Mortgage servicers that deal with a large number of distressed borrowers continue to struggle with negative consumer perceptions about customer service, according to the results of the J.D. Power Primary Mortgage Satisfaction Survey released earlier this week.

Only the highest and three lowest scoring servicers remained the same from 2014, with a shuffle in the rest of the field, though a redesigned survey makes direct year-over-year score comparisons impossible

The survey's results indicate that lower-ranked servicers' reputations supersedeefforts to improve customer experience, with consumers retaining the belief that the servicers are driven mainly by profit, and not from a mandate to assist distressed borrowers.

Quicken Loans' standing among consumers remains strong, even after being sued by the Department of Justice over the underwriting of Federal Housing Administration-insured mortgages.

While typically, servicers open communication with consumers with debt collection disclosures mandated by regulation, Quicken's correspondence addresses its borrowers with a formal greetingone way the company sets expectations for customer experience.

Its record of prioritizing its borrowers over its investors is what continues to set Quicken apart, not necessarily their products, said Craig Martin, director of the mortgage practice at J.D. Power.

As for servicers as a group, just the way they approach customer contact "from a legal compliance standpoint" could be having an impact on how consumers view the interaction, Martin said.

USAA is another company that has this attitude. The company has high brand loyalty from its customer base, which is made up of military families. In fact, USAA got a higher customer service score than Quicken, at 845. But because USAA is a membership organization and does not deal with the general public, its score is not recognized in the survey and is not counted in the industry average.

Companies ranked lower if consumers believed they view their investors as their customers.

Responses to the survey show a clear connection, Martin continued.

Customers defining themselves as at-risk made up 15% of the respondents, after hovering around 18% to 20% over the past few years.

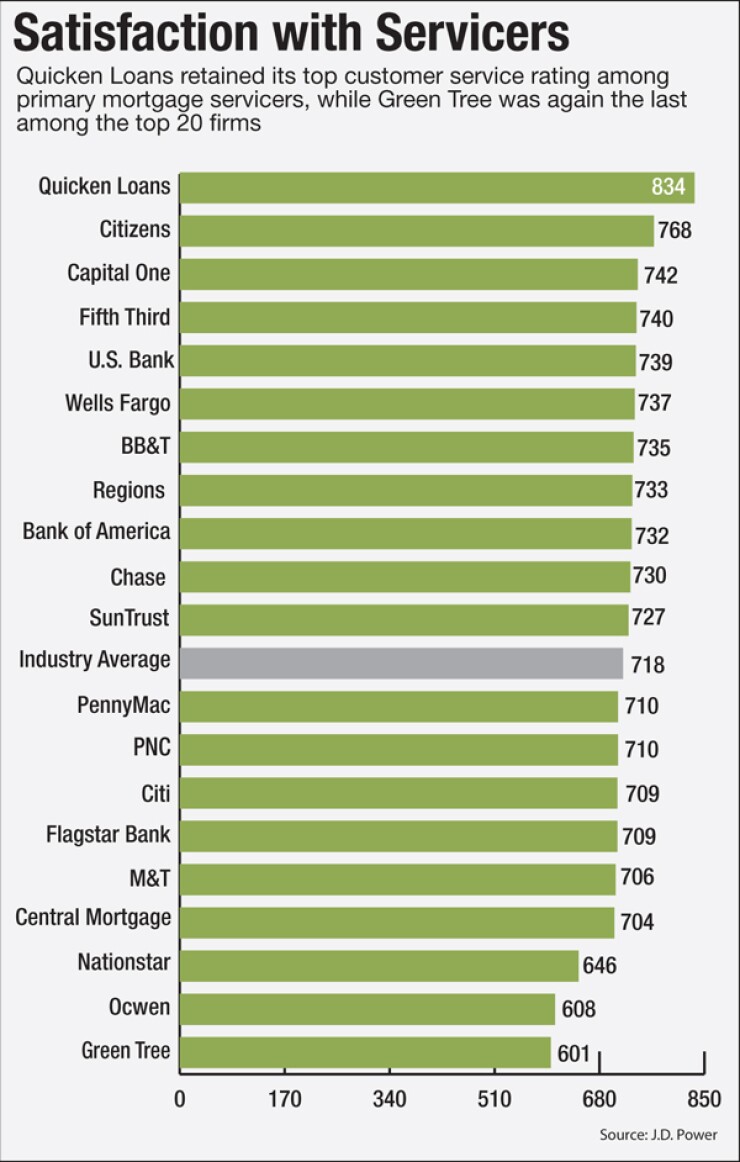

Nationstar (with a score of 646) was in the lowest tier of the 20 ranked companies along with Ocwen (608) and Green Tree (601); the only change from last year is that Nationstar and Ocwen have switched positions.

Martin noted that the three bottom tier companies have migrated from dealing primarily with distressed borrowers to dealing with performing customers. He pointed to Nationstar in particular as a company looking to improve the customer experience.

The survey also found that while just 17% of at-risk borrowers said they were highly satisfied with their servicer, this is true for just 19% of those borrowers who are not having problems paying their loan.

"A lot of this has to do with how they are being treated. Someone who is struggling, if you put out a little effort they really appreciate that," Martin said. "How you treat them, how you communicate with them, that can have a real impact" on perceptions about customer service.

Another factor in customer service scores is how easy or difficult it is for consumers to get their questions answered. When they are able to resolve an issue entirely on their servicer's website, the industry's satisfaction score is 765. When they need to start making phone calls because they can't get the answer online, the score is 650.

Borrowers are comparing their online experience with their servicer to their experience with Amazon, Apple or Google, not another servicer. And that has an impact about how they feel about the experience, he said. Consumers are still finding they need to make a phone call for information they should be able to easily find online.

Quicken Loans remained at the top of the list with a score of 834; it is the only servicer in the highest tier based on the six categories J.D. Power rated. The two servicers in the second tier are Citizens Bank with a score of 768 (it was not ranked in 2014) and Capital One Bank at 742 (ranked 15th last year). Last year's No. 2, Chase, fell to 10th while Regions went from No. 3 to No. 8.

The other nonbank servicer ranked, PennyMac, is tied for 12th with a score of 710.

Of the five nonbank servicers rated by consumers, three have the lowest scores.

The industry average score is 718.