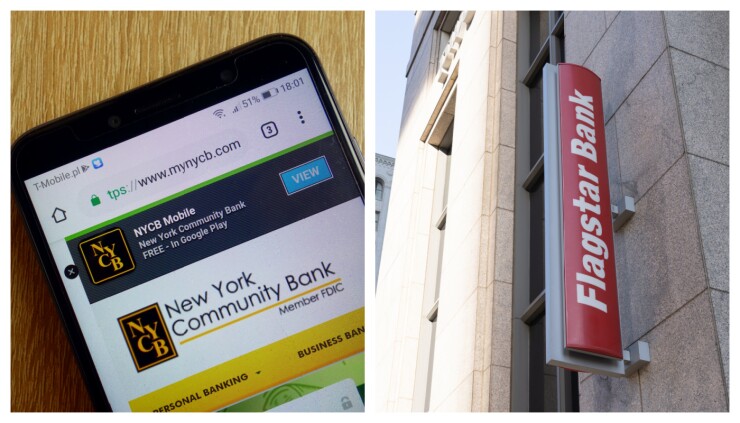

New York Community Bancorp and Flagstar Bancorp announced changes to their overdraft programs on Monday as they await regulatory approval for their merger.

The two banks said they will eliminate transfer fees for customers who use linked accounts to remediate an overdraft, and they also pledged to scrap nonsufficient-funds fees for customers who bounce checks or get purchases declined.

The changes are “another step in helping our customers better manage their finances,” NYCB Chairman, President and CEO Thomas Cangemi said in a press release. The Hicksville, New York-based bank also said it will launch a new Early Pay feature in the third quarter, which will help customers access their direct deposits up to two days earlier.

In a separate press release, Troy, Michigan-based Flagstar said it will eliminate fees that customers can rack up for having a negative balance for consecutive days. It will also limit how many times customers can incur an overdraft in a day, lowering that threshold from five to three, and will not charge overdraft fees on transactions of $10 or less.

The changes will “make it easier for people to stay on a sound financial footing,” said Anne Bertelsen, head of retail banking at Flagstar, which has $23.2 billion of assets.

Both companies said the changes — part of a

The announcements on overdraft fees came more than a year after the $2.6 billion merger was

The latter move means the merger needs approval from the Federal Reserve and Office of the Comptroller of the Currency, which has supervised Flagstar and its mortgage business for several years. The original deal would have required approval from the Fed, Federal Deposit Insurance Corp. and New York state’s banking regulator.

“I will tell you that we truly believe that with the national banking platform, and where we're heading the bank in the future, that the OCC charter is the way to go,” NYCB’s Cangemi told analysts in April.

For NYCB, which had about $61 billion of assets last quarter, the Flagstar deal would be its first whole-bank acquisition since the financial crisis.