Jamarkus Swinson, a recent graduate and fresh entrant to the post-college workforce, has high expectations for his career — and so too does his new employer.

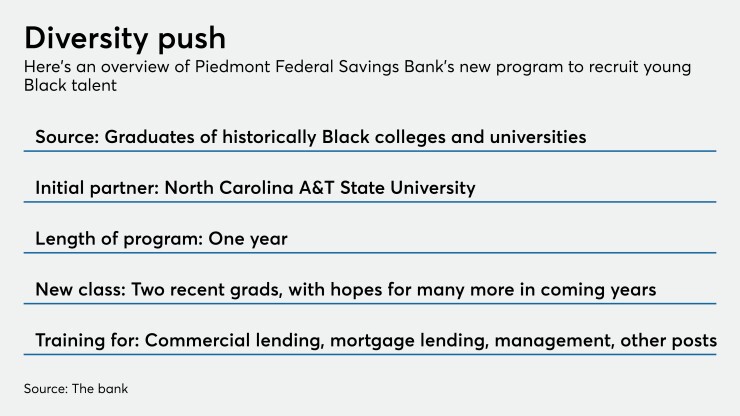

Swinson and a fellow graduate of North Carolina A&T State University's business school constitute the inaugural class of Piedmont Federal Savings Bank’s GPS Banker Development Program, a yearlong, multifaceted training program for new bankers, with an emphasis on recruitment from historically Black colleges and universities, or HBCUs.

Piedmont Federal included GPS in the name to connote a sense of positioning itself and the participants for the future.

The goal is for Swinson and others to build on their degrees from A&T and other HBCUs, learn hands-on the various operations of the thrift and become long-term business bankers and leaders at the $893 million-asset Piedmont. The Winston-Salem, N.C., thrift has long been a mortgage lender but, at the start of 2020, diversified into commercial lending with a focus on small businesses.

“That’s the attractive part of this — I’m investing myself in the company and it’s investing in me for the long term,” Swinson said. “They are not just throwing me to the wolves; they are training me and providing time to really learn the business so I can succeed. And when I succeed, they succeed.”

To be sure,

U.S. Bancorp in Minneapolis, for example, said it

But Piedmont Federal President and CEO David Barksdale said he thinks the thrift’s program is unique among community banks, though it would not surprise him to see more follow suit. “This is the right thing to do for a lot of reasons,” he said.

Bruce Kershner, head of the banking executive search firm Kershner & Co., agreed.

“I think this is an important step,” Kershner said. “And I think more banks need to do it.”

Kershner said that, especially among big banks, extensive training and development programs were common 20 or more years ago but have since faded in number and are scarce today. The result: “Trying to recruit really good bankers who understand credit is very difficult,” he said. “So it definitely makes sense” to develop talent internally.

Barksdale, who took the helm at Piedmont in 2019 after helping to lead other banks in the Carolinas, said the thrift determined early in his tenure that it needed to diversify its business lines to grow and more effectively serve its communities. To do this, it also decided, it needed to diversify its workforce to better reflect North Carolina’s population and its business owners.

The killing of Floyd earlier this year, followed by the racial reckoning in cities across the United States throughout the summer, made action more urgent, Barksdale said. Young Black professionals too often are not entering the workforce on an even playing field, including in the banking profession. As such, banks remain predominantly white and short on the diversity — in backgrounds, in thoughts, in experiences — needed to serve the entirety of their potential customer bases.

“The fact is” in North Carolina’s Piedmont Triad region, which consists of cities Greensboro, Winston-Salem and High Point, “there are very few commercial bankers of color,” Barksdale said. Yet about a third of the area’s population is Black or Hispanic. “So clearly, banks need to do better. You’ve got to be intentional.”

For Piedmont Federal, that meant deepening existing ties with North Carolina A&T, the largest HBCU in the country, to identify interested and talented seniors and recent graduates to launch its development program. While the effort starts modestly, Piedmont Federal expects participation to expand in coming years as the bank grows.

The program, which formally launches this month, will be comprehensive in scope, covering banking principles, operations, accounting, technology, management and leadership.

Participants will work through the yearlong curriculum building on their strengths developed in college with an intensive training program to accelerate their careers, preparing them for advanced positions and future leadership roles with Piedmont Federal.

Allen Suttle, director of business banking at Piedmont Federal, said that while the program is focused on developing commercial bankers, “it is very flexible” and will likely produce branch managers as well as leaders in the mortgage business and other areas of the bank over time.

For his part, Swinson said he is grateful to have successfully navigated a suddenly difficult labor market — many employers froze hiring plans over the summer, as the shocks of the pandemic rolled though the economy — and found an ideal match in his home state.

“It’s an uphill battle out there right now” for job hunters, he said. “I intend to make the most of this.”