When Andy Collins walks through a crowded suburban shopping mall, he doesn't see shoppers all around him. As the vice president of emerging payments for USAA Federal Savings Bank, a direct financial institution without a single traditional branch to its name, what Collins sees is perambulating banks.

With smartphones capable of depositing checks, monitoring balances and moving money between accounts, Collins explains, "all those people walking around potentially have a bank in their pocket."

Direct banking, once a clunky adjunct to traditional banking that involved the phone, the Internet, attractive interest rates-and lots of calls to the help desk-is going mainstream.

Advocates of traditional banks may have seen ING Direct's recent sale to Capital One as a sign that the direct-bank model was finally getting its comeuppance. But that was no fire sale, and in fact there is evidence that the country's four major direct banks, Ally Bank, Discover Bank, Capital One 360 (as ING Direct was recently rebranded) and USAA, are starting to nibble the lunch of their brick-and-mortar competitors, and not just the big banks and large regionals but community banks and credit unions as well.

In a new study by research firm TNS, direct banks stood out as the only category of banks to gain share in the past decade among retail customers establishing or moving their primary banking relationships. The share of new relationships captured by the large, national banks, the regional banks, and even the community banks and credit unions was flat to down. But the direct banks, which a decade ago attracted about 3.5 percent of new, primary retail banking relationships, have since increased that share to about 8 percent.

Deposits at the major direct banks have more than doubled over the past five years-a growth rate that is three times the industry average for the period. Ally Bank, for example, says its deposits hit $35 billion last year, up 25 percent from 2011, while deposits at Discover Bank reached $27.9 billion in 2012, up 5 percent for the year, according to the company.

Even Barclaycard US, the latest entry in the direct banking field-which, because it launched last May, was not included in the TNS survey-is off to a fast start, garnering $1 billion in deposits by October and $1.5 billion by January of this year.

"This is going to be an important funding source for our $14 billion credit-card operation," says Steve Carp, head of deposits at Barclays US. "That's what we were hoping for and it's one of the key reasons we got into this direct banking business."

Besides selling into a customer base that is increasingly comfortable with the idea of banking mainly by phone or online, direct banks have shown some success in attracting consumers with desirable demographics.

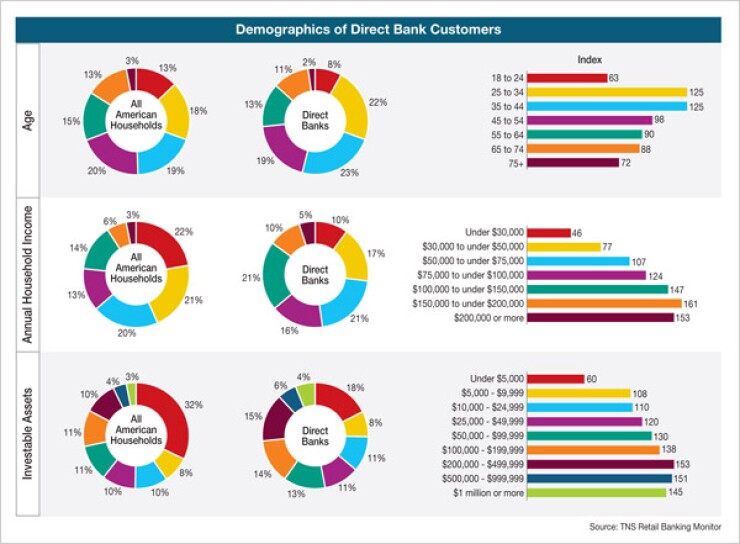

Customers of the four big direct banks skew young (a full 45 percent are in the 25-to-44 age bracket) and wealthy (according to TNS, 36 percent have household incomes of $100,000 or more, something that can be said of only 23 percent of American households overall).

These customers also have significant assets. Nearly 40 percent of them have at least $100,000 to invest. Only 28 percent of all U.S. households have $100,000 or more in investable assets, according to TNS' study.

As Morningstar equity analyst Dan Werner points out, the growth rate for direct banks, while healthy, is on a small base. According to the TNS study, direct banks only hold about 5 percent of total primary banking relationships in the United States, compared to 30 percent for community banks and credit unions, 27 percent for regional banks and 37 percent for the big banks-but at the same time, theirs is the only share that's growing.

"The brick-and-mortar banks will have to figure out how" to compete, Werner says. He says it will be a challenge for them to match the savings and loan rates offered by banks that have no branches in their cost structure.

"We are growing at the traditional banks' expense. That's true," says Collins at USAA, which is the oldest and largest of the four big direct banks, with a market share greater than all its direct banking competitors combined. "Even as the traditional banks try to enter the field of direct banking, we think we can continue to be a fierce competitor."

Discover Bank's president of consumer banking and operations, Carlos Minetti, is similarly optimistic. "We believe that the direct banking model is very viable, and that it will prevail," Minetti says.

Discover has one physical branch, located in its headquarters state of Delaware. "It's a great branch," Minetti says, hastening to add that even so, there are no plans to replicate it.

"Physical branches will become irrelevant," he predicts. "I think you'll continue to see a role for small branches on the business banking side, but we're a totally consumer banking company, so we don't see any need for that."

His vision of a branchless future may be starting to take shape already across the Atlantic in Scandinavia, where direct banks have been making a sizeable dent in the retail market. "I've never seen branches closed so fast as they're doing there," Morningstar's Werner says.

The earliest true direct banking operation was debuted in 1989 by Midland Bank in the U.K. It started off as a phone-based business, but as Internet usage became more commonplace, more of the business migrated to the Web. Midland eventually sold the unit to HSBC, which rebranded it as HSBC Direct.

HSBC dipped a toe into Internet banking in the United States in 2005, offering a Web-based savings account to compete with ING Direct, which began signing up U.S. retail customers in 2000. But HSBC never expanded the U.S. direct banking effort into anything broader. Its current online-only U.S. retail savings account doesn't compete head-to-head with true direct banks (its basic savings account, for example, offers a rate of 0.2 percent, vs. 0.8 percent at Discover Bank).

HSBC Direct does still offer direct banking in the U.K. and in places like Taiwan and South Korea, but the bank seems to have decided against offering direct retail banking in the United States.

"We're a customer-relationship-driven bank, not a product-driven bank," explains Neal McGarity, a U.S. spokesperson for HSBC.

Indeed, with new regulations making customers less profitable than they once were, many banks are now actively discouraging smaller depositors by adding or increasing fees for accounts that don't meet minimum balance thresholds. But this presumably has had the effect of making direct banks an even more popular alternative for customers who want low-fee checking or higher interest rates without paying more for the privilege.

Traditional U.S. banks have long been skeptical of direct banks, and not without good reason. After all, it was unclear what kind of asset growth many of these banks could get to go along with deposits on the liability side of the balance sheet, although in recent years the direct banks have been more strategic on that front.

Bankers also resented having to compete with the high interest rates on deposits offered by a bank like Ally, which went on an advertising blitz to drive up deposits while simultaneously benefiting from the outsized support of the federal government. (Billions of bailout dollars from the Troubled Asset Relief Program had been pumped into GMAC, which rebranded its banking unit as Ally Bank in May 2009.)

But if traditional bankers were dismissive of direct banks before, "that is certainly not the case now," Werner says. "Look at Capital One's purchase of ING's ING Direct ... And the same goes for Bank of Nova Scotia, which purchased ING Direct's operation in Canada. Those banks are certainly not trashing the idea of direct banking."

Also among the converts: consumers. Though they may be lured initially by the relatively attractive rates they can earn on their deposits, they also have a rising comfort level with the technology at the center of a direct banking relationship-and with the security it promises.

"These direct banks are redefining what convenience means, and in consumer banking, convenience is everything," says Joe Hagan, senior vice president of multiclient programs at TNS and one of the authors of the firm's recent study.

Nonetheless, many consumers who use direct banks continue to maintain a relationship with a local branch bank, too, Hagan says. This explains why, while more than 12 percent of U.S. households reportedly have a deposit relationship with one of the four big direct banks, the direct banks hold less than 5 percent of the primary banking relationships of consumers.

Hagan suggests that most of the direct banks actually encourage the dual-banking scenario, as it solves one of the thorniest challenges remaining for the direct banks: how to enable customers to withdraw more cash than the typical limit at the ATM.

By maintaining checking accounts at a brick-and-mortar bank, customers can simply transfer funds electronically from their direct bank to their local checking account, and then withdraw whatever cash they need. In the past, this technique was also how direct bank customers would deposit checks, but now remote deposit capture apps and scanners are eliminating the need to shuffle money between accounts.

There are still complaints from account holders that the transfer process required for large withdrawals can take several days, which can necessitate a bit of advance planning on the part of customers. But the direct banks are working to solve this, too.

USAA’s Collins hints at a coming partnership with a retailer (he declined to say which) that would permit customers to deposit cash. USAA already has an arrangement with UPS that allows customers to walk into any UPS office and have their ATM card swiped and their paper checks scanned by a UPS clerk, with the deposit slip printed on the back of the scanned check serving as a paper record of the transaction-a creative solution for customers who lack a smartphone or who have lingering security concerns about using one to make deposits.

Ally Bank, meanwhile, will authorize specific ATM withdrawals of up to $1,000, and, following a fraud review that can take up to 24 hours, it can authorize withdrawals of up to $9,900.

Werner says the one big question out there-a "shoe waiting to drop," perhaps-is what happens when the direct banking industry experiences its first big security breach. How direct institutions respond to being inundated with thousands of worried customers trying simultaneously to get through to their help line will likely have a big impact on how widely customers adopt the virtual model, with no branches to supplement the Internet and mobile apps.

Ally Bank deposits executive Diane Morais, for one, isn't too concerned. "We've invested in a high degree of security and we've run a number of disaster recovery simulations," she says. "While I can't say that under no circumstances would we have any disruptions, we take the issue extremely seriously and I am confident that we can accommodate a crisis."

The main players in direct banking have taken different approaches to pursuing customers.

Barclaycard US is focused simply on gathering deposits in its savings and certificate of accounts, though Carp says "down the road we may expand our product set."

Ally, with roots dating back nearly a century to the 1919 founding of General Motors Acceptance Corp., obtained a bank charter in 2008 and was rebranded as Ally Bank a year later. Last September, it was named "Best Online Bank" by Money magazine on the basis of its customer service, competitive rates, no-fee ATM policy and no deposit minimums.

Like the Barclays effort, Ally is only a deposit-taking institution. It leaves the lending to other subsidiaries of its holding company, Ally Financial, which offers personal loans, car loans and mortgages, with Ally Bank's deposits providing the funding to support that lending.

Discover Bank, which similar to the Barclaycard US effort was born out of a credit-card business, has expanded beyond savings and CD accounts and has gone after the student loan market in a big way, acquiring Citigroup's student loan portfolio. "It's a very attractive market segment: young individuals who have a lot of potential," Minetti says. "We can get them involved with us as borrowers and hopefully later they'll become depositors, too."

Discover also is in the home mortgage business, with its acquisition of LendingTree Loans. "At this point, we only do conforming loans," Minetti says. A tie-in advantage offered to Discover Card customers is that if you pay the appraisal fee on your Discover mortgage with your Discover card, you get a 5 percent cash-back bonus.

Discover's mortgages are arranged entirely online, except for the closing.

"For that, we send the closer to you," Minetti says. For the rest of the process, he says there is an advantage to transacting digitally: "A mortgage is a highly emotive process, and with us, the borrower can monitor the process online any time. If you wake up in the middle of the night and have a question, you can contact someone online or on the phone 24/7. With a mortgage broker or a traditional bank, you'd have to wait until the next business day."

ING Direct, purchased last year by Capital One Bank from ING Groep NV and rebranded in February as Capital One 360, is a full-service direct banking operation offering deposits and loans. Under its Dutch parent, ING Direct had built its considerable customer base by offering free accounts, high interest rates on deposits and competitive loan terms. Since the acquisition, the result of a restructuring agreement that ING's former parent company reached with its regulators in Europe, Capital One has been assuring customers that it would continue the ING Direct model of no fees and competitive rates.

USAA, a full-service bank offering deposits, investment services and loans, including mortgages, is unusual in that its entire customer base is connected to the military. Originally available only to active-duty military personnel, the bank has expanded its market enormously. Now any veteran can use it, and if a veteran is a customer, then all of his or her direct relations-children, grandchildren and great-grandchildren, as well as parents and grandparents-also can become customers. "With 9 million current customers, we have a long way to go in our expansion to reach all those people," laughs USAA's Collins.

He notes only half-jokingly that it took the bank 90 years to reach 1 billion online contacts. "We'll hit that many contacts online in one year this year," he says.

And with the explosion in smartphone usage, growth is speeding up. Next year, Collins says, "We will hit 1 billion in mobile contacts alone."

Dave Lindorff is a freelancer. He is based in Philadelphia.