New York Community Bancorp saw some much-needed market relief Tuesday as its stock price gained nearly 10% after investors exchanged their preferred shares for common stock.

The Long Island-based bank has had a roller-coaster ride in the stock market this year, starting the year at $30.60 and then plummeting at the end of January on a sizeable fourth-quarter loss. Shares fell below $10 in March and have hovered around that level ever since.

Shares closed at $10.28 on Tuesday and are down nearly 67% for the year.

Tuesday's rally was spurred by the $119 billion-asset bank's disclosure that funds managed by Liberty 77 Capital, Hudson Bay Capital Management and Reverence Capital Partners exchanged their preferred stock for the issuance of about $200 million worth of New York Community's common stock.

The exchange was part of a

There has been "a lot of really good progress on behalf of the team here [and] great momentum, I think, amongst people in the bank," Otting said on the company's second-quarter earnings call last month. "They can see the finish line that this company can be a really successful regional bank, and there's a lot of good energy and excitement."

New York Community has seen a major shift in its equity performance since the investment, including a 1-for-3 stock split last month to inflate its share price.

While the bank has been somewhat aloof with analysts and investors as it drew up a new game plan, analysts from Piper Sandler and Citi published research notes on Tuesday, prior to the stock rally, based on conversations with Otting, Chief Financial Officer Craig Gifford and the president of the commercial and private bank, Rich Raffetto.

"With the bank nearly through its comprehensive internal review and credit analysis, we believe the baton pass to future profitability improvement is likely to be a bit more sporadic (vs linear) and likely starts to take shape throughout 2025," Citi analyst Ben Gerlinger wrote.

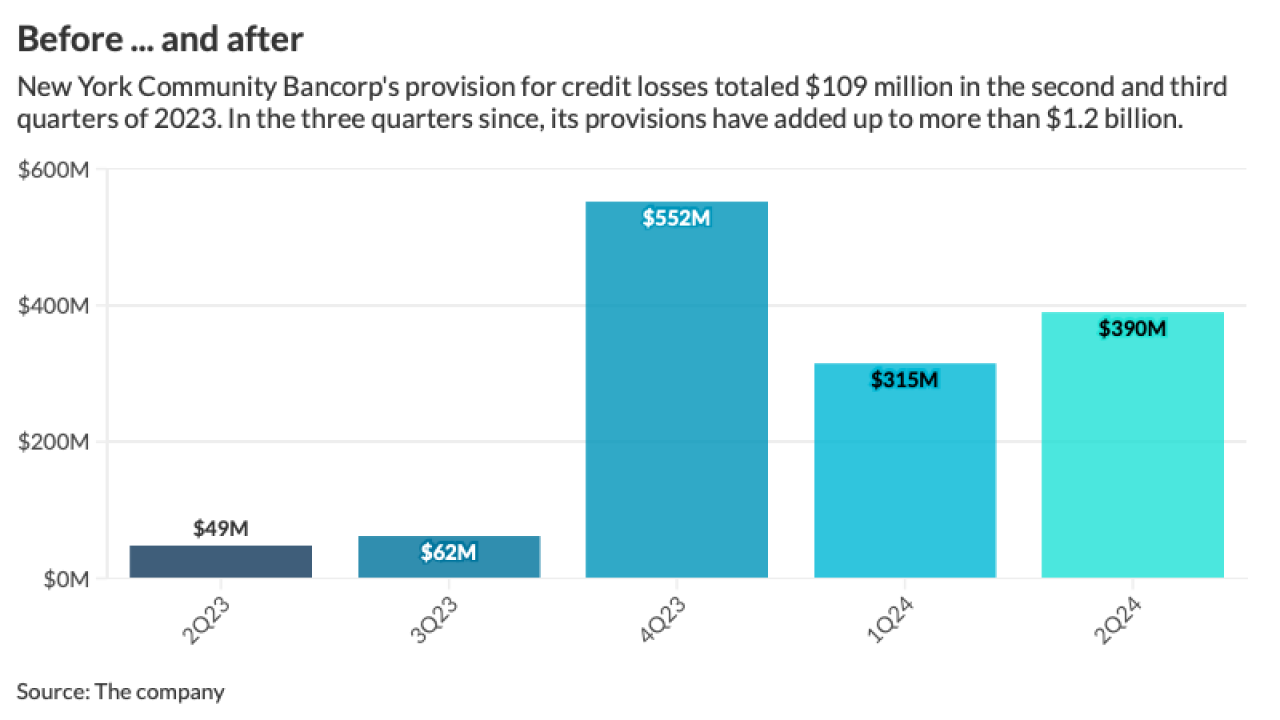

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

The biggest variable for New York Community will be how the Federal Reserve moves interest rates, Gerlinger wrote.

Piper Sandler analyst Mark Fitzgibbon wrote that the bank's new management has an "amazing grasp of what the balance sheet risks and opportunities were." New York Community also seems to have a better handle on the risks in their loan book, "having had a few months to drill deep," Fitzgibbon wrote.

Credit has been a high priority for the bank since it took a large provision for losses at the beginning of this year and found "material weaknesses" in its loan review process. New York Community spent decades building a business of lending to owners of rent-regulated apartments in New York City, which have seen a value slump following a key policy change in 2019, along with the rapid rise in rates and high inflation.