Banks that market credit cards to teenagers and college students must weigh the potential for gaining lifelong customers against the obvious risks of lending to people with little experience managing their finances.

The number of teens who use credit cards rises each year, and as the age at which card use begins continues to drop, critics say targeting this demographic can do banks more harm than good. However, some banks are trying to sign up teens for prepaid debit cards, which they tout as a way to help young people learn to budget.

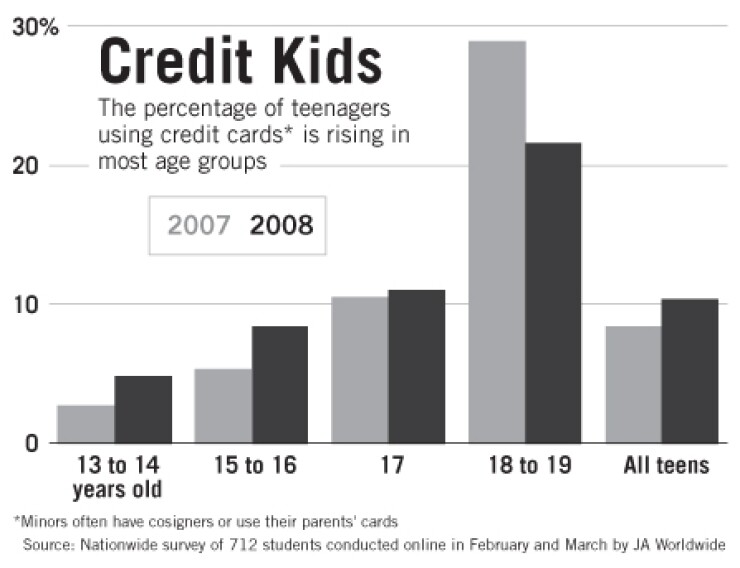

Despite the ongoing credit crunch, 10.4% of teens said they used credit cards this year, up from 8.5% last year, according to a survey released in May by JA Worldwide, a nonprofit that promotes financial knowledge among elementary and high school students. (Eighteen- and 19-year-olds may have credit cards in their own name, while 16- and 17-year-olds often have a co-signer. Younger teens may be authorized users of their parents' cards.)

Susan Menke, a senior financial services analyst at the market research firm Mintel International Group Ltd., said it is hard to tell whether banks are more actively pursuing this market, since credit card mail solicitations are down overall this year.

A search of Mintel's database found 52 issuers that targeted students through print, direct mail, and e-mail advertisements between January and June. A search for the same period in 2006 returned 72 issuers. However, Ms. Menke said, "the student market is huge" and of "increasing interest."

Frontier Bank in Park City, Utah, is one of at least half a dozen issuers of the Visa Buxx prepaid debit card. Vivian Arriaga, the bank's central operations manager in Palm Desert, Calif. (where it does business as El Paseo Bank), said the strategic rationale for marketing to teens is that "the earlier you start, the better" it is for fostering brand loyalty.

"We want to be the first impression children have of banks," she said.

Similarly, U.S. Bancorp's Elan Financial Services, which offers a Young Adult Visa Classic credit card, says on its Web site: "Research shows that cardholders will likely remain loyal to the issuer of their first credit card."

The card is available to anyone 16 and older with a co-signer and marketed as a way for young adults to establish a credit rating. Elan also issues the College Rewards Visa Card, which does not require a co-signer and lets students earn points toward electronics and entertainment discounts. Elan declined to comment for this article. (U.S. Bancorp also issues a Visa Buxx card.)

Capital One Financial Corp. offers four "young adult" cards for people 18 and older with little or no credit history. Diana Don, a spokeswoman for the McLean, Va., issuer, said credit lines on these cards range from $300 to $3,000. She would not say how many people have applied for or received the cards, and referred other questions to the card networks.

The JA Worldwide survey found that 13.2% of the 72 respondents who used cards paid only the minimum balance each month. Judge John C. Ninfo 2nd, of the U.S. Bankruptcy Court for the Western District of New York, said teens who have not learned the basics of personal finance may easily fall into lifelong debt.

"These customers aren't as responsible — they're hungry consumers," said Mr. Ninfo, who founded Credit Abuse Resistance Education, a national program funded by the bankruptcy court. "The longer we can keep credit cards out of their hands, probably the better."

C. Red Gillen, a senior analyst at the research firm Celent, a Marsh & McLennan Cos. unit, said that if a high percentage of teens have difficulty managing the debt they run up on their credit cards, "it will blow up in the bank's face."

"I think that given the amount of 'churn' in the credit card space, there are very few lifelong customers," Mr. Gillen said. "Combine this with the fact that teens typically aren't issued a very large line of credit — and thus don't represent a huge revenue opportunity — and I think banks would be best off not aggressively pursuing the teen market." (The survey found that 38% of teen cardholders charge an average of $50 or less a month.) If banks seek lifelong customers, it is more "prudent and responsible" for them to offer debit or prepaid cards, he said.

Such prepaid products include the MYplash issued by First Premier Bank of Sioux Falls, S.D., whose users receive exclusive offers from musical artists; and the PAYjr card issued by MetaBank of Storm Lake, Iowa, which lets parents transfer money into children's accounts once they have finished assigned chores.

The Visa Buxx card is available to those 13 and older and can store up to $250. "The core of the product is about financial responsibility, and teaching young adults to properly use payment products," said Steve Diamond, Visa Inc.'s senior business leader of prepaid products. The card is valuable to the network and its issuers because teens are a "huge demographic with a lot of spending power."

El Paseo often markets the card to parents, but also brings students into branches to learn about saving. Haddon Libby, the bank's chief financial officer, said these visits are often the child's first introduction to a financial institution, and that most who visit choose to open a savings account or get a Visa Buxx card. Many of the children remain with the bank after their under-18 account expires and open a checking account, Mr. Libby said.