Banks are back on billboards, in mailboxes and over the airwaves in full force.

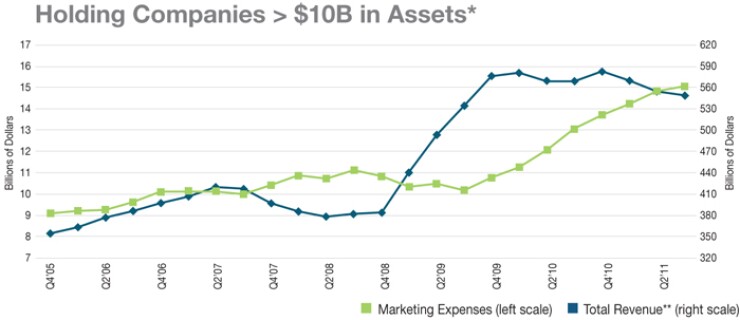

Advertising outlays have been steadily climbing since the third quarter of 2009, rebounding from the sharp pullback that occurred amid the recession. According to data from Financial Information Systems, marketing expenses at holding companies with more than $10 billion of assets reached 2.8 percent of revenue in the year through Sept. 30, surpassing levels that prevailed during the middle of the previous decade and nearing heights reached in 2008.

In the Orwellian language of earnings calls, this is what executives call "investment spend." Analysts and investors are more likely to call it heartburn-inducing profligacy. Capital One Financial shares lost 6 percent of their value a day after the company announced

Among the big holding companies, trailing-four-quarter marketing expenses to revenues peaked at 2.9 percent in the third quarter of 2008, largely resulting from a crater in revenues as marketing expenses held about steady.

Bank of America made headlines recently when it initiated a search for a new agency to focus on the company's brand positioning. In addition to needing a reputational boost after the flap over a proposed $5-a-month debit card fee, BofA no doubt is looking over its shoulder at JPMorgan Chase, a relentless advertiser.

Citigroup has been far less consistent than Chase in its commitment to advertising, but of the 62 holding companies with more than $10 billion in assets, it had the 10th highest ratio of marketing outlays to revenue in the first three quarters of last year. (The attached chart shows trend lines for the 12 firms with the highest ratios among big holding companies.) In January, Citi CEO Vikram Pandit told analysts that the company used 2011 to make up for steep cuts in earlier periods, and that major increases in such expenses "are behind us."

Card businesses typically shoulder massive advertising budgets, and American Express, subsidized by billions of dollars of settlement payments from Visa and MasterCard, has led the post-crisis marketing surge. But its revenue has grown even faster, outpacing expense growth by 6 percentage points in the fourth quarter.