-

What makes for a high-performing bank? We take an in-depth look at what drove profitability for the institutions at the top of our annual rankings, all of which are based on three-year average returns on equity. See the list of banks and thrifts with under $2 billion in assets or the mid-tiers with $2 billion to $10 billion of assets. Stay tuned as those with $10 billion to $50 billion of assets are still to come.

May 10 -

Performance among banks and thrifts with $2 billion to $10 billion of assets has not changed much over the past year, judging from our annual ranking.

July 28 -

Banks with $2 billion to $10 billion of assets ranked by three-year average return on equity. Our chart offers an in-depth look at the performance of mid-tiers nationwide, including key metrics like net income, efficiency ratio and tangible equity.

July 29

On several key measures banks and thrifts with $2 billion to $10 billion of assets showed improvement over the past year.

Core deposits among institutions in this size range grew a median of 8.67% in 2014 compared with the previous year, and net loans rose a median of 11.24%, an analysis by Capital Performance Group shows. That's partly because gathering core deposits has become a strategic focus for many as a means to fund higher loan demand, says Kevin Halsey, a senior analyst for CPG.

These upward trends contributed to median revenue growth of 4.97% for the overall group and, even though noninterest expenses also increased, a lot of the new revenue apparently went to the bottom line, as median net income increased 9.19%.

Three-year average returns on equity the measure used as the basis for our ranking also offers evidence of positive momentum. This year 40% of the mid-tiers posted double digits, up from 34% in

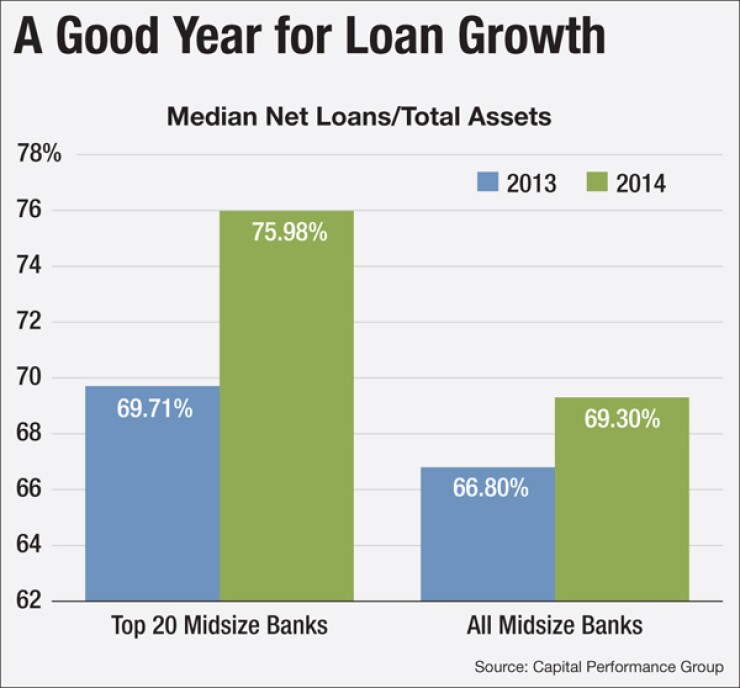

To get a sense of what helps separate the highest performers from the rest, CPG compared metrics for the top 20 institutions on this list with the overall peer group. Fee income, loan growth and net interest income were among the differentiators in 2014.

The top 20 had a median noninterest income to average assets ratio of 1.36% compared to 0.92% for peers, with net gains on the sale of loans and deposit service charges contributing to the disparity.

The top 20 also had a median net interest income to average assets ratio of 3.62%, which is 34 basis points better than the peer group. CPG attributes this to their ability to achieve better loan growth while maintaining higher yields (a median of 4.08% on average assets compared to 3.95% for peers).

Though loan growth for the mid-tiers overall was in the double digits, the median for the top 20 was a very impressive 15.92%. The growth for both groups was led in part by 1-to-4 family loans and commercial and industrial loans.

Of the 191 public and private companies included in this ranking, 20 of them grew their way into the mid-tier segment during 2014 by climbing above $2 billion of assets, according to the CPG analysis. Five others scrolled off the list because they shot past the $10 billion mark during the year.

Since those registered as subchapter S corporations are not subject to federal corporate income tax, their data is adjusted accordingly to allow for a fair comparison with their peers.

To avoid having deferred tax assets skew the results, the ranking excludes institutions for which a negative provision for taxes contributed more than 10% to net income in 2014, 2013 or 2012.

Banks and Thrifts with $2 Billion to $10 Billion of Assets

| ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | Institution | Location | Total Assets ($000) | 3-Yr. Avg. ROAE (%) | ROAE (%) | ROAA (%) | Efficiency Ratio FTE (%) | Net Interest Margin (%) | Cost of Funds (%) | Net Loan Growth, YOY (%) | Change in Noninterest Expenses, YOY (%) | Change in Net Income, YOY (%) |

| 1 | Fremont Bancorp.* | Fremont, CA | 2,721,714 | 24.64 | 10.82 | 0.88 | 77.68 | 3.86 | 0.22 | 16.68 | -12.71 | -58.54 |

| 2 | Union Savings Bank* | Cincinnati, OH | 2,446,095 | 21.98 | 11.86 | 1.21 | 54.36 | 2.62 | 0.70 | 26.06 | -14.74 | -43.63 |

| 3 | HomeStreet | Seattle, WA | 3,534,779 | 18.98 | 7.69 | 0.69 | 87.48 | 3.53 | 0.42 | 26.43 | 10.50 | -6.51 |

| 4 | Wilshire Bancorp | Los Angeles, CA | 4,155,464 | 18.19 | 12.55 | 1.57 | 51.39 | 4.23 | 0.46 | 15.16 | 25.87 | 30.05 |

| 5 | State Bankshares | Fargo, ND | 3,273,905 | 17.61 | 20.04 | 1.51 | 65.78 | 3.86 | 0.42 | 10.20 | 8.52 | 57.93 |

| 6 | BofI Holding | San Diego, CA | 5,194,721 | 17.53 | 18.31 | 1.56 | 34.28 | 4.17 | 1.01 | 54.81 | 13.10 | 44.73 |

| 7 | Woodforest Financial Group* | The Woodlands, TX | 4,555,898 | 17.25 | 18.20 | 1.31 | 84.47 | 2.74 | 0.21 | 22.15 | 4.52 | 24.47 |

| 8 | Beal Financial Corp.* | Plano, TX | 7,811,748 | 16.73 | 13.21 | 4.40 | 20.04 | 7.97 | 0.89 | -4.59 | -11.14 | -13.47 |

| 9 | Heartland Bancorp* | Bloomington, IL | 2,514,214 | 16.24 | 13.69 | 1.35 | 58.07 | 4.32 | 0.27 | 3.40 | -14.99 | 9.14 |

| 10 | Landrum Co. | Columbia, MO | 2,156,350 | 16.00 | 14.72 | 0.83 | 67.89 | 4.21 | 0.35 | 8.42 | 6.03 | 3.63 |

| 11 | First Security Bancorp | Searcy, AR | 4,751,538 | 15.97 | 13.86 | 2.17 | 39.84 | 5.71 | 0.45 | 2.45 | 0.67 | -1.75 |

| 12 | Bank of the Ozarks | Little Rock, AR | 6,766,499 | 15.84 | 15.12 | 2.01 | 44.00 | 5.56 | 0.41 | 53.13 | 31.69 | 36.12 |

| 13 | ServisFirst Bancshares | Birmingham, AL | 4,098,679 | 15.40 | 14.55 | 1.40 | 39.69 | 3.69 | 0.42 | 17.41 | 21.33 | 25.85 |

| 14 | Olney Bancshares of Texas* | Olney, TX | 2,608,316 | 15.05 | 14.47 | 1.43 | 48.46 | 4.06 | 0.22 | 24.56 | 20.62 | 12.12 |

| 15 | First Financial Bankshares | Abilene, TX | 5,848,202 | 13.87 | 14.00 | 1.67 | 49.14 | 4.28 | 0.07 | 9.25 | 9.45 | 13.56 |

| 16 | German American Bancorp | Jasper, IN | 2,237,099 | 13.40 | 13.22 | 1.30 | 56.77 | 3.76 | 0.31 | 4.52 | 5.11 | 11.53 |

| 17 | First Bancshares | Merrillville, IN | 2,729,739 | 13.26 | 12.72 | 1.22 | 59.35 | 3.82 | 0.34 | 16.70 | 4.57 | 10.19 |

| 18 | Stock Yards Bancorp | Louisville, KY | 2,563,995 | 13.24 | 14.19 | 1.45 | 59.32 | 3.72 | 0.25 | 9.02 | 3.02 | 28.16 |

| 19 | Canandaigua National Corp. | Canandaigua, NY | 2,117,469 | 13.19 | 12.90 | 1.01 | 64.64 | 3.66 | 0.32 | 11.29 | 2.17 | 6.64 |

| 20 | Stockman Financial Corp.* | Miles City, MT | 3,025,682 | 13.16 | 12.05 | 1.17 | 53.24 | 3.55 | 0.51 | 16.96 | 9.59 | -3.24 |

| 21 | Westamerica Bancorp. | San Rafael, CA | 5,036,399 | 12.99 | 11.57 | 1.22 | 51.23 | 3.69 | 0.08 | -7.08 | -4.96 | -9.72 |

| 22 | USAmeriBancorp | Clearwater, FL | 3,077,285 | 12.94 | 11.29 | 0.92 | 57.49 | 3.45 | 0.74 | 9.38 | -8.65 | -23.77 |

| 23 | Fishback Financial Corp. | Brookings, SD | 2,014,004 | 12.81 | 11.56 | 1.33 | 60.79 | 4.29 | 0.55 | 10.66 | 0.92 | -7.00 |

| 24 | City Holding Co. | Charleston, WV | 3,474,969 | 12.76 | 13.38 | 1.56 | 53.65 | 3.99 | 0.40 | 1.79 | -6.89 | 9.85 |

| 25 | Amarillo National Bancorp* | Amarillo, TX | 3,908,212 | 12.58 | 12.15 | 1.34 | 49.02 | 3.45 | 0.22 | 14.26 | 9.50 | 7.30 |

| 26 | Lakeland Financial Corp. | Warsaw, IN | 3,443,509 | 12.52 | 12.77 | 1.32 | 49.15 | 3.34 | 0.51 | 9.23 | 5.40 | 12.79 |

| 27 | Fidelity Southern Corp. | Atlanta, GA | 3,085,953 | 12.48 | 12.10 | 1.11 | 74.38 | 3.66 | 0.39 | 26.88 | 4.86 | 8.68 |

| 28 | Burke & Herbert | Alexandria, VA | 2,615,678 | 12.43 | 11.03 | 1.31 | 54.56 | 3.98 | 0.33 | 7.59 | 5.20 | -2.66 |

| 29 | Midland Financial Co.* | Oklahoma City, OK | 9,803,360 | 12.36 | 12.03 | 1.36 | 62.24 | 3.87 | 0.91 | 5.54 | 6.71 | 13.26 |

| 30 | Horizon Bancorp | Michigan City, IN | 2,076,922 | 12.28 | 9.96 | 0.93 | 66.83 | 3.90 | 0.74 | 29.55 | 5.99 | -8.93 |

| 31 | Arrow Financial Corp. | Glens Falls, NY | 2,217,420 | 12.26 | 11.79 | 1.07 | 57.21 | 3.17 | 0.29 | 11.63 | 1.55 | 7.18 |

| 32 | Home BancShares | Conway, AR | 7,403,272 | 12.13 | 12.35 | 1.63 | 42.54 | 5.43 | 0.31 | 12.84 | 21.57 | 69.97 |

| 33 | Eagle Bancorp | Bethesda, MD | 5,248,715 | 12.12 | 11.97 | 1.32 | 49.58 | 4.45 | 0.36 | 46.31 | 18.04 | 16.98 |

| 34 | CNB Financial Corp. | Clearfield, PA | 2,189,321 | 12.10 | 12.76 | 1.07 | 57.60 | 3.73 | 0.60 | 4.63 | 20.26 | 38.34 |

| 35 | First American Bank Corp.* | Elk Grove Village, IL | 3,419,973 | 12.06 | 10.77 | 0.69 | 75.12 | 2.49 | 0.34 | 15.76 | 6.14 | -4.61 |

| 36 | Park National Corp. | Newark, OH | 7,003,256 | 11.89 | 12.32 | 1.22 | 64.52 | 3.56 | 0.65 | 4.70 | 3.56 | 8.89 |

| 37 | Hometown Community* | Morton, IL | 2,865,792 | 11.87 | 12.14 | 1.02 | 52.54 | 3.22 | 0.82 | 5.64 | 5.63 | 8.76 |

| 38 | BTC Financial Corp. | Des Moines, IA | 3,589,951 | 11.85 | 13.41 | 0.85 | 66.00 | 3.00 | 0.58 | 14.29 | 4.91 | 21.84 |

| 39 | Washington Trust Bancorp | Westerly, RI | 3,587,732 | 11.84 | 11.88 | 1.23 | 59.76 | 3.28 | 0.82 | 17.59 | -1.89 | 12.92 |

| 40 | Farmers & Merchants Bancorp | Lodi, CA | 2,361,689 | 11.78 | 11.53 | 1.17 | 54.13 | 3.90 | 0.11 | 23.85 | 1.14 | 5.57 |

| 41 | Talmer Bancorp | Troy, MI | 5,867,537 | 11.74 | 12.56 | 1.61 | 68.20 | 4.13 | 0.24 | 41.45 | -13.93 | -7.82 |

| 42 | CVB Financial Corp. | Ontario, CA | 7,377,920 | 11.72 | 12.51 | 1.46 | 44.53 | 3.62 | 0.26 | 8.13 | 11.02 | 8.80 |

| 43 | Square 1 Financial | Durham, NC | 3,099,215 | 11.68 | 12.86 | 1.26 | 51.66 | 3.94 | 0.02 | 24.37 | 17.98 | 52.72 |

| 44 | Meta Financial Group | Sioux Falls, SD | 2,108,101 | 11.66 | 9.27 | 0.76 | 74.92 | 2.94 | 0.14 | 46.70 | 8.15 | 7.07 |

| 45 | Alpine Banks of Colorado | Glenwood Springs, CO | 2,451,605 | 11.61 | 13.74 | 1.07 | 68.68 | 4.22 | 0.19 | 4.41 | 4.16 | 2.97 |

| 46 | Institution for Savings | Newburyport, MA | 2,034,487 | 11.54 | 12.26 | 1.55 | 78.00 | 2.31 | 1.21 | 26.81 | 45.55 | 9.78 |

| 47 | Century Bancorp | Medford, MA | 3,624,036 | 11.40 | 11.57 | 0.61 | 62.27 | 2.24 | 0.51 | 5.24 | 1.73 | 9.05 |

| 48 | Bryn Mawr Bank Corp. | Bryn Mawr, PA | 2,246,506 | 11.32 | 11.57 | 1.32 | 62.48 | 3.93 | 0.33 | 7.08 | 0.89 | 13.91 |

| 49 | Great Southern Bancorp | Springfield, MO | 3,956,408 | 11.18 | 10.81 | 1.14 | 64.82 | 4.89 | 0.46 | 24.86 | 6.80 | 29.06 |

| 50 | TrustCo Bank Corp NY | Glenville, NY | 4,644,641 | 11.14 | 11.57 | 0.97 | 54.82 | 3.16 | 0.37 | 8.76 | 2.27 | 11.00 |

| 51 | Educational Services | Farragut, TN | 3,212,254 | 11.12 | 12.83 | 1.31 | 57.91 | 3.19 | 2.70 | 20.12 | 21.92 | 31.74 |

| 52 | Republic Bancorp | Louisville, KY | 3,747,013 | 11.00 | 5.16 | 0.81 | 69.21 | 3.33 | 0.65 | 17.59 | -8.07 | 13.23 |

| 53 | American National Corp.* | Omaha, NE | 2,718,647 | 11.00 | 10.92 | 1.09 | 57.64 | 4.00 | 0.23 | 9.91 | 1.84 | 3.03 |

| 54 | Enterprise Financial Services | Clayton, MO | 3,277,028 | 11.00 | 9.01 | 0.86 | 63.54 | 4.10 | 0.50 | 11.38 | -3.49 | -17.92 |

| 55 | Cardinal Financial Corp. | McLean, VA | 3,399,134 | 10.96 | 8.90 | 1.03 | 64.88 | 3.60 | 0.89 | 20.19 | 13.74 | 28.12 |

| 56 | Customers Bancorp | Wyomissing, PA | 6,825,370 | 10.87 | 10.39 | 0.78 | 56.48 | 2.91 | 0.75 | 79.28 | 32.84 | 32.18 |

| 57 | Community Trust Bancorp | Pikeville, KY | 3,723,765 | 10.84 | 9.94 | 1.18 | 59.00 | 3.91 | 0.37 | 4.63 | -3.86 | -4.25 |

| 58 | Pinnacle Bancorp* | Central City, NE | 8,084,758 | 10.78 | 10.62 | 1.11 | 57.05 | 3.58 | 0.31 | 10.42 | 2.87 | 2.37 |

| 59 | Bremer Financial Corp. | Saint Paul, MN | 9,231,165 | 10.66 | 10.68 | 1.12 | 62.18 | 3.91 | 0.27 | 6.95 | 0.79 | 12.99 |

| 60 | Luther Burbank Corp.* | Santa Rosa, CA | 3,970,158 | 10.54 | 6.76 | 0.61 | 63.42 | 2.55 | 1.10 | 2.48 | 39.30 | -34.44 |

| 61 | BBCN Bancorp | Los Angeles, CA | 7,140,330 | 10.52 | 10.45 | 1.30 | 48.11 | 4.10 | 0.60 | 9.41 | 6.34 | 8.39 |

| 62 | WSFS Financial Corp. | Wilmington, DE | 4,853,320 | 10.47 | 12.22 | 1.17 | 65.50 | 3.71 | 0.38 | 8.09 | 11.50 | 14.66 |

| 63 | BancFirst Corp. | Oklahoma City, OK | 6,574,975 | 10.44 | 10.92 | 1.00 | 65.42 | 3.08 | 0.22 | 14.09 | 6.85 | 17.62 |

| 64 | Farmers & Merchants | Lincoln, NE | 3,085,249 | 10.43 | 8.93 | 0.98 | 75.17 | 3.10 | 0.49 | 9.23 | 2.55 | -7.06 |

| 65 | Dime Community Bancshares | Brooklyn, NY | 4,497,107 | 10.38 | 9.83 | 1.03 | 45.87 | 3.03 | 1.25 | 11.45 | -2.33 | 1.60 |

| 66 | Heartland Financial USA | Dubuque, IA | 6,052,362 | 10.36 | 8.95 | 0.72 | 72.97 | 3.95 | 0.64 | 11.39 | 10.46 | 13.89 |

| 67 | First of Long Island Corp. | Glen Head, NY | 2,721,494 | 10.34 | 10.25 | 0.92 | 51.81 | 3.07 | 0.56 | 22.20 | 6.41 | 8.05 |

| 68 | Boston Private Financial | Boston, MA | 6,798,034 | 10.33 | 10.35 | 1.04 | 67.41 | 3.01 | 0.45 | 3.15 | 3.13 | -2.44 |

| 69 | Durant Bancorp* | Durant, OK | 2,565,016 | 10.29 | 10.50 | 0.97 | 72.20 | 3.68 | 0.44 | 10.91 | 8.65 | -5.95 |

| 70 | Pacific Premier Bancorp | Irvine, CA | 2,038,897 | 10.21 | 8.71 | 0.91 | 63.13 | 4.27 | 0.48 | 30.88 | 9.37 | 84.77 |

| 71 | Tompkins Financial Corp. | Ithaca, NY | 5,269,561 | 10.18 | 10.76 | 1.03 | 64.20 | 3.58 | 0.46 | 6.25 | 1.04 | 2.33 |

| 72 | Camden National Corp. | Camden, ME | 2,789,853 | 10.15 | 10.38 | 0.92 | 60.45 | 3.12 | 0.46 | 12.36 | -5.77 | 7.84 |

| 73 | Financial Institutions | Warsaw, NY | 3,089,521 | 10.12 | 10.80 | 0.98 | 59.73 | 3.51 | 0.23 | 4.14 | 4.21 | 14.98 |

| 74 | Hills Bancorp. | Hills, IA | 2,334,318 | 10.11 | 9.59 | 1.21 | 55.24 | 3.46 | 0.78 | 8.84 | 5.04 | 4.02 |

| 75 | First South Bancorp* | Lexington, TN | 2,428,539 | 10.11 | 11.66 | 1.03 | 73.05 | 3.94 | 0.38 | 14.90 | 12.23 | 19.93 |

| 76 | CoBiz Financial | Denver, CO | 3,062,166 | 10.09 | 9.82 | 1.00 | 69.80 | 3.97 | 0.33 | 15.90 | 6.96 | 5.06 |

| 77 | North American Bancshares | Sherman, TX | 2,199,214 | 9.95 | 11.07 | 1.22 | 54.48 | 3.75 | 0.35 | 15.38 | -1.80 | 16.01 |

| 78 | Glacier Bancorp | Kalispell, MT | 8,306,823 | 9.95 | 11.08 | 1.42 | 54.01 | 4.32 | 0.34 | 10.70 | 10.90 | 17.89 |

| 79 | ConnectOne Bancorp | Englewood Cliffs, NJ | 3,446,761 | 9.94 | 6.06 | 0.74 | 62.78 | 3.66 | 0.72 | 165.56 | 116.67 | -6.83 |

| 80 | QCR Holdings | Moline, IL | 2,524,958 | 9.87 | 10.48 | 0.63 | 69.25 | 3.15 | 0.74 | 11.68 | 1.30 | 0.10 |

| 81 | Bridge Bancorp | Bridgehampton, NY | 2,288,547 | 9.82 | 7.76 | 0.64 | 66.99 | 3.38 | 0.32 | 32.43 | 38.19 | 5.12 |

| 82 | RCB Holding Co.* | Claremore, OK | 2,442,348 | 9.67 | 9.90 | 0.95 | 61.75 | 3.79 | 0.43 | 19.64 | 12.42 | 8.61 |

| 83 | ANB Corp. | Terrell, TX | 2,599,347 | 9.57 | 9.09 | 0.79 | 71.56 | 3.55 | 0.19 | 18.33 | 6.55 | -0.71 |

| 84 | TriCo Bancshares | Chico, CA | 3,916,458 | 9.48 | 8.67 | 0.87 | 72.68 | 4.22 | 0.18 | 37.50 | 17.92 | -4.71 |

| 85 | Community Bank | Pasadena, CA | 3,585,719 | 9.47 | 9.32 | 0.75 | 64.02 | 3.22 | 0.60 | 11.10 | 10.54 | 3.62 |

| 86 | First Interstate BancSystem | Billings, MT | 8,604,995 | 9.45 | 9.87 | 1.07 | 64.56 | 3.51 | 0.26 | 13.22 | 7.92 | -2.01 |

| 87 | 1st Source Corp. | South Bend, IN | 4,830,325 | 9.43 | 9.65 | 1.21 | 62.62 | 3.60 | 0.44 | 4.10 | 1.38 | 5.66 |

| 88 | Enterprise Bancorp | Lowell,MA | 2,022,228 | 9.27 | 9.21 | 0.77 | 73.08 | 4.03 | 0.25 | 9.98 | 11.05 | 8.29 |

| 89 | Midland States Bancorp | Effingham, IL | 2,700,475 | 9.20 | 6.63 | 0.60 | 77.31 | 3.84 | 0.44 | 60.01 | 14.23 | -28.86 |

| 90 | Independent Bank Group* | McKinney, TX | 4,132,640 | 9.18 | 6.75 | 0.86 | 63.48 | 4.14 | 0.51 | 86.06 | 52.94 | 46.35 |

| 91 | Community Bank System | DeWitt, NY | 7,489,440 | 9.17 | 9.65 | 1.24 | 60.52 | 3.68 | 0.18 | 3.11 | -26.71 | 15.89 |

| 92 | Independent Bank Corp. | Rockland, MA | 6,364,912 | 9.14 | 9.66 | 0.95 | 63.64 | 3.49 | 0.37 | 5.32 | -0.85 | 19.09 |

| 93 | Stifel Financial Corp. | Saint Louis, MO | 9,518,152 | 8.99 | 8.09 | 1.87 | 86.30 | 2.16 | 0.74 | 30.70 | 7.13 | 8.67 |

| 94 | Mercantile Bank Corp. | Grand Rapids, MI | 2,893,379 | 8.97 | 8.07 | 0.76 | 72.32 | 3.79 | 0.56 | 100.81 | 73.08 | 1.74 |

| 95 | NBT Bancorp | Norwich, NY | 7,797,926 | 8.90 | 8.87 | 0.97 | 63.33 | 3.65 | 0.34 | 3.59 | 7.11 | 21.58 |

| 96 | Dacotah Banks | Aberdeen, SD | 2,172,802 | 8.89 | 8.45 | 0.89 | 63.66 | 4.09 | 0.46 | 7.61 | 6.94 | 0.94 |

| 97 | W.T.B. Financial Corp. | Spokane, WA | 4,771,922 | 8.87 | 9.15 | 0.92 | 64.73 | 3.57 | 0.14 | 5.71 | 3.43 | -4.41 |

| 98 | Flushing Financial Corp. | Lake Success, NY | 5,077,013 | 8.85 | 9.82 | 0.91 | 58.00 | 3.31 | 1.14 | 11.24 | 13.14 | 17.18 |

| 99 | Commerce Bancshares | Worcester, MA | 2,094,745 | 8.71 | 8.36 | 0.63 | 60.09 | 2.70 | 0.44 | 15.02 | -6.17 | -16.33 |

| 100 | ViewPoint Bank | Plano, TX | 4,162,328 | 8.64 | 8.55 | 1.06 | 54.90 | 3.96 | 0.54 | 25.53 | -0.74 | 17.75 |

| 101 | OceanFirst Financial Corp. | Toms River, NJ | 2,361,006 | 8.64 | 9.18 | 0.86 | 64.49 | 3.38 | 0.37 | 9.78 | -3.34 | 21.98 |

| 102 | First Financial Corp. | Terre Haute, IN | 2,998,784 | 8.59 | 8.39 | 1.12 | 61.88 | 4.12 | 0.22 | -0.50 | 1.52 | 7.10 |

| 103 | First Merchants Corp. | Muncie, IN | 5,825,132 | 8.53 | 8.91 | 1.08 | 63.98 | 3.80 | 0.44 | 8.36 | 17.18 | 35.10 |

| 104 | S&T Bancorp | Indiana, PA | 4,964,686 | 8.52 | 9.72 | 1.22 | 58.07 | 3.50 | 0.30 | 8.57 | -0.30 | 14.58 |

| 105 | Farmers & Merchants Bank | Long Beach, CA | 5,581,239 | 8.48 | 7.96 | 1.15 | 54.67 | 3.51 | 0.15 | 23.15 | 10.70 | 0.39 |

| 106 | MainSource Financial Group | Greensburg, IN | 3,141,038 | 8.44 | 8.81 | 0.99 | 67.63 | 3.83 | 0.34 | 17.72 | 1.01 | 10.06 |

| 107 | First Financial Bancorp. | Cincinnati, OH | 7,217,821 | 8.42 | 8.94 | 0.96 | 65.61 | 3.75 | 0.32 | 21.14 | -12.57 | 34.44 |

| 108 | WesBanco | Wheeling, WV | 6,299,505 | 8.41 | 8.97 | 1.12 | 59.17 | 3.63 | 0.41 | 5.05 | 0.19 | 9.46 |

| 109 | Chemical Financial Corp. | Midland, MI | 7,322,143 | 8.38 | 8.19 | 0.96 | 63.78 | 3.59 | 0.26 | 22.91 | 8.21 | 9.35 |

| 110 | South Plains Financial* | Lubbock, TX | 2,335,383 | 8.32 | 9.33 | 0.64 | 79.06 | 3.63 | 0.68 | 12.03 | 7.58 | 25.33 |

| 111 | American Chartered Bancorp | Schaumburg, IL | 2,616,655 | 8.32 | 11.05 | 0.68 | 61.70 | 3.60 | 0.43 | 8.10 | -0.76 | 127.14 |

| 112 | Central Bancompany | Jefferson City, MO | 9,694,949 | 8.29 | 7.82 | 1.08 | 61.30 | 3.45 | 0.20 | 3.10 | -2.27 | 0.67 |

| 113 | Lakeland Bancorp | Oak Ridge, NJ | 3,538,391 | 8.25 | 8.48 | 0.92 | 59.48 | 3.64 | 0.30 | 7.51 | 0.50 | 24.67 |

| 114 | Carter Bank & Trust | Martinsville, VA | 4,629,941 | 8.15 | 8.67 | 0.72 | 50.68 | 2.57 | 1.07 | 15.21 | 0.30 | 28.32 |

| 115 | Sandy Spring Bancorp | Olney, MD | 4,397,132 | 8.13 | 7.43 | 0.91 | 65.69 | 3.45 | 0.51 | 12.57 | 7.92 | -14.01 |

| 116 | Ameris Bancorp | Moultrie, GA | 4,043,313 | 8.13 | 12.24 | 1.03 | 70.93 | 4.77 | 0.43 | 16.25 | 19.89 | 93.44 |

| 117 | Salem Five Bancorp | Salem, MA | 3,629,523 | 8.10 | 7.03 | 0.74 | 66.47 | 2.80 | 0.88 | 9.19 | -5.19 | -0.74 |

| 118 | First Defiance Financial Corp. | Defiance, OH | 2,178,952 | 7.97 | 8.65 | 1.12 | 64.16 | 3.59 | 0.35 | 3.96 | 3.75 | 9.25 |

| 119 | Peapack-Gladstone Financial | Bedminster, NJ | 2,702,397 | 7.92 | 7.97 | 0.63 | 67.32 | 3.00 | 0.31 | 42.98 | 7.90 | 60.78 |

| 120 | Peoples Bancorp | Marietta,OH | 2,567,769 | 7.87 | 6.17 | 0.74 | 75.67 | 3.44 | 0.54 | 36.12 | 24.44 | -5.06 |

| 121 | OFG Bancorp | San Juan, PR | 7,449,109 | 7.86 | 9.32 | 1.10 | 54.17 | 6.64 | 1.11 | -3.84 | -13.77 | -13.47 |

| 122 | Pinnacle Financial Partners | Nashville, TN | 6,018,248 | 7.80 | 9.19 | 1.24 | 54.21 | 3.79 | 0.27 | 10.94 | 6.69 | 22.08 |

| 123 | Broadway Bancshares* | San Antonio, TX | 3,217,760 | 7.78 | 8.29 | 0.96 | 65.02 | 3.41 | 0.12 | 15.10 | 4.57 | 18.59 |

| 124 | First National Bank Alaska | Anchorage, AK | 3,312,586 | 7.67 | 7.03 | 1.02 | 62.08 | 3.41 | 0.06 | 6.41 | 0.61 | 0.88 |

| 125 | Univest Corp. of Pa. | Souderton, PA | 2,235,321 | 7.58 | 7.75 | 1.01 | 68.47 | 3.87 | 0.21 | 5.92 | 7.54 | 4.92 |

| 126 | Mechanics Bank | Richmond, CA | 3,370,491 | 7.56 | 8.07 | 0.77 | 68.41 | 3.71 | 0.08 | 0.62 | -6.88 | 17.92 |

| 127 | Oritani Financial Corp. | Washington Twp., NJ | 3,250,407 | 7.55 | 7.84 | 1.32 | 39.35 | 3.37 | 1.24 | 10.52 | 3.89 | -2.33 |

| 128 | Community Bancshares | Brandon, MS | 2,498,782 | 7.50 | 8.44 | 0.79 | 67.80 | 4.13 | 0.56 | 5.69 | 0.36 | 8.47 |

| 129 | First Community Bancshares | Bluefield, VA | 2,607,934 | 7.50 | 7.44 | 0.98 | 62.32 | 4.11 | 0.68 | -0.98 | 13.47 | 9.35 |

| 130 | Happy Bancshares | Canyon, TX | 2,575,257 | 7.34 | 7.53 | 0.76 | 70.44 | 3.92 | 0.28 | 18.93 | 11.16 | 15.88 |

| 131 | INTRUST Financial Corp.* | Wichita, KS | 4,962,069 | 7.32 | 11.13 | 0.67 | 69.43 | 2.65 | 0.25 | 7.62 | 5.05 | 27.43 |

| 132 | South State Corp. | Columbia, SC | 7,833,349 | 7.29 | 7.79 | 0.95 | 69.06 | 4.80 | 0.23 | 1.15 | 22.37 | 53.27 |

| 133 | National Penn Bancshares | Allentown, PA | 9,750,865 | 7.28 | 8.87 | 1.14 | 57.07 | 3.44 | 0.37 | 15.53 | -25.04 | 84.89 |

| 134 | Central Bancshares | Lexington, KY | 2,107,664 | 7.28 | 7.95 | 0.77 | 77.37 | 3.90 | 0.42 | 1.78 | -0.54 | 31.27 |

| 135 | TowneBank | Portsmouth, VA | 4,982,485 | 7.18 | 7.10 | 0.87 | 75.68 | 3.41 | 0.64 | 5.48 | 4.28 | 0.97 |

| 136 | Union Bankshares Corp. | Richmond, VA | 7,363,853 | 7.13 | 5.34 | 0.73 | 71.00 | 4.11 | 0.33 | 74.92 | 75.18 | 52.45 |

| 137 | BancPlus Corp. | Ridgeland, MS | 2,441,543 | 7.08 | 7.87 | 0.80 | 74.95 | 3.49 | 0.45 | 7.48 | 1.74 | 11.59 |

| 138 | Simmons First National Corp. | Pine Bluff, AR | 4,643,354 | 6.97 | 8.48 | 0.80 | 75.35 | 4.49 | 0.32 | 14.32 | 45.90 | 53.62 |

| 139 | Community Trust Financial | Ruston, LA | 3,738,061 | 6.92 | 4.77 | 0.51 | 73.29 | 3.58 | 0.45 | 21.25 | 17.62 | -22.74 |

| 140 | Provident Financial Services | Iselin, NJ | 8,523,377 | 6.90 | 6.75 | 0.92 | 58.63 | 3.38 | 0.58 | 17.42 | 14.40 | 4.39 |

| 141 | Metro Bancorp | Harrisburg, PA | 2,997,608 | 6.88 | 8.46 | 0.73 | 69.72 | 3.72 | 0.30 | 14.10 | 1.06 | 22.16 |

| 142 | First Busey Corp. | Champaign, IL | 3,665,607 | 6.70 | 7.72 | 0.93 | 65.15 | 3.16 | 0.21 | 5.36 | -3.73 | 14.09 |

| 143 | Bangor Bancorp MHC | Bangor, ME | 3,111,886 | 6.68 | 6.75 | 0.72 | 72.24 | 3.34 | 0.40 | 6.09 | 3.88 | 9.05 |

| 144 | Renasant Corp. | Tupelo, MS | 5,805,129 | 6.67 | 8.61 | 1.02 | 63.77 | 4.12 | 0.47 | 2.70 | 11.67 | 77.93 |

| 145 | Columbia Banking System | Tacoma, WA | 8,579,543 | 6.51 | 7.35 | 1.09 | 64.90 | 4.78 | 0.06 | 20.95 | -7.40 | 35.92 |

| 146 | Lone Star National | McAllen, TX | 2,171,863 | 6.30 | 5.15 | 0.54 | 81.81 | 3.52 | 0.72 | -3.72 | 15.06 | -18.71 |

| 147 | LegacyTexas Financial Group | Plano, TX | 4,166,127 | 6.25 | 5.60 | 0.85 | 63.07 | 3.98 | 0.53 | 25.53 | 10.42 | -1.30 |

| 148 | Brookline Bancorp | Boston, MA | 5,799,880 | 6.23 | 6.79 | 0.77 | 60.69 | 3.61 | 0.66 | 10.24 | 5.40 | 20.85 |

| 149 | Middlesex Bancorp MHC | Natick, MA | 4,156,678 | 6.08 | 5.88 | 0.72 | 68.28 | 2.82 | 0.33 | 1.86 | 1.97 | 1.74 |

| 150 | Cambridge Financial Group | Cambridge, MA | 2,841,958 | 6.02 | 5.84 | 0.59 | 71.04 | 3.05 | 0.41 | 15.65 | 5.25 | 6.62 |

| 151 | Southern BancShares | Mount Olive, NC | 2,226,982 | 6.02 | 3.00 | 0.29 | 85.48 | 4.16 | 0.32 | -6.19 | 4.59 | -56.99 |

| 152 | 1867 Western Financial Corp. | Stockton, CA | 2,408,382 | 6.01 | 5.84 | 0.91 | 63.31 | 4.09 | 0.08 | 15.46 | 8.72 | 14.98 |

| 153 | Dollar Bank | Pittsburgh,PA | 6,984,312 | 5.98 | 4.87 | 0.54 | 73.14 | 2.86 | 0.50 | 7.22 | -0.39 | -16.29 |

| 154 | CBFH | Beaumont, TX | 2,632,097 | 5.97 | 7.08 | 0.90 | 62.02 | 3.95 | 0.28 | 6.78 | 17.43 | 50.05 |

| 155 | Green Bancorp | Houston, TX | 2,197,293 | 5.94 | 6.33 | 0.79 | 67.29 | 4.00 | 0.58 | 32.84 | 28.92 | 16.91 |

| 156 | First Commonwealth | Indiana, PA | 6,360,285 | 5.78 | 6.18 | 0.71 | 68.77 | 3.29 | 0.33 | 4.21 | 1.18 | 7.16 |

| 157 | Northwest Bancshares | Warren, PA | 7,817,585 | 5.68 | 5.68 | 0.78 | 67.87 | 3.65 | 0.81 | 3.29 | 3.99 | -7.16 |

| 158 | Firstrust Savings Bank* | Conshohocken, PA | 2,608,527 | 5.67 | 5.02 | 0.65 | 77.10 | 4.40 | 0.30 | 4.79 | 10.63 | -3.99 |

| 159 | Liberty Bank | Middletown, CT | 3,816,965 | 5.61 | 5.53 | 0.90 | 74.74 | 3.57 | 0.45 | 7.91 | 3.67 | 7.48 |

| 160 | West Suburban Bancorp | Lombard, IL | 2,109,407 | 5.60 | 7.66 | 0.66 | 73.24 | 3.04 | 0.31 | 4.09 | 1.18 | 82.98 |

| 161 | Heritage Financial Corp. | Olympia, WA | 3,457,750 | 5.57 | 5.62 | 0.74 | 73.84 | 4.58 | 0.19 | 85.27 | 68.57 | 119.47 |

| 162 | Berkshire Hills Bancorp | Pittsfield, MA | 6,506,362 | 5.52 | 4.87 | 0.55 | 70.98 | 3.25 | 0.52 | 12.04 | 5.24 | -17.98 |

| 163 | Eastern Bank Corp. | Boston, MA | 9,480,037 | 5.51 | 4.78 | 0.62 | 76.61 | 2.94 | 0.08 | 28.71 | 3.38 | -10.49 |

| 164 | Mutual of Omaha Bank | Omaha, NE | 6,625,772 | 5.47 | 4.85 | 0.52 | 76.71 | 3.47 | 0.32 | 0.23 | 6.25 | -12.22 |

| 165 | State Bank Financial Corp. | Atlanta, GA | 2,882,210 | 5.21 | 7.24 | 1.17 | 65.42 | 5.94 | 0.35 | 19.38 | -2.32 | 142.55 |

| 166 | TriState Capital Holdings | Pittsburgh, PA | 2,846,857 | 5.11 | 5.25 | 0.61 | 65.52 | 2.62 | 0.53 | 29.21 | 57.61 | 23.79 |

| 167 | Sturm Financial Group* | Denver, CO | 2,392,977 | 4.76 | 7.10 | 0.50 | 79.24 | 2.97 | 0.16 | 42.34 | -5.19 | 67.92 |

| 168 | Capitol Federal Financial | Topeka, KS | 9,069,453 | 4.50 | 5.29 | 0.81 | 43.18 | 1.95 | 1.23 | 3.93 | -4.25 | 15.47 |

| 169 | Valley View Bancshares | Overland Park, KS | 3,178,032 | 4.35 | 4.62 | 0.73 | 59.92 | 3.45 | 0.53 | -5.57 | -3.79 | 1.02 |

| 170 | First Midwest Bancorp | Itasca, IL | 9,445,139 | 4.21 | 6.64 | 0.80 | 68.74 | 3.68 | 0.25 | 18.46 | 10.61 | -12.61 |

| 171 | Meridian Bancorp | Peabody, MA | 3,278,799 | 4.13 | 4.87 | 0.73 | 66.75 | 3.26 | 0.73 | 16.84 | 3.43 | 45.28 |

| 172 | Park Sterling Corp. | Charlotte, NC | 2,368,321 | 4.09 | 4.75 | 0.59 | 73.17 | 4.36 | 0.36 | 22.85 | 11.23 | -13.80 |

| 173 | Bank Mutual Corp. | Brown Deer, WI | 2,328,445 | 3.87 | 5.16 | 0.63 | 73.69 | 3.31 | 0.47 | 8.23 | -2.86 | 35.84 |

| 174 | CenterState Banks | Davenport, FL | 3,776,869 | 3.82 | 3.31 | 0.38 | 83.98 | 4.44 | 0.25 | 65.73 | 29.05 | 5.89 |

| 175 | Sterling Bancorp | Montebello, NY | 7,429,996 | 3.81 | 6.16 | 0.83 | 59.51 | 3.80 | 0.49 | 16.96 | 29.39 | 1,287.02 |

| 176 | Home Federal Bank of Tenn. | Knoxville, TN | 2,125,844 | 3.75 | 3.60 | 0.59 | 67.79 | 2.67 | 0.45 | -0.21 | 0.41 | -0.84 |

| 177 | Yadkin Financial Corp. | Raleigh, NC | 4,266,310 | 3.56 | 5.24 | 0.65 | 77.89 | 4.60 | 0.54 | 114.08 | 101.89 | 2.19 |

| 178 | Union Savings Bank | Danbury, CT | 2,234,659 | 3.50 | 4.83 | 0.42 | 78.50 | 3.20 | 0.62 | 1.03 | -6.98 | 188.29 |

| 179 | Spencer Savings Bank | Elmwood Park, NJ | 2,435,612 | 3.45 | 3.59 | 0.47 | 69.81 | 2.91 | 0.93 | 26.57 | 14.83 | 0.79 |

| 180 | Parkway Bancorp | Harwood Heights, IL | 2,166,748 | 3.40 | 4.91 | 0.46 | 61.01 | 2.92 | 0.75 | 16.63 | -11.28 | 124.14 |

| 181 | Bancorp | Wilmington, DE | 5,017,989 | 2.70 | -4.99 | -0.41 | 85.54 | 1.74 | 0.13 | 0.05 | 23.52 | NM |

| 182 | Ridgewood Savings Bank | Ridgewood, NY | 5,087,405 | 2.66 | 2.21 | 0.28 | 87.54 | 2.19 | 0.94 | 2.10 | -3.91 | -33.15 |

| 183 | First Connecticut Bancorp | Farmington, CT | 2,484,739 | 2.35 | 3.98 | 0.41 | 78.88 | 2.95 | 0.44 | 17.65 | -1.00 | 152.02 |

| 184 | First Bancorp | Southern Pines, NC | 3,219,549 | 1.82 | 6.53 | 0.78 | 65.73 | 4.59 | 0.29 | -2.43 | 0.78 | 20.76 |

| 185 | Kearny MHC | Fairfield, NJ | 3,547,871 | 1.67 | 1.99 | 0.22 | 79.86 | 2.49 | 0.82 | 16.73 | -4.54 | 5.37 |

| 186 | FCB Financial Holdings | Weston, FL | 5,950,335 | 1.53 | 2.90 | 0.41 | 79.34 | 3.64 | 0.62 | 74.12 | 40.29 | 30.29 |

| 187 | National Bank Holdings | Greenwood Village,CO | 4,819,646 | 0.56 | 1.07 | 0.19 | 86.62 | 3.83 | 0.36 | 16.38 | -12.99 | 32.47 |

| 188 | Columbia Bank MHC | Fair Lawn, NJ | 4,676,060 | -0.04 | 6.01 | 0.52 | 65.01 | 2.62 | 1.03 | 7.63 | -2.42 | 15.20 |

| 189 | Standard Bancshares | Hickory Hills, IL | 2,287,169 | -1.96 | 5.50 | 0.63 | 70.54 | 3.66 | 0.20 | 7.83 | -1.69 | 74.91 |

| 190 | Sun Bancorp | Mount Laurel, NJ | 2,718,000 | -10.98 | -11.95 | -1.02 | 112.57 | 2.92 | 0.47 | -26.67 | -15.18 | NM |

| 191 | Byline Bancorp | Chicago, IL | 2,376,449 | -24.69 | -0.62 | -0.05 | 95.44 | 3.90 | 0.23 | 8.04 | 95.32 | NM |

| Median for all 191 institutions | 3,457,750 | 8.89 | 8.90 | 0.92 | 64.73 | 3.63 | 0.41 | 11.24 | 5.04 | 9.19 | ||

| Median for the top 20 institutions | 3,149,794 | 15.99 | 13.78 | 1.38 | 55.57 | 3.86 | 0.38 | 15.92 | 5.57 | 10.86 | ||

| Average for all 191 institutions | 4,210,719 | 8.82 | 8.80 | 0.95 | 64.82 | 3.65 | 0.47 | 16.91 | 8.85 | 23.08 | ||

| Average for the top 20 institutions | 3,755,605 | 16.38 | 13.91 | 1.51 | 55.79 | 4.17 | 0.41 | 17.20 | 6.16 | 9.35 | ||

Notes: Ranking is of top consolidated bank holding companies, banks, and thrifts with total assets of between $2 billion and $10 billion as of 12/31/14 and is based on three-year average return on equity for 2012 to 2014. Additional data is for the year ended 12/31/14; year-over-year changes compare 2014 to 2013.

Excludes industrial banks, nondepository trusts, foreign-owned banks and bankers' banks. Excludes institutions with credit cards to total loans of more than 25%, loans to total assets or loans to total deposits of less than 20%, a leverage ratio of less than 5%, a Tier 1 risk-based capital ratio of less than 6%, or a total risk-based capital ratio of less than 10% as of 12/31/14. Excludes institutions that received a tax benefit of greater than 10% of net income or that did not report data for any year in the ranking period. Also excludes institutions that have fewer than 5 depository branches and are owned by a company not primarily focused on commercial or retail banking.

* Denotes institutions that operated as a subchapter S corporation for at least one quarter between 2012 and 2014. Profitability ratios were adjusted accordingly.

Viewpoint was acquired between Jan. 1 and March 31, 2015.

Source:

© 2015 American Banker Magazine