Banks and credit unions oppose federal proposals to let the Small Business Administration make some 7(a) loans directly in addition to its traditional role of guaranteeing credits extended by private lenders.

The Biden administration’s

Legislation approved by the House Small Business Committee last week included an option for the SBA to originate small 7(a) loans “through partnerships with third parties” — which presumably could include some banks and credit unions. At the same time, the bill would authorize SBA “to originate and disburse direct loans.”

With details still in short supply, Ian McKendry, a spokesman for the American Bankers Association, said in a statement that his group “want[s] to better understand why it makes sense to create a direct lending program to compete with banks that are already meeting demand for 7(a) loans.”

“It could have the unintended effect of making it more difficult for some lenders to continue participation in the 7(a) program,” McKendry said.

SBA’s role in 7(a), its largest loan program, has been to guarantee loans made by banks, credit unions and other private-sector entities. Through the first 11 months of fiscal 2021, which ends Sept. 30, SBA guaranteed a record $30.1 billion of loans.

On a conference call with reporters Tuesday, Sen. Ben Cardin, D-Md., chairman of the Senate Small Business Committee, and Rep. Nydia Velazquez, D-N.Y., chairwoman of the House Small Business Committee, said not enough of that record 7(a) funding is reaching the smallest small businesses.

Both Cardin and Velazquez said smaller businesses also struggled to obtain loans last year during the initial phase of the Paycheck Protection Program, in large part because banks — which provided most of the funding under PPP — favored borrowers seeking larger, more profitable loans.

“It didn’t matter how hard [smaller businesses] tried,” Velazquez said. “When the first money through the relief package was made available, they were left behind because they didn’t have preexisting relationships with the banks and because those types of loans are not profitable.”

In a similar vein, Cardin said that “the smallest small businesses … found it very difficult to get [banks’] attention to process a PPP loan because it was not as profitable as larger loans.”

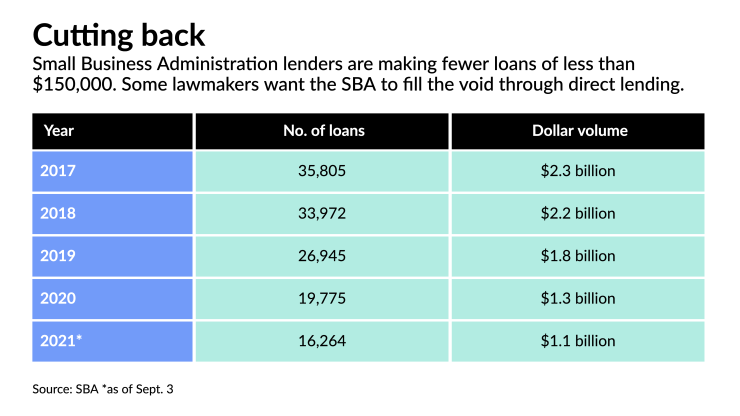

Through Sept. 3, SBA had guaranteed 16,264 loans of $150,000 or below. That is less than half of the 35,805 loans backed in fiscal 2017.

A blueprint for a possible partnership arrangement with the private sector exists. After the PPP’s initial $313 billion appropriation was exhausted in April 2020, SBA moved to channel money to smaller borrowers by reserving portions of later funding rounds for community development financial institutions, minority depository institutions and smaller banks and credit unions. Even so, lawmakers seemed to indicate a preference for a direct lending role Tuesday.

“The Small Business Administration is better equipped today,” Velazquez said. “It has the infrastructure in place to be able to provide direct lending.”

Cardin said he wanted to see the program providing smaller loans become a permanent feature of 7(a). The administration’s legislative package would authorize the $4.5 billion program through Sept. 30, 2031.

“Ten years is a long time, but I would think if the program were successful, we’d be looking at making it permanent,” Cardin said.

Rep. Blaine Luetkemeyer of Missouri, the ranking Republican on the House small business panel, said he is dead set against any direct lending option for SBA.

"Private-sector lenders are far better equipped to handle direct lending — that is what they do,” Luetkemeyer said Wednesday. “Any attempt to expand the SBA’s direct-lending capabilities is extremely irresponsible and will put the American taxpayer dollar at increased risk.”

Banking and credit union groups also appeared dubious about the plan — and they challenged suggestions their members had spurned small businesses in need. A spokeswoman for the Consumer Bankers Association called such suggestions “inaccurate.”

“If we’ve learned anything from the last 18 months and the enormous success of the PPP, America’s leading retail banks are well capitalized and well positioned to support businesses of all sizes across all sectors of the economy, including making and maintaining a loan,” the association’s Lauren Blair Bianchi said Wednesday in a statement to American Banker.

According to a source familiar with the proposal, SBA expects to lean on community development financial institutions to help make its direct loans. The participating institutions would adhere to underwriting standards set by SBA and receive fee income for their services.

Paul Merski, group executive vice president of congressional relations and strategy at the Independent Community Bankers of America, called the plan "preposterous policy."

"Community banks have the local presence, relationships and underwriting expertise with small business to do SBA 7(a) that the SBA just doesn’t have," Merski said.

The National Association of Federally-Insured Credit Unions said Wednesday that SBA “should continue to partner with credit unions and other community financial institutions” to direct credit to smaller businesses.

Indeed, NAFCU “strongly supports efforts to ensure the nation’s Main Street small businesses have access to the credit they need,” Director of Regulatory Affairs Ann Kossachev said.

NAFCU “[does] not believe the SBA should be making loans directly,” Kossachev said.