Green Dot and its shareholders may be experiencing déjà vu, as a raft of low-cost competitors are again undercutting the prepaid card issuer’s business model.

Earlier this decade, banks such as JPMorgan Chase and American Express

But that competition eventually dwindled, which helped spark

Now the 20-year-old company is facing a new threat from challenger banks such as Chime and Varo. Consumers who might previously have used prepaid cards as an alternative to traditional checking accounts can now sign up for mobile phone-based accounts that do not charge overdraft fees. For example, Varo allows customers to overdraw their accounts by up to $50 without incurring a fee.

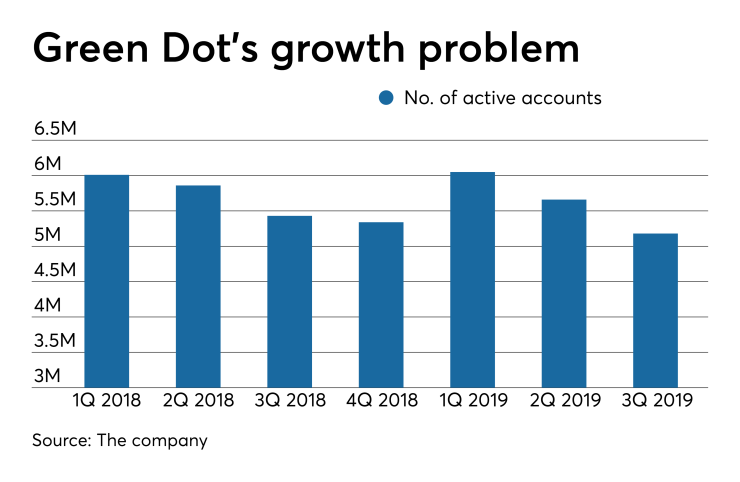

Green Dot said Thursday that it had 5.18 million active accounts at the end of the third quarter, which was down by 250,000 from the same period a year earlier. In August, the firm reported a 200,000 decline compared with the second quarter of 2018.

“We recognize that we have more work to do to get our consumer business back on a growth trajectory, and that Green Dot's ongoing leadership in the free neobank era is not guaranteed,” Green Dot CEO Steve Streit said Thursday during the company’s quarterly earnings call.

Green Dot’s decline in active accounts has slowed since its July 30 launch of an account that offers 3% cash back on all online and in-app purchases, according to Streit.

He also noted that the number of accounts that customers use for the direct deposit of their paychecks has seen strong growth since the new product’s launch. Such accounts tend to be much more profitable than those that are not linked to direct deposit.

Still, Green Dot fell into red ink in the third quarter, reporting a net loss of around $500,000, after reporting net income of $4.6 million in the same period last year.

More significantly, Green Dot said that it expects its adjusted earnings before interest, taxes, depreciation and amortization to decline by $60 million to $65 million in 2020, which is about 25% lower than the $240 million the company has projected for this year.

In midday trading Friday, shares in Green Dot were down 21% to $23.78. Since the start of the year, the company’s stock price has plunged by 70%.

Analysts at BTIG Partners reiterated their neutral recommendation on Green Dot’s stock, writing in a research note that they were surprised by the extent of the projected decline in the company’s financial performance next year.

One reason for that anticipated decline is that the terms of Green Dot’s partnership with Walmart will become more favorable to the retail giant under

But Green Dot expects its consolidated margins to decline by 1.5% as a result of the terms of the renewed contract. Green Dot will also grant 975,000 shares of its common stock to Walmart.

With the financial outlook in Green Dot’s prepaid card business looking weaker, Streit urged investors to consider the growth potential of some of its newer business lines.

Under a deal with Uber Technologies, Green Dot is providing a new debit card for Uber drivers. And Green Dot owns a 20% stake in a recently announced joint venture with Walmart that will focus on developing products at the intersection between financial services and omnichannel retail shopping experiences.

Streit also suggested that competition from venture capital-backed neobanks will likely dwindle over time, as it did several years ago in the prepaid card market. Green Dot estimates that the challenger banks have collectively spent several hundred million dollars to acquire 3 million to 4 million accounts while generating hundreds of millions of dollars in losses, according to Streit.