OnDeck Capital fully expects its budding partnership with JPMorgan Chase to be a big moneymaker someday. But investors, already frustrated with its uneven quarterly results and plummeting stock price, are clearly starting to get antsy.

The online small-business lender's shares plunged again Tuesday after its revenue outlook for 2016 fell short of Wall Street's expectations. New details about the firm's plans to provide its technology to Chase and other big banks did nothing to stanch the bleeding.

OnDeck's earnings report, released late Monday, included guidance stating that gross revenue this year is expected to total between $320 million and $328 million. The midpoint of that range fell $15 million short of analysts' expectations.

-

OnDeck Capital in New York reported a $5.1 million loss in the fourth quarter as revenue failed to keep pace with rising expenses.

February 22 -

Hours after Jamie Dimon alluded to the budding partnership, the banking giant and marketplace lender went public with their plans to launch an online lending platform in 2016.

December 1

OnDeck, which was founded in 2006, also stated that it expects spending on technology and analytics capabilities to continue to grow at a faster rate than its gross revenue. During the fourth quarter, expense growth at OnDeck outpaced gains in revenue,

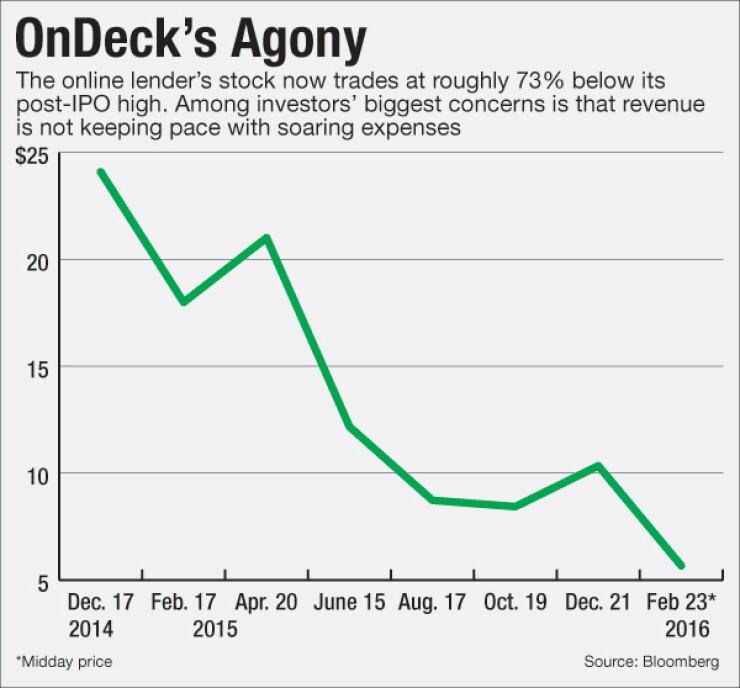

In late trading Tuesday, shares in New York-based OnDeck were down 23% from Monday's closing price, to $6.77.

During a call with analysts late Monday, OnDeck officials disclosed new details about the firm's recently announced plans to place less emphasis on its own lending business and more on providing its technology to banks and other lenders. The centerpiece of that strategic shift is a partnership with JPMorgan Chase,

Under that deal, Chase will use technology from OnDeck to make fast decisions on online loan applications. The New York-based megabank will shoulder the risk of the loans going bad.

OnDeck Chief Executive Officer Noah Breslow did not say Monday when the Chase-branded online loan platform is expected to launch. Nor did he provide detailed projections about the revenue OnDeck expects to earn from the partnership, though he did say that his firm will get paid fees based on the loan volume on the Chase platform.

OnDeck is working on similar initiatives with other large banks, according to Breslow. "I will say that our partnership strategy has largely been focused on the major banks — the top 25, top 50," he said.

Also during in the conference call, OnDeck Chief Financial Howard Katzenberg said: "We believe the bank market is on the cusp of a significant shift away from making small-business loans offline to online. And we believe OnDeck is uniquely positioned to be at the heart of this transition, providing the technology platform that powers these transactions for banks."

But those efforts — dubbed OnDeck-As-a-Service — will take time to bear fruit. OnDeck does not expect the initiative to start generating significant revenue until 2017 and 2018.

That might be too long of a wait for some investors. The stock now trades at roughly 75% below its initial public offering price and some analysts expect it to continue to languish throughout this year.

"While we see longer-term potential from the JPM and other partnerships, the company's near-term earnings power remains constrained," Michael Tarkan, an analyst at Compass Point Research & Trading, wrote in a research note.

Tarkan, who has a "neutral" rating on OnDeck, lowered his price target from $8.50 to $7.50 on Tuesday. Mark Palmer, an analyst at BTIG Research, has a "buy" rating on the company, but he lowered his price target from $18 to $15.

For now at least, OnDeck's executives made clear that they are not abandoning the firm's own lending business. OnDeck originated $499 million in small-business term loans during the fourth quarter, keeping about 60% on its own balance sheet and selling the remaining 40% to other buyers.

OnDeck plans to continue making loans to customers who do not qualify for bank loans, while it plans to provide its technology to banks that serve more creditworthy businesses. The effective interest yield on OnDeck's loans was 35.7% during the fourth quarter.

"Banks will always have a certain risk tolerance," Breslow said. "And historically OnDeck largely serves customers that weren't able to access capital from banks."

Todd Baker, an industry consultant and an outspoken skeptic of the marketplace lending business, expressed disappointment that OnDeck is not more aggressively pursuing its strategy of partnering with big banks.

"The question for a company like this is, if it can't make money as a lender in the best credit market in 30 years, when will it be able to?" Baker, managing principal at Broadmoor Consulting, said in an email. "OnDeck should focus on what it does best, which is using technology to simplify and improve online loan origination for others."