The sweeping

The 1,100-word memo Mulvaney sent to

“The people we regulate should have the right to know what the rules are before being charged with breaking them,” Mulvaney said in the memo.

Many in the industry applauded the mission statement that shifts the agency's focus away from using enforcement actions as a substitute for new rules or guidelines, which signals that the bureau will try to be more upfront about its expectations. They welcomed the sense that the CFPB under Mulvaney will work with them, not against them.

"We have a regulator telling us they will provide clear notice of what's allowed and what's not, rather than telling [companies] after the fact, and will only engage in enforcement after they've exhausted all efforts," said Christopher J. Willis, a partner at Ballard Spahr. "And they're going to use data and only address consumer harm that is quantifiable."

The most common response to Mulvaney's memo was frustration and anger at Cordray, who often used novel interpretations of the law in enforcement, lawyers said. Some pointed to a ruling Monday by a federal judge rejecting the CFPB's request — that had originated under Cordray — for $235 million in customer restitution from the installment lender CashCall as an example of Cordray's overreach. The judge said CashCall's alleged violations did not justify such a fine.

"Throughout the Cordray administration, many in the financial services industry were targets of enforcement actions for practices that had long been considered lawful," said Allen Denson, a partner at Hudson Cook. "The bureau’s investigation or enforcement action often was the first indication that conduct was prohibited."

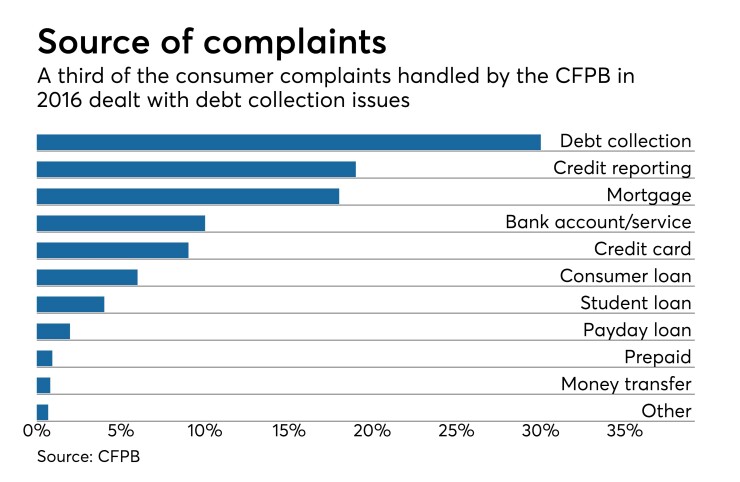

Still, the memo did point to the bureau's consumer complaint system as guiding the agency's priorities in terms of which industries on which to focus. This led some to suggest that the agency could prioritize complaints against debt collectors, which were higher than those for other sectors.

"In 2016, almost a third of the complaints into this office related to debt collection," Mulvaney wrote. "Only 0.9% related to prepaid cards and 2% to payday lending. Data like that should, and will, guide our actions."

Jaret Seiberg, an analyst at Cowen Washington Research Group, said Mulvaney's singling out of "debt collectors as a major source of consumer complaints ... is as clear of a sign one could get that the agency will focus on debt collectors."

Yet consumer advocates and supporters of the Cordray-led bureau said Mulvaney's comments are in direct opposition to the core idea of Dodd-Frank and the reason the CFPB was created after the calamity of the financial crisis and mortgage meltdown. They also drew links between Mulvaney's memo and news earlier on Tuesday that the agency had dropped an investigation into a lender that had given to the acting director's past political campaigns.

"This is a great loss," said Paul Bland, executive director of Public Justice. "The CFPB was created with the purpose of having an agency that focuses on and prioritizes consumer protection. Mulvaney seems to want to turn [the CFPB] into another agency" that "ends up caring much more about the industry’s interests than consumers."

Ron Klain, a former senior aide in past Democratic administrations, tweeted his objection to Mulvaney's comment in the memo that "Lady Justice wears a blindfold and carries a balance."

"Yes, Justice is blindfolded; that's how the JUSTICE Department works," tweeted Klain, who said the memo "is nuts."

"Mulvaney is running the CONSUMER Protection Bureau. It's not neutral; it's supposed to PROTECT CONSUMERS," Klain said.

But industry representatives said Mulvaney's philosophy valuing rulemaking over enforcement actions could actually lead to better industry behavior.

"Our industry would embrace some clear cut rules and regulations because the vast majority of people in the industry want to conduct themselves in an ethical and legal manner," said Steve Wolff, principal at McCarthy, Burgess & Wolff in Cleveland.

Debt collectors want clarity in regulations "as opposed to regulation by enforcement, which has been Cordray's practice to date," Wolff said.

Mulvaney seemed to suggest in the memo that the CFPB plans to use a cost-benefit analysis in determining enforcement cases, which is not mandated in Dodd-Frank. Rather, he quoted a provision of Dodd-Frank that refers to the agency's rulemaking function, and suggested he will use such a calculus for enforcement actions as well, lawyers said.

If anything, Mulvaney's comments gave financial institutions the opportunity to vent their frustration at the practices of the previous administration.

"Making it harder and harder for financial institutions to do business [and] hitting them with massive fines based on questionable theories does a disservice not only to the financial institution but also to all of its customers," said Robert Jaworski, a partner at Reed Smith. "While I suspect that some will try to paint as 'anti-consumer' the interim director’s recognition that the CFPB needs to value the concerns of companies it regulates to the same extent as consumers, rather than simply looking at them as the 'bad guys,' it is not."

Henry Coffey, a managing director at Wedbush Securities, said Mulvaney is signaling that the CFPB is "going to have an intelligent, cooperative approach."

"The way Cordray ran things was to create some confusing regulations and then fine a company even if they disclosed the error," Coffey said. "The real drama-seeking pejorative lawsuits now are shelved."