threshold.

“That’s my guess — two more smaller deals near term,” Scouten said.