-

JPMorgan Chase's record $13 billion settlement has significant implications for the financial industry, but they may not be what casual observers expect. Following is a guide to the key takeaways from the deal.

October 20 -

SunTrust Banks (STI) is forecasting as much as $300 million in legal losses tied to mortgage probes, and it has disclosed the existence of four new investigations.

February 25 -

Housing Secretary Shaun Donovan and four state attorneys general vowed to hold banks to the terms of the settlement while saying more institutions were likely to shortly join their ranks.

June 19 -

Comerica (CMA) in Dallas slashed its quarterly earnings by 20% Tuesday after a Montana jury ordered the company to pay $52 million in damages to an office supply company.

January 21

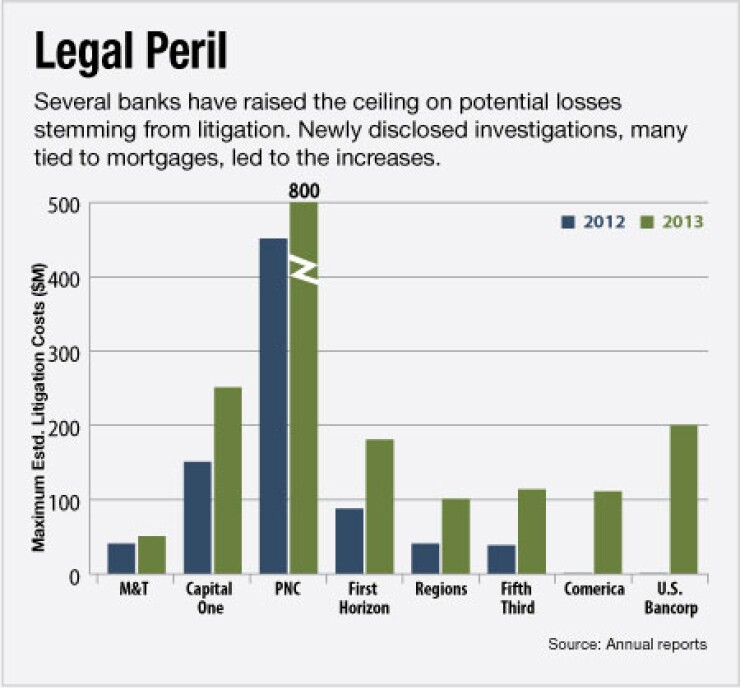

The potential for crushing legal bills isn't just for megabanks any more.

At least eight regional banks have raised the ceiling on their potential losses tied to ongoing legal matters. For some institutions, the new estimates, disclosed in recently filed 2013 annual reports, are huge increases over the previous year.

M&T Bank (MTB), Regions Financial (RF), First Horizon National (FHN) and Fifth Third Bancorp (FITB) all boosted the upper end of their "reasonably possible losses" tied to litigation.

Some of the jumps in forecasted legal costs are huge. Cincinnati's Fifth Third boosted its estimate to as high as $113 million as of Dec. 31. That's an increase of almost 200% from its upper limit at the end of 2012.

Comerica (CMA) and U.S. Bancorp (USB) estimated at the end of 2012 that they had no potential legal losses that could do any material harm. But by the end of last year, Comerica said the upper limit of its losses could reach $110 million, and U.S. Bancorp said it's could be as high as $200 million.

"The financial crisis and the tail risk associated with it is not over," says Allen Tischler, an analyst at Moody's Investors Service.

"It's not that we don't think the banks can absorb the cost or that it will restrict their activities," Tischler says. "Really it's just that it's going on longer than people would have guessed."

The persistent costs of legal issues has been frustrating to bankers and to investors. Todd Hagerman, an analyst at Sterne Agee, asked PNC Financial Services Group (PNC) during a Jan. 16 conference whether to expect continued high costs from legal matters.

Bill Demchak, the Pittsburgh company's president and chief executive, responded that mortgage-related settlements with Fannie Mae and Freddie Mac had been a big source of the legal costs in the past, but that he could not speculate if the problems would be coming to an end soon.

"We continue to operate in a fairly strange environment as it relates to people coming after banks," Demchak said.

Less than two months after the conference call, PNC reported that it had increased the upper limit on its possible losses to $800 million from $450 million. In the past year, PNC has been hit with numerous new legal issues, including litigation tied to lender-placed insurance; patent infringement litigation; mortgage repurchase litigation; and subpoenas from federal prosecutors on matters ranging from the foreclosure of loans guaranteed by the federal government to its Small Business Administration lending activities.

Fred Solomon, a PNC spokesman, said the company does not comment on litigation or investigations beyond what is disclosed in its annual report.

SunTrust Banks (STI) in the past year

U.S. Bancorp, in Minneapolis, acknowledged the possibility

"[U.S. Bancorp] has not agreed to any settlement," it said in its annual report. "However, if a settlement were reached it would likely include an agreement to comply with specified servicing standards, and settlement payments to governmental authorities."

There are other reasons besides mortgages for some banks' potentially higher legal bills. Comerica, in Dallas, r

However, in its annual report, Comerica said that two days after it revised its fourth-quarter earnings, the opposing party in the Montana case filed new claims against the bank seeking "court costs, pre-judgment interest, punitive damages above the statutory maximum permitted by the State of Montana and attorneys' fees."

Comerica "believes there are substantial defenses to these claims and intends to defend them vigorously," it said in the annual report.