Though analysts may be more bullish on big-bank stocks in 2005, they also expect it to be a good year for community bank stocks.

Large banking companies are poised to capitalize on a surge in demand from large corporate borrowers and a rebound in the capital markets, analysts say, but they predict that strong overall banking profits will boost stock prices throughout the industry.

Ryan Beck & Co. Inc. predicts that community banks' earnings growth will be "roughly twice that of the broader market," said Anthony Davis, an analyst at the BankAtlantic Bancorp unit.

Ryan Beck is one of several investment firms compiling lists of community bank stocks to watch in 2005. Those whose names made the lists did so because they are either expected to generate strong revenue in attractive markets or niche businesses, or they are undervalued. At least one is on the rebound after profit struggles.

Two that Ryan Beck's analysts chose are the $6.9 billion-asset First Midwest Bancorp Inc. of Itasca, Ill., and the $1.2 billion-asset First Mariner Bancorp in Baltimore.

First Midwest has successfully integrated the smaller banks it recently bought and opened more branches in the affluent northwestern Chicago suburbs - both of which should pay off in the form of higher revenue, Mr. Davis said.

First Mariner's assets have grown 40% a year since 1995, when it was founded by a group of mortgage bankers from the former Baltimore Bancorp. (It had been sold in 1994 to First Fidelity Bancorp of New Jersey, which was eventually sold to what is now Wachovia Corp.)

First Mariner has the largest mortgage operation in Maryland, as well as a "very nice" consumer lending business, Finance Maryland LLC, Mr. Davis said. Earnings growth should accelerate now that the company has completed its initial operational investment, he said.

Analysts at Howe Barnes Investments Inc. of Chicago said its three community banking companies to watch in 2005 are the $3 billion-asset Independent Bank Corp. in Ionia, Mich.; the $1.3 billion-asset Lakeland Financial Corp. in Warsaw, Ind.; and the $1 billion-asset Oak Hill Financial Inc. of Jackson, Ohio.

Daniel E. Cardenas, Howe Barnes' director of research, said that the firm, which at the beginning of every year selects three stocks as its "top picks," looks for ones that are trading at a discount. Independent bought two smaller banks last year and changed the management at Mepco Insurance Premium Financing Inc., which it bought in April 2003, and reserved for any problems that may arise there. (Last summer the company announced that it had received an anonymous letter about business practices at Mepco that may have occurred before the purchase.)

Independent's stock started the year at $28.89; Mr. Cardenas has set a target price of $34.

Mr. Davis at Ryan Beck, who also chose Independent, said revenue in that niche business, as well as in the company's core banking business in the resort areas of northern Michigan, is expected to continue rising.

Lakeland has done a good job of growing while lending wisely, and is moving into the higher-growth market of Fort Wayne, Ind., Mr. Cardenas said. It also has an asset-sensitive balance sheet that should benefit from rising interest rates, he said. The stock was trading at $39.51 early Tuesday; his target price is $44.

Oak Hill has built its business by lending in rural Ohio, an area mostly ignored by larger banks, said Eric Rothmann of Howe Barnes. Now it is moving into high-growth markets such as Cincinnati, Dayton, and Columbus.

"They're able to take their capabilities from one place and apply it to another," said Mr. Rothmann, who has a target price of $45 on Oak Hill's stock. It was trading at $38.30 early Tuesday.

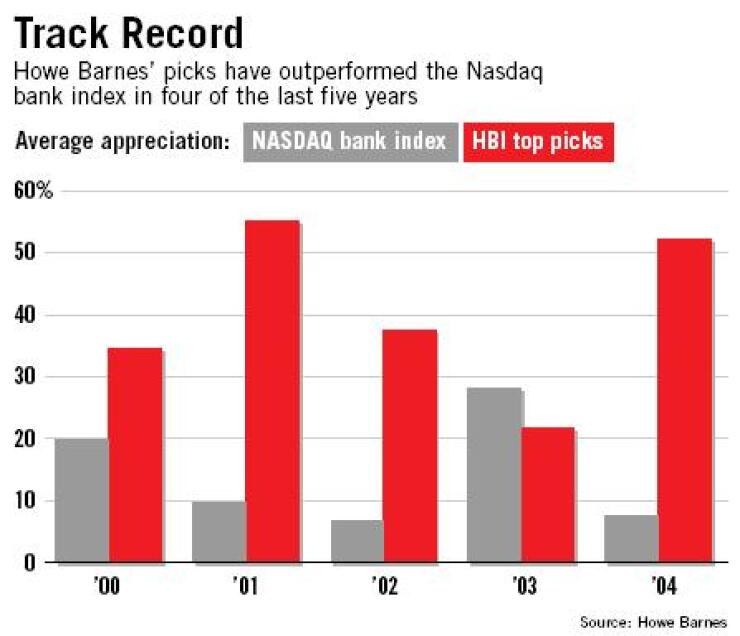

Howe Barnes has a strong record of picking stocks. Its three top ones last year were CoBiz Inc. in Denver; Gold Banc Corp. Inc. in Leawood, Kan.; and Pinnacle Financial Partners Inc. in Nashville. Their combined stock prices appreciated 52.3%, versus 7.5% for the Nasdaq bank index. The firm's choices outperformed the same index in 2000, 2001, and 2002.

Joseph K. Morford of Royal Bank of Canada's RBC Capital Markets in San Francisco selected two California companies: the $4.9 billion-asset Silicon Valley Bancshares in Santa Clara and the $1.3 billion-asset Vineyard National Bancorp in Rancho Cucamonga.

"Silicon Valley is the poster child of asset sensitivity and should do very well in a rising rate environment," Mr. Morford said. About 60% of the company's deposits are non-interest-bearing, and about 80% of its loans are floating rate. Loan growth should be strong as the area's economy revives, and warrant income from technology customers should improve as the venture capital business ramps back up, he said.

Vineyard is based in California's Inland Empire, the fastest-growing region in the country, according to the Census Bureau. It specializes in tract-housing construction, a big driver of growth as people leave the more expensive coastal cities, Mr. Morford said. The company's stock is also trading at a discount. It was at $29.82 early Tuesday, and his target before expected revisions is $35.

Analysts at First Horizon National Corp.'s FTN Midwest Research Securities Corp. in Nashville picked the $2.3 billion-asset Main Street Banks Inc. in Atlanta; the $3.1 billion-asset Sterling Bancshares Inc. in Houston; and the $1.1 billion-asset Virginia Commerce Bancorp Inc. in Arlington, Va.

Main Street is the largest and most profitable community banking company headquartered in Atlanta, whose population is growing three times as fast as the nation's, says Jeff Davis, an FTN analyst. Main Street is also benefiting from the recent acquisition of two larger competitors with branches in the Atlanta market: National Commerce Financial Corp., which SunTrust Banks Inc. bought in October; and SouthTrust Corp. of Birmingham, Ala., which Wachovia Corp. purchased in November.

Also among FTN's hot picks was the $685 million-asset Pinnacle, the best-performing of the three stocks on Howe Barnes' list last year. Pinnacle was founded in 2000 by a team of bankers from the former First American Corp., which AmSouth Bancorp had bought in 1999, Mr. Davis said.

The management team is "tapping into its deep ties" in the rapidly growing Nashville market, Mr. Davis said, and Pinnacle should have faster earnings growth after having made investments in technology and branch openings. Its stock rose more than 83% last year, to $22.62, but he forecasts that it will rise to $27 before yearend, and significantly higher in years to come.

FTN analyst Mark Muth said Virginia Commerce "is one of the best-performing banks that we cover." It consistently posts 20%-plus growth in both assets and earnings, and its return on equity is typically over 17% - well above its peers nationwide. Its branches are in the suburbs of northern Virginia, near Washington, and the company can take market share from some of the bigger banks there, he said.

Brett Rabatin, also at FTN, chose Sterling because he expects it to make a comeback. Profitability troubles in the low-rate environment were compounded by the loss of a solid revenue stream after Sterling sold Sterling Capital Mortgage Co. to RBC Mortgage in September 2003.

But, Mr. Rabatin said, "the company is well positioned in the attractive Houston region, and I think the market is going to be pleasantly surprised with its margin over the next couple of years" as interest rates rise further.

If Sterling "can make a 12% ROE by the end of 2005, then our 80 cents-per-share estimate is realistic," he said.