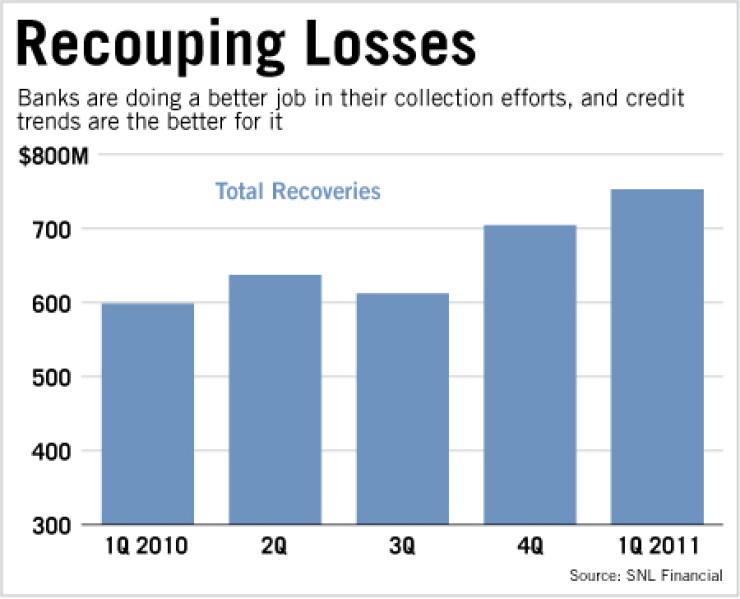

Community bankers are beginning to recoup some of the chargeoffs that have plagued their balance sheets the past few years.

The upswing has occurred for two straight quarters now, with most of the so-called recoveries tied to loans backed by commercial properties, which are starting to sell for more than the written-down value.

"It's a pleasant surprise" to collect from delinquent borrowers, says Jay Fant, the chairman and CEO of First Guaranty Bank and Trust Co. in Jacksonville, Fla.

Recoveries rose 6% in the first quarter from the fourth quarter and 26% from a year earlier, to $752.8 million, according to data from SNL Financial. For banks with $20 billion or less in assets, first-quarter recoveries rose 7% from the fourth quarter and 15% from a year earlier.

"On the commercial side, there seems to be more confidence that not everything is going to fall off a cliff," says Harold Reichwald, who co-chairs the financial services and banking group at Manatt, Phelps & Phillips.

He says the data supports a view that bankers and real estate investors are finding common ground for pricing assets.

Recouped funds are nowhere near the chargeoffs being booked.

In the first quarter, banks recovered $1 for every $8 charged off. A year earlier, they recouped $1 for every $11 in chargeoffs.

(Chargeoffs themselves fell 13% from the fourth quarter and 33% from a year earlier, to $5.9 billion.)

Such trends can improve financial results, as banks see less need to set aside money for expected loan losses.

SVB Financial Group benefited from such a convergence in the first quarter, as chargeoffs fell 59% from the fourth quarter, to $4.3 million, and recoveries doubled, to $6.8 million.

The improvement allowed SVB to release $3 million in reserves in the first quarter.

Some bankers, including Mike Descheneaux, SVB's chief financial officer, are keeping their feet on the ground.

Descheneaux warned during an April 21 conference call that the results may be unsustainable. "We believe the combination of low chargeoffs and high recoveries … is unlikely to be repeated," he said.

SVB may be cautious, but other bankers hope they can keep recouping delinquent debts.

"This recovery is important, but make no mistake, additional collection efforts will continue for any and all chargeoffs we've incurred," said John Allison, the chairman of Home Bancshares Inc., which reported $4.4 million in recoveries last month.

The recoveries came after the Conway, Ark., company shocked analysts with $53 million in fourth-quarter chargeoffs.

"I haven't seen any other bank kitchen-sink a quarter" to that extent, says Andy Stapp, an analyst at B. Riley & Co.

"They wanted to get it behind them and accelerate a return to normalized earnings."

Stapp says that Home's shocking fourth-quarter move likely helped it recognize recoveries sooner. He says few banks are able to take such a large hit in one quarter.

Improved recoveries could trigger more asset sales, but observers said it could also raise expectations among bankers who want higher prices for those distressed assets.

Last month, Popular Inc. in Hato Rey, Puerto Rico, called off a sale of $375 million in nonperforming assets because it could not agree to terms.

The $9 billion-asset company had one of the highest total recoveries among U.S. banks with less than $20 billion in assets in the first quarter, at $21.5 million.

Jorge Junquera, Popular's chief financial officer, says recoveries earlier this year were driven mostly by the bidding process.

"There's no real or clear indication that prices moved higher in the market during that quarter," he says.

"The value at which banks are able to sell assets has improved over the last two years but very slowly," he adds. "To the extent that the economy continues to improve, and buyers feel more comfortable with increasing the price, then that will encourage more sales."