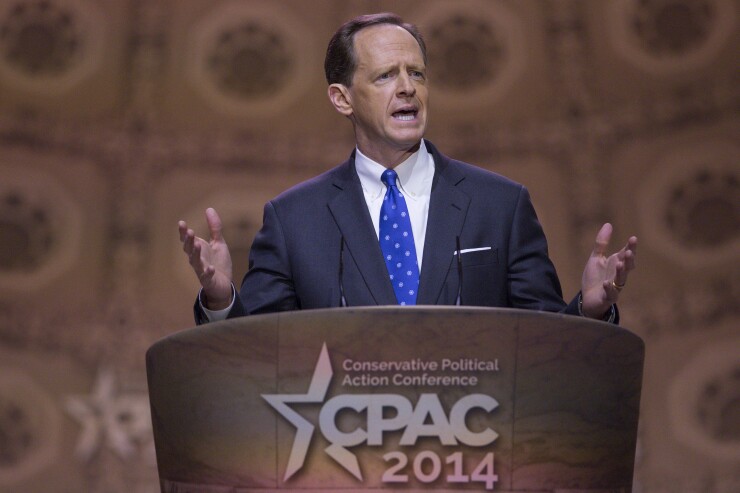

WASHINGTON — With slim odds of getting eight Democrats to support major Dodd-Frank Act reforms, Republicans will have to use other measures to make changes to the 2010 reform law, Sen. Pat Toomey, R-Pa., said Thursday.

“I don’t see much prospect in getting eight Democrats” to support "big things,” Toomey told an audience at the U.S. Chamber of Commerce.

Toomey said that one tool will be the Congressional Review Act, which allows Congress, through a majority vote, to roll back rulemakings that were finalized in the last 60 legislative days. Republicans have already used the law to repeal more than a dozen rules that were finalized in the waning days of the Obama administration, but Toomey said "the clock runs out on formal rulemakings" soon.

"We are rapidly approaching what we can do” using the Congressional Review Act, he said.

But Toomey said that the "statute is very clear" that informal rulemakings are eligible for the review act as well.

“Sometimes it happens through the issuance of other devices, guidance letters, for instance, agency [Frequently Asked Questions], financial institution letters,” Toomey said. “These kinds of actions have the power of a rulemaking, which is the same as saying they have the power of law. They exist outside the traditional rulemaking.”

Toomey said that Congress can ask the Government Accountability Office to determine whether a piece of guidance or a letter has the power of law and that if GAO determines that it does, then it would be subject to Congressional review, and could be repealed by a majority vote.

Toomey told reporters after his speech that he is already in the process of reviewing “several” pieces of guidance that have been issued by financial regulators and “we are in the process in determining if we can get a GAO determination.”

Some industry representatives appeared interested in pushing it even further. Dorothy Savarese, the chairman of the American Bankers Association, asked if the review law could be used to overturn enforcement actions.

"We will take a look at that," Toomey replied.

Toomey is also continuing to push fellow Republicans to use another obscure legislative process, known as reconciliation, to make changes to Dodd-Frank. The reconciliation process allows changes that are related to the budget and, like the Congressional Review Act, only requires a majority to pass.

Toomey said he believes reconciliation would be best suited to make changes to the Consumer Financial Protection Bureau and the Federal Deposit Insurance Corp.'s Orderly Liquidation Authority because Democrats will filibuster any law that includes measures directed at those items.

“We are very unlikely to get eight democrats to come join us in any major reforms of the CFPB, which I think are long overdue,” Toomey said. “The reconciliation device I think … allows us to just do that."

Toomey added that he would also support getting rid of the CFPB altogether and returning its consumer protection powers back to the federal financial regulators.

While possible, such a move may be politically risky for Republicans. Although bankers passionately oppose the CFPB, it is politically popular with most voters, including those who identify as Republican.