Regulators and bankers worked together Wednesday to craft new contingency plans in the wake of Hurricane Katrina's devastation.

John Ducrest, Louisiana's banking commissioner, said he was negotiating with federal regulators to allow banks to share branches. One teller line at an operating bank would be dedicated to customers of a bank whose branches were closed by flooding.

Pat Barron, the first vice president of retail payments at the Federal Reserve Bank of Atlanta, said the central bank stands ready to lend but has not yet had much demand.

"Most of the individuals are basically in a rescue-and-survival mode. The last thing on their mind is trying to find an ATM machine," he said. "Our concern, just like everyone else's, is health and human services. I'm sure banks, just like everyone else, are worried about that first, and worried about their businesses second."

How regulators respond may be the single most important key to survival for the Gulf Coast banks hit hardest by the nation's worst storm in 13 years.

"New Orleans is going to be a ghost town for at least three months, and the question is: What are the regulators going to do about this?" said James Schutz, and analyst with Sterne, Agee & Leach in Birmingham. "Regulators are going to have to cut small banks a lot of slack."

But Bert Ely, a consultant in Alexandria, Va., said liquidity issues could still sink some small banks.

"If the community has been wiped out and is nonfunctioning, how can the bank function?" he said. "Particularly if you don't have a strong capital base and strong management, you are going to have a harder time surviving. I just think we are going to lose some of the weaker players here."

Looking further down the road, bad loans could threaten banks, said L. William Seidman, a former Federal Deposit Insurance Corp. chairman.

"The banks may have some real problems because they will have some loans on property down there that aren't insured," he said. "If anything over 5% to 6% of their loans go bad, then they are in some serious trouble. If they have 9% to 10% go bad, then it would be doubtful that a bank can recover unless somebody comes along with a huge amount of capital and bails them out."

It's hard to predict what will happen, because limited communication has made damage assessment difficult.

"I've covered a number of banks that have been involved in serious hurricanes. … None of them have involved the degree of damage that this one has," Mr. Schutz said.

"In all the cases I can contact the chief executives or senior officers of the banks the next day, [but] the 504 area code has disappeared."

State and federal bank regulators have held twice-daily conference calls since Monday to discuss the status of certain financial institutions.

"The main thing we want to do is have contact with the institutions but stay out of the way so they can resume operations," said John Corston, associate director of supervision and consumer protection at the Federal Deposit Insurance Corp.

Banks are supposed to have some operations running within 24 hours, and this includes the ability to allow customers to access their accounts.

Mr. Corston said the agency does not think Katrina will cause a bank failure, mainly because all financial institutions are required to have examiner-approved contingency plans. Also, no bank has failed in recent memory because of a natural disaster.

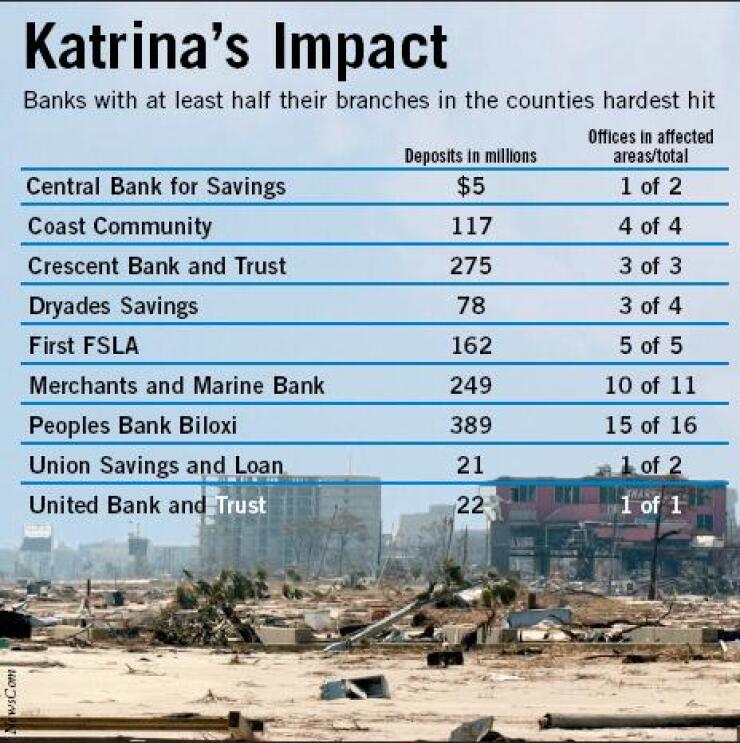

But the most vulnerable banks are those without operations beyond the affected areas.

For example, in New Orleans, the $307 million CB&T Holding Corp. has all three branches of its Crescent Bank and Trust in the city, and the $106 million-asset Dryades Savings Bank has all but one of its four offices and 90% of its deposits there.

On the Gulf Coast of Mississippi, the $664 million-asset Peoples Bank Biloxi has all but one of its 16 branches in the affected area plus 98% of its deposits. Others with concentrated operations are the $364 million-asset Merchants and Marine Bank, with all but one of its 11 branches on the coast; the $227 million-asset First Federal Savings and Loan Association, with all five of its branches; and the $203 million-asset Coast Community Bank, with all four of its branches there.

Much of southern Mississippi is still without power. Mac Deavers, the executive director of the Mississippi Bankers Association in Jackson, said many affected banks are relocating operations to the northern part of the state. He said he has yet to hear from some of the smaller banks on the Gulf.

"I don't think banks anticipated it being quite so bad, and a lot of banks are scurrying down there and still trying to get communication established," Mr. Deavers said.

Mr. Ducrest said bankers would get early access once anyone is allowed back into New Orleans.

"The biggest question banks have is 'When can I get back in and look at my facilities and assess damage?' " he said. "And we don't know when, but it will be before the general public."

Peter Gwaltney, the executive director of the Louisiana Bankers Association, said that most banks with large New Orleans operations have put their disaster recovery plans in place and are relocating to Baton Rouge.

Hancock Holding Co. of Gulfport, Miss., said it had temporarily relocated its corporate headquarters to Baton Rouge. Whitney Holding Corp. of New Orleans said it moved its senior management to Houston.

However, Mr. Gwaltney said, the backup plans for many of the smaller banks in New Orleans did not account for such "widespread damage."

"Community banks that have most of their locations in New Orleans have a monumental task ahead of them to get operations back up and running and serving customers again," Mr. Gwaltney said.

At midday Wednesday the Web sites and consequently online banking at Crescent Bank and Dryades Savings were still down.

The bigger banks in both Mississippi and Louisiana were scheduled to hold separate conference calls Wednesday to discuss how they might help banks in the hard-hit areas, particularly the smaller banks without operations elsewhere.

"Banks are sticking together and leaning on each other, and competitive issues are out the window," Mr. Gwaltney said.

Rusty Cloutier, the chief executive officer of the $511 million-asset MidSouth Bank, said that banks in less-affected areas, such as Lafayette, La., where his company is headquartered, are coming to the aid of New Orleans banks. They are offering office space and computer systems. Because everyone is pulling together, he said, he does not think Katrina will be the end of any of them.

"It's going to be a challenge and it's going to be difficult, but they will get through this," he said.

Though the near-term outlook is bleak, over the longer term the region's banks should benefit from the deposit influx from insurance settlements and a boom in construction lending.

"Time and time again we see an adverse impact on operations because of a hurricane, and it's only temporary before the local economy starts booming again when the insurance money comes in," Mr. Schultz said.

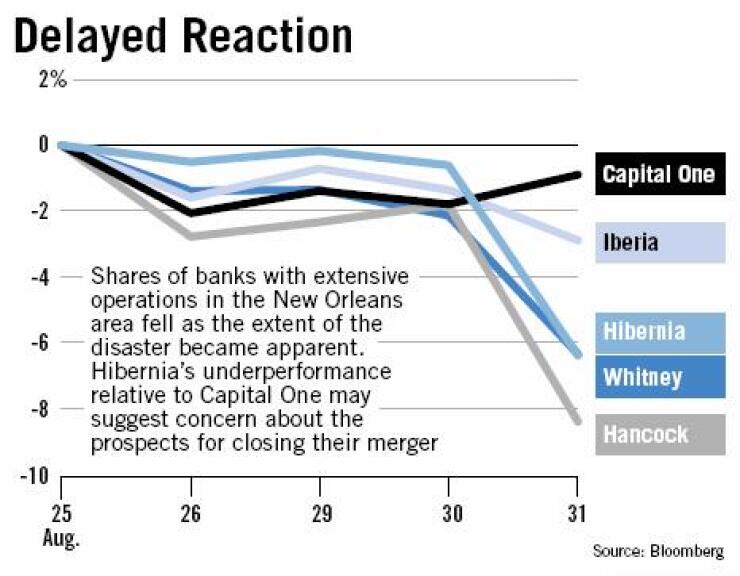

Capital One Financial Corp. of McLean, Va., said its deal for Hibernia Corp. of New Orleans would close on time today.

Hibernia's stock sank Wednesday, suggesting that investors were concerned that the hurricane had spoiled the deal.

"People are becoming quite concerned that the Capital One-Hibernia transaction, if not delayed, could be postponed … with Capital One trying to exercise the material-adverse-change provision within the merger agreement, given the hurricane and preliminary damage assessment," said Todd Hagerman, an analyst at Swiss Reinsurance's Fox-Pitt, Kelton.

"Obviously the action of the stock today - people are saying, 'You know, I have had a great run with this; maybe it's time to bail out and wait for the dust to settle.' "

Shares of Whitney, Hancock, and Hibernia were in a free fall in morning trading. Whitney, after dropping 7.5%, recovered in the afternoon to close down 4.4%. Hancock failed to regain ground; it closed down 6.9%. Hibernia was off 5.8%, but Capital One rose 1.1%.