A new partnership called the Btech Consortium is helping community banks identify emerging technologies.

The strategic partnership, which announced its launch on Wednesday, was formed by the institutional alternative asset manager Elizabeth Park Capital Management, venture capital firm Strandview Capital and an unnamed number of community banks. The consortium will operate an investment fund for technology companies that focus on community banking. The Btech member banks will be limited partners.

"Bank consortiums are not a new concept," Mike Sekits, co-founder of Strandview Capital, said in a press release. "The money-center banks have been forming technology consortiums for decades."

He says Btech will look beyond "shiny objects" like blockchain.

"The Consortium is focused on a practical, near-term approach to help banks achieve a digital native, API-driven [or application programming interface], mobile-first banking environment," Sekits said.

The goals of Btech are to help its member banks find alternatives to legacy technology, compete more effectively with large banks, learn about fintech trends and sort through potential providers. To meet those goals, Btech is also operating an online portal it calls the Consortium Hub, where members can look up details about the organization's investment activity, product demos, fintech sector overviews, how other member banks are using technology and more.

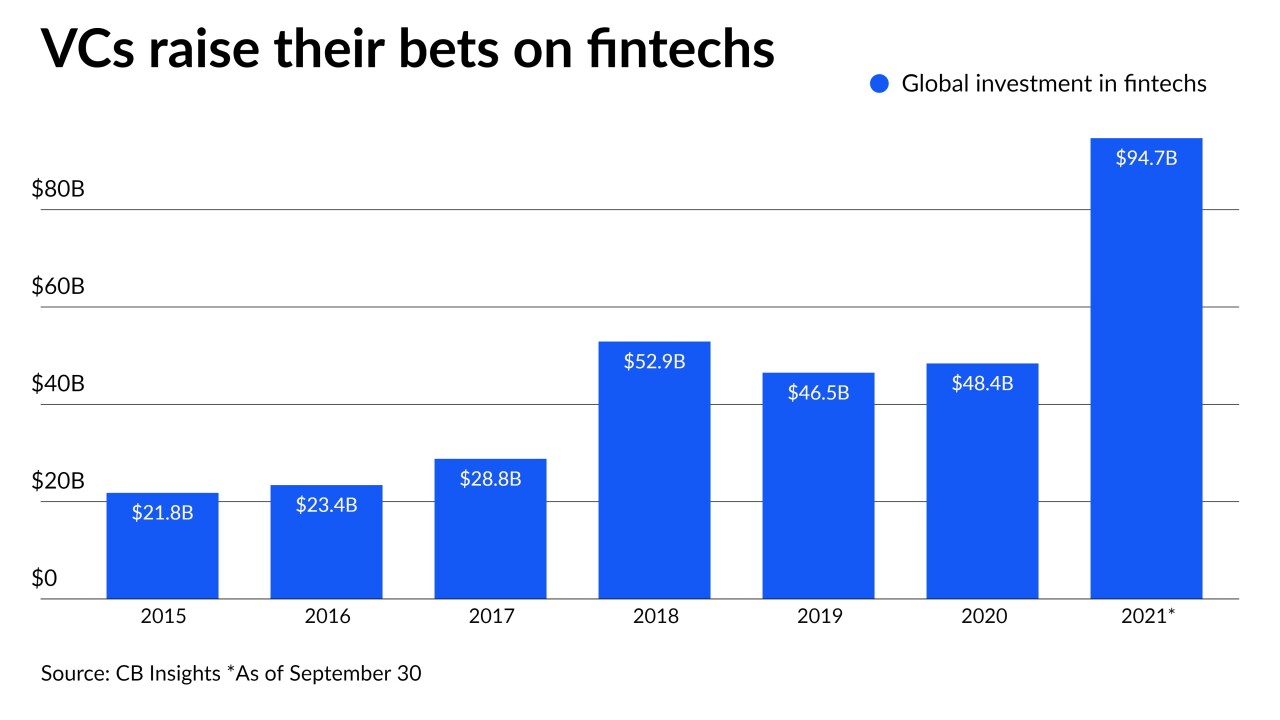

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

Select bank members include Customers Bancorp, East West Bancorp, Farmers National Banc Corp., First Western Financial, Lakeland Financial Corp., OceanFirst Financial Corp., Park National Corp., Premier Financial Corp., and Private Bancorp of America.

"The Btech Consortium helps to solve the buy versus build dilemma faced by mid-sized and community banks giving us access to an array of fresh, cutting-edge solutions that can be adapted to the needs of Consortium members," Sam Sidhu, CEO of

Consortium organizers say they will let their members' needs guide their investments. The areas they are eyeing include business payments, cybersecurity, commercial loan origination and servicing, regulatory compliance, robotic process automation, commercial deposit gathering and more.

"Community banks play a vital role in maintaining thriving local communities," Fred Cummings, founder and president of Elizabeth Park, said in the release. "We increasingly see technology as a key differentiator that allows banks to serve their customers better, generate new sources of revenue, and operate more efficiently."

Btech Consortium's fund is the latest addition to a stream of