Hire a talented executive and then find a business for him or her to run.

This method has worked well for David Becker, First Internet Bancorp's chairman, president and CEO, over his nearly 18 years at the helm of the $1.8 billion-asset institution. That credo was on display earlier this month when the company hired Timothy Dusing to lead its municipal lending team.

The Fishers, Ind., company has never been a prominent lender to local governments, but that did not stop Becker from adding an executive with a long track record in the business.

The decision to hire Dusing "wasn't a planned play," said Becker, who was introduced to the executive by another First Internet employee. "My mantra has always been, if you run across a good employee, find a home for him."

In doing so, First Internet joins a growing list of banks that are either entering municipal finance or significantly raising their profile in the space.

HomeTrust Bancshares in Asheville, N.C.,

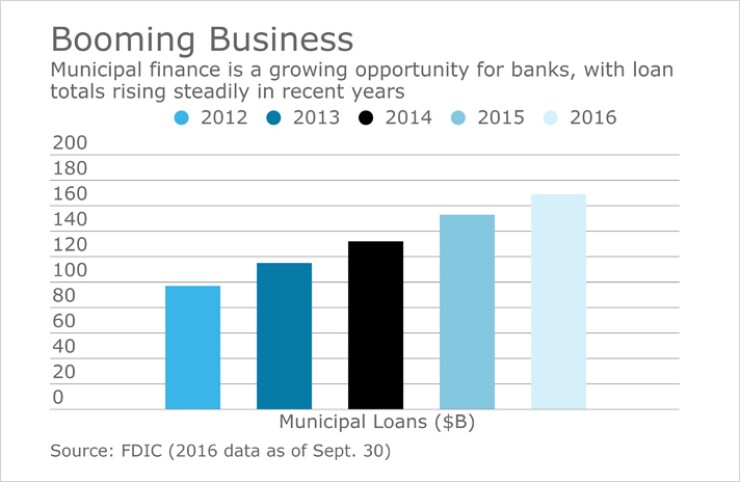

Municipal lending is gaining broader traction. The number of municipal loans on banks' book increased by 10% over the first nine months of 2016, to $169 billion at Sept. 30, based on data from the Federal Deposit Insurance Corp.

Government finance can benefit banks in several ways, industry experts said.

Loans to municipalities typically have better credit quality compared to private-sector loans and they provide a way to diversify beyond areas such as commercial real estate. Those relationships could also pave the way for banks to bring in more municipal deposits, which could have greater importance in a rising interest rate environment.

"It's a new opportunity to generate quality assets for the bank," Becker said.

Municipal loans, however, tend to have lower yields compared to other types of credits, said Jerry Johnson, a former chairman and CEO of Mercantile Bancorp in Grand Rapids, Mich.

"We never made a municipal loan," Johnson said. Publicly traded banks "live and die by analysts' estimates, so return on assets and equity are very important."

First Internet found a banker with extensive experience in the municipal finance field.

Dusing previously spent 24 years at City Securities, an Indiana investment firm, where he focused on public finance. He cut ties with the company after it sold in September to Stifel Financial.

While this is its first formal foray into public finance, First Internet has made municipal loans in the past. At Sept. 30, the portfolio had $8.1 million of loans, or less than 1% of the company's $1.2 billion in total loans, based on FDIC data.

Becker said the municipal book was built on an ad hoc basis as lenders came across deals for fire trucks, garbage trucks and other heavy equipment used by local governments in the course of their normal commercial lending activities.

Dusing now must boost that number, though he has largely been given autonomy when it comes to charting a course. Specific goals and strategy for the municipal operation are "TBD," Becker said.

"He'll take it to whatever level he can," Becker said. "He's certainly got the skill set."

Dusing plans to leverage his "experience and network of investors, public finance professionals and financial advisors," to expand the business, First Internet said in its release announcing his hiring.