Banks that want a partner network to help them offer remittances now have more options, and at least one of the alternatives is gaining traction.

More than 40 financial companies are developing remittance services that use Swift's global messaging network. Meanwhile Visa Inc. and MasterCard Inc. are promoting transfer services that banks can offer to consumers.

Bankers say these options can be preferable to forging partnerships with the two big names in money transfers, Western Union Co. and MoneyGram International Inc. Many banks view those firms as competitors, but until recently they were about the only game in town for financial companies that wanted to get into the remittance business but lacked their own network.

As a banker offering money transfers, "you have to be able to compete with the service bureaus that are out there that have very, very large networks," said George Koutzen, the director of global remittances for Citigroup Inc.

His company is one of 43 banks that have agreed to use the Workers' Remittances system that Swift introduced in March of last year.

Citi has offered remittances for several years through a separate system. Using the Swift network, Koutzen said, would help his company standardize its system and extend its reach.

While growing its remittance business is a key goal, Koutzen said Citi was not interested in working with one of the money-transfer giants, because it considers them rivals. "That's a model that Citi is less interested in," he said.

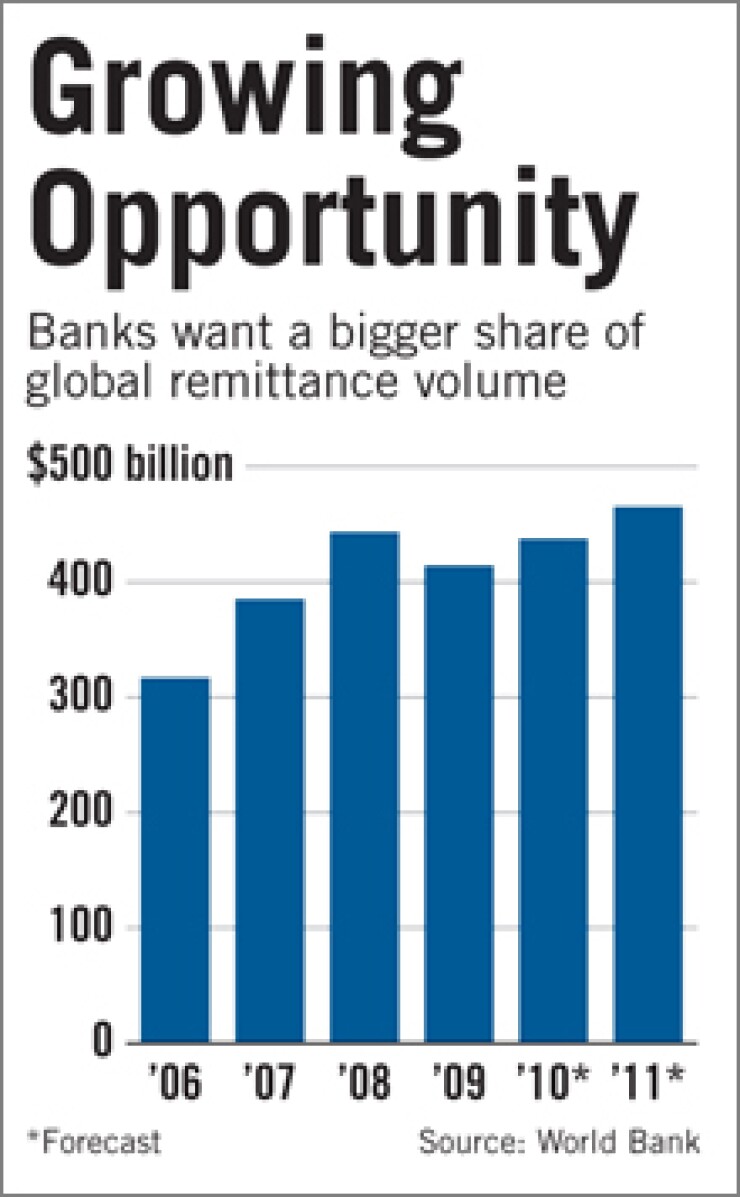

Analysts said banks are keen to fatten their share of the remittance business, which they see as a potential source of fee income and new customers.

"Looking at other channels for growth is very logical," said Brian Riley, the research director of TowerGroup's bank cards practice. "Playing in that arena has a lot of opportunity."

The remittance business represents a roughly $15 billion business opportunity, said Gwenn Bezard, a research director and co-founder of Aite Group LLC. If new players "start capturing even a small slice of the market," it could be "significant," Bezard said.

Of the 43 banks that have agreed to use Swift's service, 14, including Citi, are live now or certified to go live shortly. Other participants include BBVA Bancomer and Banco do Brasil.

Banks considering the Swift service include JPMorgan Chase & Co. "We have a dialogue in place with Swift," said Christine Doria, a managing director and global business executive for U.S. dollar clearing for JPMorgan Chase. The company is "trying to really understand what their offering is and how it could fit into JPMorgan Chase's strategy."

Wells Fargo & Co. evaluated an early version of Swift's offering and passed, but Danny Ayala, an executive vice president and the group head of global remittance services, said company is now reconsidering an updated version.

Wells, considered one of the bank leaders for remittances, uses an in-house system, and Ayala said it has resisted striking up partnerships in the past.

"We want to be able to control our pricing" and avoid putting Wells' reputation in "another company's hands," Ayala said.

However, he also said Wells can see the benefit of a uniform system like Swift's, which offers a simplified way to reach new markets.

Swift, formally the Society for Worldwide Interbank Financial Telecommunication, has said its remittance service provides a common messaging format and streamlining the process of establishing agreements with receiving banks in other countries.

At a Swift operations forum in New York in April, Jairo Namur, the group's regional manager for Latin America, framed the network's technology as a tool for banks to compete against money-transfer firms instead of partnering with them to sell the firms' services through bank branches, a strategy some are using.

Stacy Rosenthal, the senior business manager for banking initiatives at Swift, said the service gives banks an easy way to enter the remittance business.

"The banks have very little market share in this area," Rosenthal said. "Most of the transfer mechanisms that exist are proprietary in nature," which makes it time-consuming and technically challenging to set up relationships with banks in foreign countries.

Swift's system includes guidelines for participating banks and a message standard used for clearing and settling payments, Rosenthal said. It also maintains a database" to which banks can upload details of locations they have enabled transfers to flow to and guidelines for drafting business agreements between sender and recipient institutions, she said.

Visa's Money Transfer service lets card issuers and other financial companies initiate payments for consumers directly to a recipient's credit, debit or prepaid card over its payments network.

Visa has about 50 partners that are offering the service, including two recently announced U.S. customers. Last week the company said it plans to expand the service's U.S. availability.

MasterCard provides its issuers a similar service called MoneySend that allows end users to initiate transfers to MasterCard and Maestro cardholders via automated teller machines, online, branches and other venues.

Though he acknowledged these competitive challenges, Daniel O'Malley, the executive vice president of MoneyGram's Americas region, said his company has an established brand and sees opportunities to expand as more banking companies decide to do more in the remittance field, he said.

Western Union did not respond to requests for comment.

For Citi, the benefit of working with a partner like Swift is consistency, Koutzen said. "They're helping us to standardize the technology so we can transmit from origination countries to destination countries [with] a predictable service-level agreement."

"The last thing you want to do is build a distribution network with individual APIs or interfaces," Koutzen said. Citi was certified in September to use Swift's Workers' Remittances system.

Using the system, the bank is sending remittances from about 150 branch locations in New York, New Jersey and Connecticut to Ecuador. It plans to expand the availability of the service in the U.S., including in California, Texas, Florida and Illinois, Koutzen said. The next target country for Citi is the Dominican Republic.

Citi is currently handling 50 to 60 remittance payments a day through the service, Koutzen said. He noted that Citi has been offering remittance services for several years and that in early 2008 it acquired PayQuik Inc., a money-transfer operator.

With Swift, "we're very, very comfortable that we can put a product in the market that can compete," he said.