-

Provident New York Bancorp (PBNY) in Montebello has raised roughly $46 million to help fuel its expansion in the New York City area.

August 7 -

Heritage Financial is paying 1.5 times tangible book value for Valley Community, but the markets welcomed the deal because Heritage expects to slash the seller's expenses as much as 50% because of market overlaps.

March 18 -

A healthy bank preemptively sells. Unspent capital burns a hole in a private-equity investor's pocket. A niche player waves the white flag. These are among six deal scenarios you'll see repeatedly next year.

December 17 -

Hudson Valley Holding Corp. (HVB) has completed the sale of $474 million in loans after it was required to reduce its concentrations in commercial real estate and classified loans.

April 2 -

Lakeland Bancorp in Oak Ridge has agreed to buy Somerset Hills Bancorp in Bernardsville, N.J.

January 29 -

Two large community banks merging in South Carolina could create the next Southeast regional player and acquirer of choice.

February 20 -

Provident New York Bancorp in Montebello said Wednesday that it has agreed to acquire Gotham Bank of New York for roughly $40.5 million in cash.

January 18

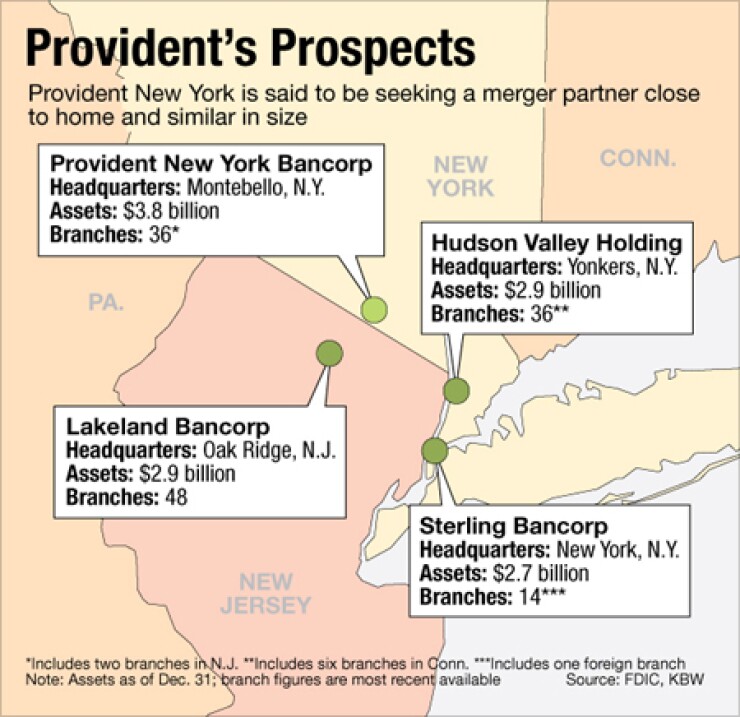

Provident New York Bancorp (PBNY) seeks a mate to change its life, and that is hard to find.

The $3.8 billion-asset company is searching for a transformative deal, KBW analyst Collyn Gilbert said in a research note last week after meeting with top executives.

"Provident's CEO Jack Kopnisky reiterated his favorable view on mergers of similar size, as it provides the opportunity for efficiency increases in ... what he expects will be a prolonged low interest rate environment," Gilbert wrote in the note.

Unlike a traditional merger of equals, where the boards and management teams are mushed together, Kopnisky is eyeing a deal where Provident's team leads the way, Gilbert said in an interview. "They made it very clear that they would need to remain in control."

Executives of Provident, based in Montebello, N.Y., did not return calls for comment.

More deals among similarly sized institutions in the same markets are expected because they

Their size and focus on future performance often hold down premiums. Moreover, executives of banks in Provident's asset range likely see themselves as buyers.

"Provident has talked about that kind of transaction in the past and how they would be interested in doing a low-premium merger of equals," says Joseph Fenech, an analyst at Sandler O'Neill. "I don't think it is out of the realm of possibility, but I'm skeptical that the deal they want is out there."

KBW's "theoretical basket" of deal prospects includes the

Hudson Valley and Lakeland did not return calls for comment. Sterling was unable to provide an executive for an interview by presstime, a spokeswoman said.

Deals for any of those three would include a premium and could produce cost savings of 30% to 35%, Gilbert wrote. The addition to earnings could allow Provident to restore tangible book dilution in a year or two.

Hudson Valley, which is under a written agreement with the Office of the Comptroller of the Currency, might be the best possibility, she said in the interview.

The list was based on pro forma financials, not necessarily a willingness to sell, she added.

"If you look at the potential earnings accretion, it would be tremendous. It is very, very additive," she said. "The impediment might be that there might not be an urgency to sell."

If sellers are opportunistic, they will eye deals with a larger institution, says David Darst, an analyst with Guggenheim Securities. Essentially, if executives are going to lose their job, they want the biggest kitty that can get.

In a merger of equals "one of those management teams is going to bow out," Darst says. "And I think that organization is going to choose a sale where they can realize more today and potentially get a partner that is larger, stronger."

Darst covers Lakeland and says he doesn't see that company as a seller. In January, Lakeland announced it would

The closest thing to a transformational deal this year is the SCBT Financial (SCBT)

However, that deal is the exception, observers say. Bankers in the $3 billion to $10 billion range see M&A as a possibility, but they typically consider themselves on the buying side of that equation.

"Boy, when you get into institutions in that size range there is often an arrogance that creeps into the culture," says Justin Barr, president of BankDATAWORKS.com. "The bigger the bank, the bigger the ego."