There is a long list of items to consider when pondering a potential acquisition. The takeover target's customer base. The number of branches it has and their location. What kind of lending it does.

There is one area that has been traditionally overlooked but has recently been gaining more traction — how the buyer and seller's approaches to diversity, equity and inclusion would mesh.

"Do you understand what the workforce looks like and what it will look like after it's done around talent development?" said Carolynn Johnson, CEO of DiversityInc, which promotes workplace equality. "What about things like employee resource groups and mentoring?"

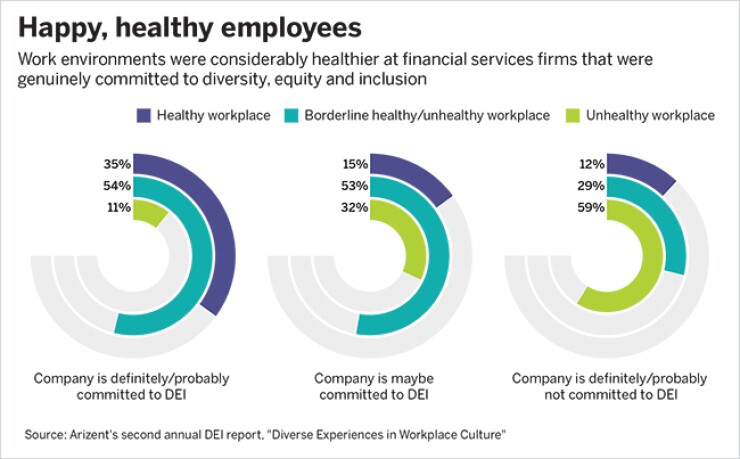

Diversity issues have only risen in importance over the last few years for the financial services sector. Almost three-quarters of bank and credit union employees thought that organizations made better decisions when there was employee diversity, according to Arizent's second annual report on diversity, equity and inclusion, which was released in October. Additionally, more than a third of employees who worked at financial institutions with a perceived commitment to DEI reported healthy workplaces, according to the Arizent research. That compares with just 15% for those who said their organization "maybe" has a commitment to DEI.

Furthermore, customers are looking for banks to step up in terms of diversity, according to RepTrak's 2022 bank reputation report released in November. More than half of respondents said that it was important for banks to address a lack of diversity, which was up six percentage points from 2021.

Given the importance that employees and customers are now placing on DEI, it's essential that potential acquirers and sellers consider this during a merger.

"You have to look at DEI as having to do with risk management," said David Pearson, principal consultant at Brook Graham, a diversity and inclusion consulting firm. "It's a way to maximize value but also minimize risk. But often the value is hidden and so is the risk."

Easier said than done

Prioritizing DEI should be done throughout the entire merger process, experts said, beginning with adding it to the list of topics to review during due diligence.

"There is a big focus on operational due diligence and financial due diligence," said Vibhas Ratanjee, a senior practice expert and executive advisor at the analytics firm Gallup. "But there is generally very little focus on cultural due diligence."

Ratanjee said that Gallup research has found there are three key issues related to employee treatment that are important in the context of a merger: Are employees treated with respect? Is the employer committed to building the strengths of each employee? If an employee raises a question about ethics or integrity, will the organization do what is right?

However, getting the answer to these questions during the due diligence can be challenging, Ratanjee added. To be sure, it's unlikely any company would openly admit it ignores ethical concerns or isn't worried about developing talent.

Instead, to get to the heart of this information, Ratanjee recommended doing a "cultural audit" before coming to an acquisition agreement. This should include not only consideration of the demographic makeup of the organization's workforce but also a review of other materials, such as hiring processes, succession planning, the company's branding and even the wording on its website.

"I would just walk through a branch. That would give you a pretty good idea of the organization's culture," he added. "Even without doing a comprehensive cultural audit, there is a lot you can observe. It's not just what you say; it's what you do."

Potential buyers should consider the demographic makeup of not only the C-suite and board but also the entire rank and file. If there isn't a strong pipeline of diverse talent that's being mentored and trained to advance, then that could say a lot about the financial institution.

Buyers also need to ask about any internal complaints made to human resources that the potential seller has gotten on employment related issues, said Jocelyn Cuttino, a partner at Morgan Lewis who advises clients on employment practices.

"We are looking at how those were addressed and whether appropriate action was taken," she added. "A lot of companies are putting out statements about their commitments to DEI, but you need to see how true that rings to the employee experience."

Still, if a potential takeover target hasn't focused on DEI as much as the buyer, that isn't necessarily a deal breaker, experts said. But it is a factor that should be considered and something that should be proactively addressed by management, said Stephanie Dolan, an M&A consulting principal at Deloitte Consulting.

"Every difference represents a risk," she added. "That increases the imperative of being strong on words and actions. That should include thinking about which leaders are involved in announcing the deal and the demographics there. That sends a message about whether the company stands behind something."

Considerations after the deal closes

Thinking about how the two companies' cultures and approach to DEI mesh is just the first step of the process. There is even more work that has to be done once the deal is closed and the two organizations become one.

"Center culture and center DEI in the discussion, and do it early," said Corliss Garner, chief diversity, equity and inclusion officer at Old National Bank in Evansville, Indiana. "There is so much hard work that leads up to closing the merger. But that's just one milestone. After legal day one, there is so much more work that needs to be done to integrate the two companies. It's important to keep DEI at the center of discussions."

Garner, previously the corporate social responsibility chief of First Midwest Bank, joined the $46 billion-asset Old National after it merged with First Midwest about a year ago. When she first learned about the deal, she had questions about the structure of Old National and its commitment to corporate social responsibility and DEI.

"How far along in the journey were they compared to where we were," she said she wondered at the time. "It was important to understand where there might be gaps and synergies as the two companies came together."

A merger can already be a difficult time for any organization. Employees are potentially stressed about their job security and how the organization might change once the deal is complete. This sense of anxiety may be worse for staff members who are people of color or from another historically underrepresented group. Their current organization may be very strong in terms of diversity and inclusion, and they may fear that will end with the merger.

These concerns were hinted at in Arizent's DEI research. That report found that in general, employees don't believe that their industry is friendly to different groups, even if they believe their particular employer is, according to Arizent's second annual DEI report. That could mean staff members at a takeover target are already primed to be suspicious about the buyer.

"There is a lot of uncertainty, and typically the first question asked is, 'Is my job secure or not?'" Ratanjee said. "With the underrepresented these concerns are higher. You are looking at the company acquiring yours and deciding whether your contributions will matter or be valued or not. If this is not managed well, if these employees don't feel like they will be valued by the acquiring company, then that could lead to a lot of turnover."

Because of that, being transparent about the deal, including anything relevant to DEI, is essential, sources said.

"Putting people first is absolutely important," Johnson said. "Keep employees informed throughout the process. The worst thing is if people are confused and there is no transparency."

This annual list of luminaries honors the women who lead in banking and finance across the country, individually and in teams.

One of the more contentious aspects of a merger can be deciding who will take over in a role once the deal is completed. Diversity and inclusion need to be top of mind as this process plays out. That should include being aware of potential unconscious bias when evaluating who stays.

Are the criteria being considered in the determination process fair? Are the people who are making the decisions diverse themselves? Has the company reached out to mentors or sponsors of those who are potentially affected?

"I've done many audits through a DEI lens, and companies think they have these things in place," Pearson said. "But if you look at what is going on, you realize the system is riddled with bias and people have just become good at ignoring that. My answer isn't retaining diversity at all costs. That's tokenism."

"But when you have worked so hard to get to a leadership role as a woman or a Black person, the threat of losing that is very real. You need sponsors who will speak up as part of the deal team and say, 'This is talent we don't want to lose.' But history tells us women often come off as second best in these conversations, unless they have a very strong advocate," Pearson added.

Finally, banks and credit unions will also need to consider how to combine any DEI programs and employee resource groups that exist. It's important for acquirers to realize that sellers may have some valuable resources that they can draw upon. Therefore, the acquirer shouldn't automatically assume its programs and policies are superior.

"I've seen many cases where the acquired company has stronger policies and DEI strategies," Cuttino said. "That can be used to inform the combined company's practices going forward."

The employees at First Midwest benefited from merging with Old National since the latter already had established employee-resource groups, Garner said.

That meant staff members joining Old National could now benefit from those resources, and Garner had to find a way to ensure it was properly scaled across a larger organization. Old National further demonstrated its commitment to DEI by elevating Garner's position to the executive leadership team. That move signaled to the company's employees that leadership took concerns regarding diversity and inclusion seriously.

"I'm at the table as business decisions are being made, to ensure that DEI is being integrated as we move our company forward," she added. "An organization should be really thoughtful of where this role is placed in the company to give it the influence it needs to drive the business forward."