-

Expect the rate of terminated enforcement actions to increase in coming months as more banks get a handle on their problems, industry observers say.

April 15 -

Banks are increasing their research and monitoring of third parties as regulators take a closer look at outsourcing.

April 4

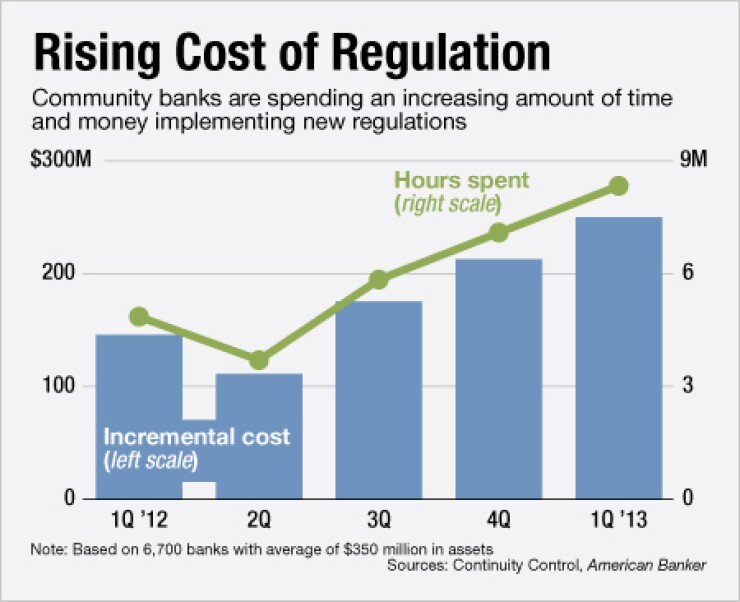

Regulatory change is taking increasingly bigger bites out of community banks' bottom lines.

Banks are spending more time and money to follow new regulations. That is problematic, especially when it distracts bankers from other duties, industry observers say.

"Anything that turns the bank's attention away from the customer is detrimental to everyone," says T. Jefferson Fair, president of consulting firm American Planning. Community banks "already know how to take care of customers legally, morally and ethically, so having to comply with regulations that tell them what they already know how to do is frustrating."

A study by Continuity Control, a risk management firm, found that smaller banks spent $250 million and 8.3 million hours complying with regulation implemented in the first quarter. The study, which used public records and data from the firm's clients, looked at banks with an average of $350 million in assets.

Shifting the dialogue from anecdotes to quantifiable data "sends a more powerful message," says Pam Perdue, Continuity Control's chief compliance strategist. "We think it will be welcomed by all of the constituencies. Most importantly, legislatures and regulators will be aware of the impact."

Updating policies and procedures to meet new regulation "is a full time job," says Raymond Altmix, president and chief executive at Bank of Marion in Illinois. He says regulation is changing at a faster pace than what he has ever experienced during his 40 years as a banker.

Bank of Marion, a $332 million-asset unit of Midwest Community Bancshares, has a full-time employee aided part-time by another staffer working on compliance, Altmix says. Continuity Control is helping the bank automate much of the process.

Mixed signals from Washington and field examiners are increasing the financial burden, industry observers say.

Some banks are having "trouble keeping up with what is an actual rule, what is a proposed rule and what is just talked about in the media," Fair says. "Then examiners come in and add a layer of interpretation. It can lead to paralysis."

Banks should act quickly to implement changes as soon as they understanding a rule, observers say. It

Meeting regulation can create a "disproportionate burden on community banks because they have less infrastructure," says John Depman, leader of regional and community banking at KPMG. "It can become tough to attract and retain people with the right skill sets in small towns. Those experts have become very costly because of the demand."

Regulators have also been issuing warnings about the use of third-party vendors. Even if a bank outsources some compliance functions, it still must

Vendor relationships "should be saving you money and not adding to your cost burden," adds Perdue, whose firm provides a compliance platform for community banks. "Compliance needs to stop being a distraction and instead create a competitive advantage."

Banks with a strong compliance management system have an opportunity to reduce the costs of new regulation, Perdue says. Banks should have a system to analyze and assess the risk of new regulations, along with a standardized way to structure policies and procedures, she says.

Automation can also keep costs in check, industry experts say.

Incurring upfront costs to properly address new regulation is less expensive than facing penalties over a lack of compliance, Depman says. Banks that run afoul of regulators also face reputational risk and, in some instances, enforcement actions that can limit expansion efforts.

"There's a balancing act that is going on," Depman says. Regulations for "things like fair lending and anti-money laundering are all good. But you don't want it to be overly burdensome."