Texas Capital Bancshares has been spending heavily to transform itself into a Lone Star State-centric machine that ultimately generates higher, more sustainable earnings.

Now, four full quarters after

Holmes said that "much of the initial lift to deliver the foundational talent, technology, products and capabilities has been incurred. … We are increasingly transitioning the firm's focus from a period of concentrated build into a state of execution."

To be sure, more investment is needed to achieve the $30.4 billion-asset company's 2025 growth targets, Holmes said.

And there are some headwinds that could delay the speed at which Texas Capital moves, according to analysts. One big challenge is the overall economic environment — inflationary pressure, for starters, but also the pace at which the federal funds rate is rising and the growing risk of recession.

"It's a timing issue," said Michael Rose, an analyst at Raymond James. "How long is it going to take, and does a recession or ongoing inflation cause them to have to spend more and take longer to hit their targets? … It's just hard to forecast how much they can actually grow."

For more than a year, Holmes and his team have been

Founded in the late 1990s, the formerly fast-growing middle-market lender had shifted away from its roots by expanding into business lines outside of Texas. Over time, capital levels suffered, and certain loans, including some to energy companies, deteriorated.

Holmes, a former JPMorgan Chase executive who

As such, Texas Capital has been investing in new technology, fee businesses and employees. In the past year, it has rolled out an investment bank, launched new private wealth and treasury solutions and expanded the number of business, middle market and corporate banking relationships — all of which have required a tremendous amount of hiring, and money.

As of June, about 1,000 of the bank's then-2,100 employees had joined since early 2021, the company has said. On Thursday's call, Chief Financial Officer Matt Scurlock declined to provide the exact number of new hires, but he said the total workforce grew 8% during the third quarter, mostly as a result of new employees in the private wealth and investment banking business.

Salaries and benefits now make up 65% of the company's noninterest expenses, he added.

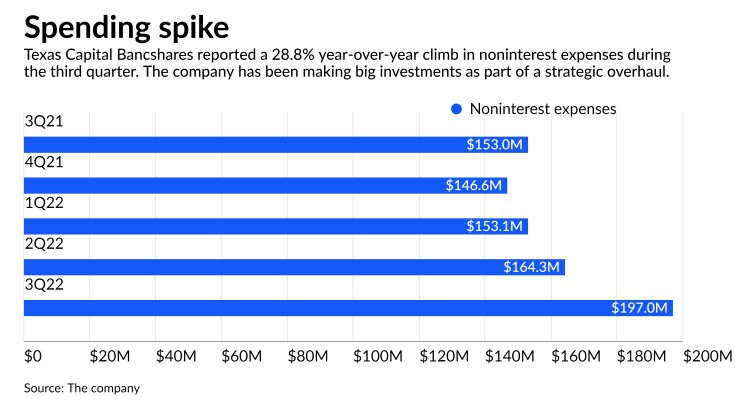

During the third quarter, noninterest expenses climbed 28.8% year over year to $197 million, the highest quarterly total in at least the past five periods. Within that category, salaries and benefits surged 47.8% compared with the year-ago quarter, while marketing expenses jumped up 290.1%.

Also included in noninterest expenses were $16.7 million worth of charges related to the

For the full year, expenses are now projected to show percentage growth in the mid-teens, up from the "low- to mid-double digits" guidance provided in July, the company said Thursday. The higher forecast includes another $15 million of costs related to the divestiture of the premium finance unit.

Holmes listed several positives for the quarter: a 38% year-over-year increase in commercial and industrial loans, excluding insurance premium finance loans; a 27% uptick in treasury product fees compared with the same quarter last year; and the fact that the company's CET1 ratio was 11.08% for the quarter, well above the company's medium-term target of 10%.

Texas Capital also achieved positive operating leverage during the third quarter, one quarter ahead of what executives had projected earlier this year, executives and analysts noted. The company now expects to deliver positive operating leverage for the foreseeable future.

Analyst Brad Milsaps of Piper Sandler said he expects Texas Capital's rate of expense growth to slow down next year as a result of the "heavy lifting" that has been done in terms of capital, asset quality and hiring, he said. Now it's time for Holmes and his team to execute because while the company has been making progress, its stock price continues to languish, Milsaps said.

"It's a complete show-me story," he said.