NBT Bancorp President and CEO John Watt said he and his counterpart at Salisbury Bancorp, CEO Richard Cantele, spent months

"This was the opposite of a shotgun wedding," Watt said. "Rick and I spent a lot of time talking about our complementary cultures, about risk management, about credit, about what we could do together."

Cantele, too, outlined the painstaking process he and Watt went through to ensure a good cultural and operational fit for the merged company. "John and I had been talking for a long time," Cantele said. "We'd been getting to know each other, how each bank operates, how we think about banking, our people and strategy."

After the talking was done, NBT agreed to pay $204 million in stock for the Lakeville, Connecticut-based Salisbury. The pro forma company would have $13 billion of assets — including $9.1 billion of loan — and $11 billion of deposits. The deal is projected to close in the second quarter.

Geographic fit was one of the deal's chief appeals. For the Norwich, New York-based NBT, acquiring the $1.5 billion-asset Salisbury would deepen its footprint in Connecticut and Massachusetts, while extending the franchise into the Middle Hudson Valley.

"If you look at the map, it sure looks like, at eye level, the deal makes sense," Watt said. "We extended the NBT franchise in the Southern Berkshires, we put more depth into our presence in Connecticut, and — importantly — we gained a strong foothold in the [Middle] Hudson Valley, where we think there is going to be significant long-term economic growth."

"When you think of all the serial acquirers out there, NBT is not one of those," Watt said. "We're episodic at most, and we do it for a really intentional reason."

A 'transformational opportunity'

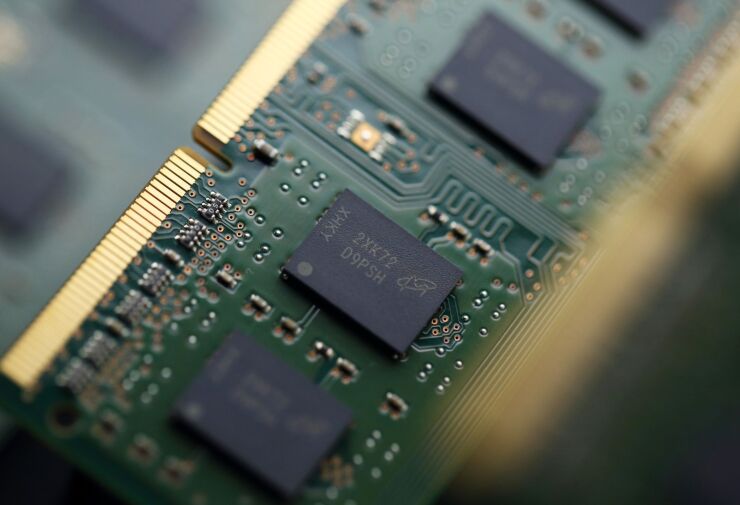

Expanding into the Hudson Valley would give the $11.6 billion-asset NBT, which last announced a bank acquisition in 2013, a presence at both ends of an emerging industrial corridor that is slated for $120 billion of investments by the semiconductor manufacturers IBM and Micron.

Both companies announced major expansion projects in October. Micron intends to spend $100 billion over the next two decades constructing what it described as a megafab in Onondaga County, outside Syracuse. The massive project could eventually include four 600,000-square-foot clean rooms and create 50,000 jobs. At the same time, IBM announced plans to spend $20 billion over the next decade to boost research and manufacturing capacity in the Hudson Valley region.

Founded in 1856, NBT, the holding company for NBT Bank, is well represented in central New York, including 21 branches in the Syracuse metropolitan area, where it holds about 8% of the $16.2 billion deposit market. By buying Salisbury, parent to the Salisbury Bank & Trust Co., whose roots stretch back to 1848, NBT seven gains Hudson Valley locations.

From Watt's vantage point, that leaves NBT sitting pretty. The bigger, stronger merged company will have the opportunity to serve road and warehouse construction firms, trucking companies and homebuilders — all of whom look set to benefit from the coming infusion of semiconductor cash.

"What people don't realize unless they think deeply about it is that the collateral benefits to the economies of these regions associated with chip fabrication are huge," Watt said. "All of that in markets that are slow-growth or no growth, historically. That is about to change."

NBT's share price has languished since the company announced plans to acquire Salisbury. Shares closed at $42.66 Tuesday afternoon, down about 8% from the pre-announcement level. Watt believes he can reverse any negative sentiment with an education campaign aimed at describing the scale of NBT's opportunity.

"The challenge here is the communication of a transformational opportunity for upstate New York," Watt said. "You've got to tell the story about 10 times, then people start following it. I'm going to tell the story 10 times, then 10 times thereafter."

Paring with 'a larger version of ourselves'

While Salisbury's board regularly surveyed strategic options, selling the company "was not part of our strategic plan," Cantele said. Over time, directors changed their minds as the challenges of maintaining independence, from building scale and ensuring management succession to maintaining profitability in a marketplace roiled by sharply rising interest rates, took their toll.

When the decision to sell was made, Salisbury naturally looked to NBT as a prime buyer candidate. During their months of conversations, "I came to realize that [Watt] and NBT would be an ideal fit for us," Cantele said. "I saw them as a larger version of ourselves."

NBT believes it can cut about $10.7 million, amounting to about 30%, from Salisbury's noninterest expense base, though little to none of those cuts will affect Salisbury's customer-facing business lines, Watt said. "There is not a business or a practice Salisbury is engaged in that we would eliminate. It's how do we enhance them. That's what we've been talking about now for months."

Just as importantly in a market that appears poised to turn high-growth, an expanded balance sheet means added deal capacity. "What's the most difficult thing to do," Watt asked. "To look across the table and tell a customer we can't do the size loan they need to drive growth. In all the markets we serve, the merged company can meet 90% to 95% of customers' [credit] needs."

To ensure continuity, Cantele will join NBT's executive team after the merger in an as yet undisclosed capacity.

"I really appreciate the opportunity to stay on through a transitional period to help ensure this is as successful [a merger] as I believe it's going to be and that we get it right with the integration," Cantele said. "I've been with Salisbury Bank my entire career. Literally since I was 21. It's part of who I am. It's part of my life."