-

Executives at Heritage Commerce and Pacific Continental on the West Coast and Texas Capital Bancshares are catering to niche customers and building market share close to home instead of taking grand steps to expand.

May 8 -

Community banks are reporting first-quarter declines in net interest income despite increased lending. Low rates and competition are to blame.

April 25 -

Community banks spent $250 million and more than 8 million hours on regulation implemented during the first quarter, a recent study found.

April 16 -

CFO Rene Jones says the two companies will "do whatever we need to do" to complete the merger, which has been delayed by the Federal Reserve Board's concerns with M&T's anti-money-laundering policies.

April 15 -

With branches becoming more like expensive billboards, banks are searching for lower-cost ways to maintain visibility in existing markets and raise their profiles in newer ones.

March 19

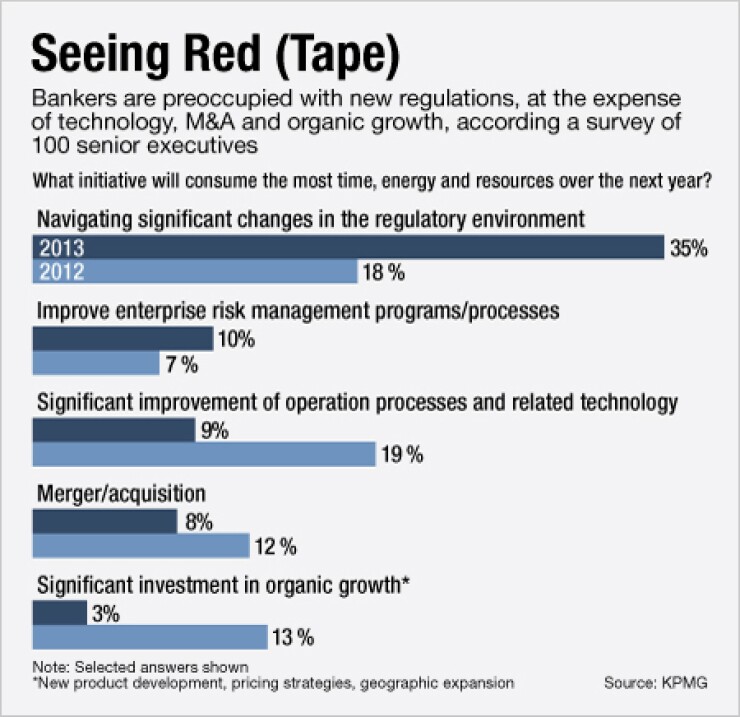

Bankers are putting organic growth, M&A and other initiatives on the back burner as they wrestle with new regulatory requirements, according to survey results to be issued Tuesday.

The

"The regulatory agenda is so dominant and so significant to what banks are doing every day," says Brian Stephens, national leader of KPMG's banking and capital markets practice. "Regulatory concerns were big last year, and it is just getting bigger."

Thirty-five percent of the bankers said navigating significant changes in the regulatory environment would consume the most time, energy and resources, up from 18% in last year's survey. Significant investment in organic growth, such as new product development and pricing strategies, fell from 13% in 2012 to 3% this year.

Almost three-fourths of bankers said that regulatory and legislative pressures presented the biggest barriers to growth. The second-highest response was risk management, at 41%.

"Bankers are walking on eggshells and the term most frequently used is fear," says Andy Greenawalt, the chief executive of Continuity Control, a compliance software company. "There is a psychological paralysis that has crept into the mix."

Tougher regulation includes more rigorous examinations and additional oversight from the Consumer Financial Protection Bureau, Stephens says. There are also qualified mortgage rules to digest, Greenawalt says.

"It's really just everything the mounting of all of the new regulations," Greenawalt adds. "We've moved past the point where we have broken the camel's back, and we are just piling on more sticks."

The survey also offered a dim outlook for mergers and acquisition activity in the coming months. About a third of respondents said they were very likely or somewhat likely to be a buyer, down from 42% a year earlier. Only 8% said they would very likely or somewhat likely to be a seller, down from 13% in 2012.

There are several reasons for the lack of deals, Stephens says. One is concern over more regulatory scrutiny. Potential buyers are hesitant to take on an institution that may be already under an enforcement action, Greenawalt says. The due diligence required for a deal is time-consuming, and "if you feel that no matter what you will stumble at the end, you will be less inclined" to try for an acquisition, Stephens says.

This risk is especially high for bigger deals that involve banks with more than $50 billion of assets, says John Rodis, an analyst at FIG Partners. For example,

Additionally there is still

Finally, buyers are concerned about picking up more deposits and

Regulatory changes are also impeding organic growth, according to the survey. Almost a third of executives were considering exiting or reducing their mortgage-servicing business in light of changes to capital requirements and increasing compliance costs. Regulatory compliance costs (58% of respondents) and other Dodd-Frank Act compliance requirements (47%) were said to have the greatest negative effect on growth.

"There is zero tolerance for getting new products and services wrong" because of additional oversight, so bankers are less willing to expand offerings, Stephens says.

The biggest driver of revenue growth over the next one to three years will be cross-selling, according to 46% of respondents. Thirty-nine percent said the biggest revenue growth would be from traditional commercial banking products, such as loans and mortgages, down from 56% a year earlier.

Competing on traditional products is currently difficult, says Steven Reider, president of consulting firm Bancography. There is

Despite these challenges, bankers need to accept the reality of regulatory oversight, which is "sometimes used as a crutch," Reider says. There are plenty of institutions posting meaningful gains, he adds.

"You have to embrace the change," Stephens says. "The status quo won't be a workable business model anymore."

This is the fifth year for the KPMG Banking Outlook Survey, which was conducted in March and includes responses from 100 senior banking executives.

Based on the most recent fiscal year, 58% of respondents worked at institutions with annual revenues greater than $10 billion, 23% with revenues between $1 billion and $10 billion and 19% with revenues between $100 million and $1 billion.