If federal regulators are disinclined to monitor banks for discrimination in small-business lending, then community groups such as the National Community Reinvestment Coalition plan to do it for them.

That’s part of the message the NCRC sent this week when it announced that it has secured a $1.2 million grant to probe the small-business lending practices of banks in three yet-to-be-determined U.S. metropolitan areas.

The nonprofit group plans to use mystery shoppers, who will pose as prospective borrowers, to determine whether women and members of minority groups are facing discrimination when they apply for loans.

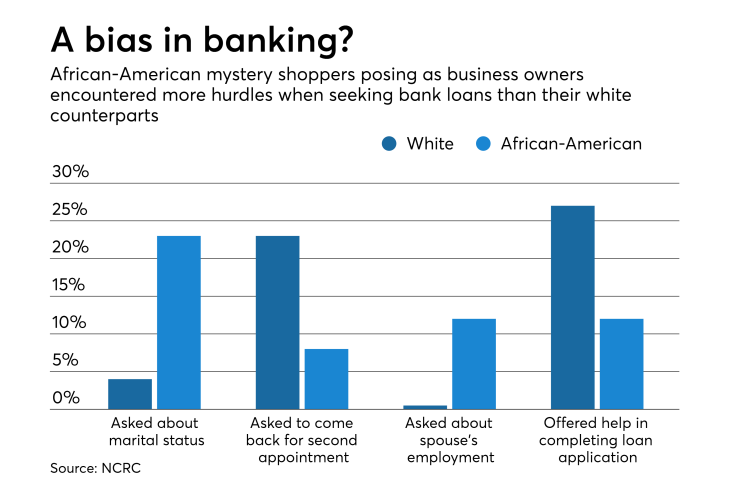

The research will be funded by W.K. Kellogg Foundation. It follows a pilot study conducted last year that found that white shoppers posing as business owners were three times more likely to be invited for follow-up appointments at banks than their black counterparts and twice as likely to be offered help in completing loan applications.

“We were shocked at the level of different treatment, particularly along racial lines,” said John Taylor, CEO of the National Community Reinvestment Coalition.

The pilot study also found that black shoppers were far more likely than whites to be asked about their marital status, as well as about the employment status of their spouses.

Taylor said that the poorer treatment of black shoppers likely reflects the biases of bank employees. “I doubt it’s a bank policy,” he said. “You’re dealing with human beings.”

The forthcoming study is meant to shed additional light on banks’ practices, but Taylor said that his organization has an obligation to inform the Justice Department if it finds a pattern of discrimination.

He argued that the study will help to fill a void left by the Trump-era Consumer Financial Protection Bureau. Acting CFPB Director Mick Mulvaney recently announced that the Office of Fair Lending and Equal Opportunity will be moved out of the bureau’s enforcement division — a move that critics saw as an effort to defang anti-discrimination efforts.

Under the Dodd-Frank Act, the CFPB is required to collect data to help determine if discrimination in small-business lending exists, but the bureau’s rulemaking process has yet to begin. A CFPB spokesman said Wednesday that the bureau is continuing to work on the rulemaking, following a public comment period that ended in September.

Industry officials argue that the CFPB rules should be tailored to avoid placing undue burdens on banks. In comments submitted to the agency last year, the Consumer Bankers Association asked officials to make sure that any new data collection requirements rely on banks’ existing reporting systems.

There is concern, too, that new regulations will make it harder for small-business owners to be approved for loans.

In a survey released Wednesday by the Mercatus Center at George Mason University, 32% of small-business owners said the impact and cost of regulation has affected their access to capital. Brian Knight, a senior research fellow at Mercatus, warned that additional data collection could further crimp lending.

“Small businesses at least seem to believe that the cost of regulation impacts their access,” he said.

However, the National Community Reinvestment Coalition and its partners in academia say that they believe lenders’ bias could also explain why many small-business owners are either rejected for loans or discouraged from applying for loans in the first place.

“Unfortunately, our early research in this area indicates that access to capital may be unequally distributed in our society,” Glenn Christensen, a marketing professor at Brigham Young University, which is partnering on the research with the coalition, said in a press release.

Dory Rand, president of the Woodstock Institute, which focuses on wealth-building in minority communities, said the research shows that minority small-business owners are facing discouragement before they even apply for a loan.

“I think it’s really, really important research,” she said.