It’s a new era at Burke & Herbert Bank & Trust in Alexandria, Va.

For most of the past 167 years, the bank has been led by a direct descendant of its two founders, John Woolfolk Burke and Arthur Herbert. Its most recent CEO, E. Hunt Burke, is the great-great-grandson of John Woolfolk Burke.

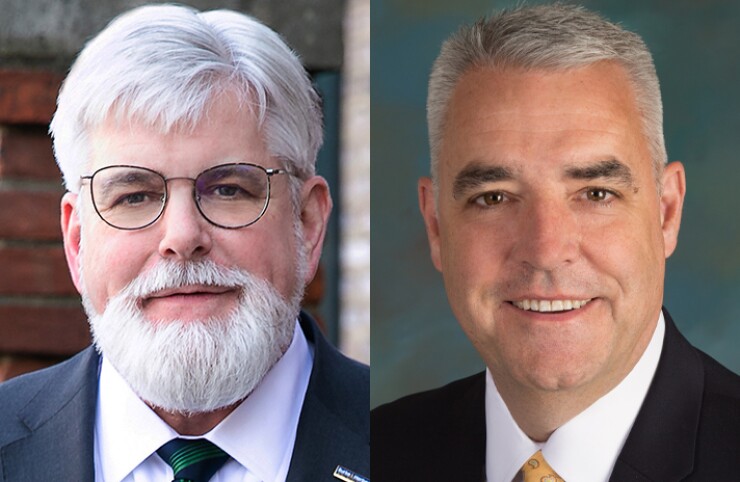

But Burke retired last week after 10 years as CEO and his successor is neither a Burke nor a Herbert. Until the of end year, W. Scott McSween, who had been president and chief operating officer at Burke & Herbert since 2009, will serve as CEO,

Boyle joined the bank last month as president and COO, following a seven-year stint as chief financial officer at the $2 billion-asset Orrstown Financial in Shippensburg, Pa. Before that, he was the chief performance officer at PNC Financial Services Group in Pittsburgh, a regional CEO with National City Bank and the chairman, president and CEO at Wayne Bancorp in Wooster, Ohio, before it was sold to National City in 2004.

Boyle’s appointment as CEO-in-waiting ends a nearly two-year search for Burke’s successor.

Burke, who remains chairman of the bank’s board, said in a news release that Boyle was chosen because he is “a proven financial leader” who “has an appreciation for the long, storied history of our bank and the unique and important role we play in the local community.”

Founded in 1852, Burke & Herbert is the oldest continuously operating bank in Virginia and one of the oldest in the country. There has been at least one CEO who was not related to the founders — Hunt Burke’s immediate predecessor, Charlie Collum — but a Burke has held a senior leadership role for five generations.

Though the bank is now under new leadership, McSween and Boyle said not to expect any major changes to its business model. Despite the pressure small banks are under to gain scale, McSween said that the $3 billion-asset bank isn’t much interested in pursuing an acquisition, being sold to a larger bank or even adding branches outside its Northern Virginia market. Burke & Herbert has never made an acquisition in its history.

“Our resources can be deployed much more efficiently by growing organically here in Northern Virginia,” McSween said.

One area in which it is looking to expand is commercial and industrial lending. More than 97% of its loans are tied to real estate, according to data from the Federal Deposit Insurance Corp., so senior leaders are looking to add more C&I loans to diversify the bank's sources of revenue.

The following is an edited transcript of American Banker’s conversation with McSween and Boyle.

What was the reason for the two-step succession plan?

SCOTT McSWEEN: We invested a lot of time in making sure that we understood what we want to be going forward. And we thought very carefully about what we were looking for in the person who will take the helm for the next decade. We interviewed a lot of people and looked at a lot of resumes. We were introduced to David, and based on our early meetings we felt that there was something quite unique there. We became convinced that he was a fantastic fit. But instead of having what might have been a succession plan that dragged out over a number of years we felt this was the best way to bring in that next person to lead the bank. I can work with him for the balance of this year to help him become familiar with the bank, the people and the community and then hand the baton to David.

David, how do you think your leadership style might be similar and/or different from what the bank has experienced?

DAVID BOYLE: Scott and I are similar in more ways than we are different. I have a bit of a financial bent that I think brings some unique opportunities. I think my background is very similar to Scott’s in that we are coming out of larger institutions, and the visibility we’ve had in those institutions can only help. From a style perspective, culturally this fits very well. The mission and values of this company align well with my own.

Going outside of the organization for the next CEO might suggest that a merger or sale is not in the works. How do you react to that?

McSween: This is something that we spent a lot of time talking about and thinking through two years ago. The board is very much of the mind that among our key objectives is remaining independent. We’re not looking to grow through acquisitions and we’re not looking to prepare ourselves to be sold. We believe that there is a very special value proposition that we can offer to people here in Northern Virginia.

How do you think fallout from the BB&T-SunTrust merger could trickle down to Burke & Herbert?

McSween: I think it’s human nature to be wary of change, and so customers’ tolerance for error when they’re going through that type of change is reduced. They’re almost looking to see what might go wrong. And when you’re doing something as complex as combining two organizations as large as they are there’s bound to be fallout. We fully expect that we will benefit from some of that.

How would you describe the D.C. market today, and how has it changed recently?

McSween: There’s obviously been a lot of consolidation, and we find that every time one of those events occurs we see a material uptick in the inflow of new relationships. Sometimes customers feel that they’ve gotten lost in the shuffle as small, local banks are acquired by larger banks. We’re a small bank so we have to make smart decisions on how best to use our resources. But we can’t afford to be on the leading edge of the technological changes that are taking place. So we observe and gauge what changes are gaining real traction and then determine whether or not to deploy our resources.

Has there been any thought about expanding the bank’s footprint?

McSween: The role of the branch is undergoing dramatic change and we have chosen not to open new branches or expand geographically until we really have a good feel for what the right position of branches will be among delivery channels going forward. I would never say that we’re not open to opportunities that might arise in key markets, but our resources can be deployed much more efficiently by growing organically here in Northern Virginia as opposed to what it would cost to create brand awareness in Maryland, for example. The D.C. market is certainly well banked, but we’re focusing on our corner of the world. But clearly for long-term growth that’s one of the things that we’ll be studying.

David, how do you think you can parlay your experience at PNC into your role as CEO?

Boyle: I learned a tremendous amount from [former Chairman and CEO] Jim Rohr and [current Chairman and CEO] Bill Demchak and the group that was leading the company at the time. I got to see how things got done at a much larger organization. Some of that applies here and some doesn’t. But it will help us expand and grow by thinking about things a little differently.

Moving to the broader economy, there are a lot of predictions about a coming recession. Are you buying into that, and how does it play into your decisions today?

McSween: Unfortunately, my crystal ball rolled off my desk this morning (laughs). With a yield curve that keeps dipping into the inversion mode, we’re concerned. But we feel confident that we’re in a good position. The bank is extraordinarily well capitalized. We believe that sticking to the things that are tried and true will be important in working though whatever we might be facing. We are working to develop a C&I program as we seek ways to diversify the loan portfolio and our sources of revenue.

Boyle: A year or two ago people were talking about a recession starting in late 2018 or early 2019 and then they said it would move out to early 2020. Now they are saying 2021. So it’s anybody’s guess as to when it’s going to happen. But we won’t have a knee-jerked response whenever it does happen.