Emergency lending programs have cut into the volume of traditional Small Business Administration loans, but they have also led more bankers to make bigger long-term commitments to the agency’s flagship offerings.

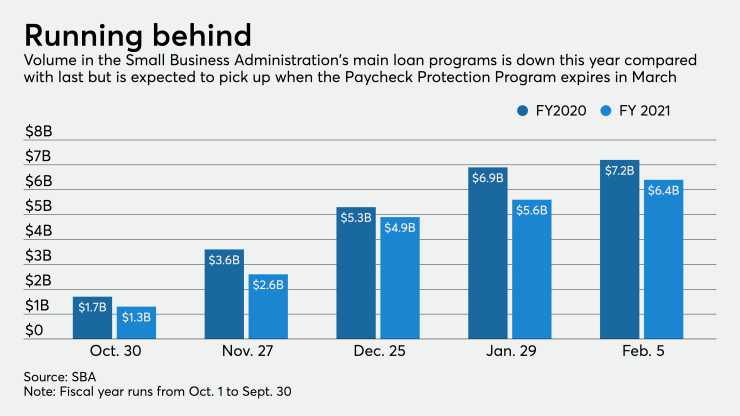

Volume in the SBA’s 7(a) program is down 11% in the 2021 fiscal year from a year earlier, at $6.4 billion. The agency's fiscal year began on Oct. 1.

Lenders largely point to the prevalence of the Main Street Lending Program, which ended on Jan. 8, and the Jan. 11 return of the Paycheck Protection Program for the lower 7(a) volume. For many bankers, it has been daunting to devote resources to both traditional and emergency loan efforts.

But many lenders are laying the groundwork for more 7(a) and 504 lending by hiring staff, entering new markets and boosting digital capabilities. Many of those investments wouldn’t have happened, or at least would have been delayed, if there had been no PPP.

PPP “really opened our eyes as to how big the opportunity is to attract more business banking customers,” said Ted Sheppe, executive vice president for business development at Axiom Bank in Maitland, Fla. “We think we can compete with bigger banks for the relationships.”

The $654 million-asset Axiom plans to hire two SBA business development officers this year, a decision that was spurred by its experience with PPP. “We are going to grow our SBA capabilities,” Sheppe said.

Other banks are laying the groundwork for more SBA lending.

Freedom Bank of Virginia in Fairfax recently hired a five-person SBA lending team to serve as the nucleus for a division that will make loans along the East Coast. Like Axiom, the $767 million-asset Freedom Bank also credits the emergency loan programs for boosting its interest in traditional SBA lending.

“Our recent success with PPP and MSLP gave us confidence that we could build a business centered on government guaranteed lending,” said Joseph Thomas, Freedom Bank’s president and CEO. “We have already developed a [solid] pipeline of new business opportunities.”

Freedom Bank has originated $105 million of PPP loans and $75 million under the Main Street program. Thomas said he expects the new SBA division to “be demonstrably accretive” to the bank’s 2021 earnings.

About 2,750 lenders participated in the 7(a) during the 2019 fiscal year, which ended a less than six months before the coronavirus pandemic led to widespread economic shutdowns and the creation of the Paycheck Protection Program.

By comparison, nearly 5,500 banks and nonbanks have originated PPP loans,

“A lot of folks learned about the SBA through PPP,” said Tom Pretty, head of SBA lending at the $388 billion-asset TD Bank, which has offered traditional SBA products for years. “A lot of institutions that may not have been participating may have become more familiar with it, may be gravitating towards it.”

Now, TD and other active SBA lenders are hoping to boost their participation in coming months, pointing to enhancements created in the stimulus package Congress passed in December.

Those improvements include fee waivers and an increase in the 7(a) loan guarantee from 75% to 90%. Lawmakers also provided funding for up to six months of principal and interest payments on 7(a) and 504 loans originated between Feb. 1 and Sept. 30 of this year.

“We’ve seen increased demand for SBA products and expect that to continue through the end of the SBA fiscal year,” Pretty said. “We are definitely seeing our pipelines grow. … There’s no better promotion in lending than to get your first six months, principal and interest, paid.”

TD, which originated $206.7 million in 7(a) loans in fiscal 2020, wants to keep growing.

“We're a large, top small-business bank,” said Chris Giamo, TD’s head of commercial banking. “It's a core franchise for us. We will definitely look to continue to add staff, even in a more accelerated way, to serve these clients, because there will be more need."

Increased digital adoption by smll businesses could make it easier for some experienced SBA lenders, like Valley National Bank in New York, to expand their geographic reach.

Valley, which has historically limited SBA lending to northern New Jersey and “a couple of big markets” in Florida, wants to make more loans across its four-state footprint, said Rick Kraemer, the $40.7 billion-asset company’s chief financial services officer.

PPP participation taught Valley a number of lessons as it looks to expand, including ways to

“I think we’ve developed a lot of skills through PPP,” Kraemer said. “We’ll call them battle scars. We’re better for it.”