-

BALTIMORE Advance Bank shareholders have approved the proposed sale of the institution to Municipal Employees CU of Baltimore, and the credit union will take control of the bank Dec. 12.

December 2 -

One-fourth of bankers surveyed by KPMG expect to become sellers in 2014 as challenges and regulatory scrutiny rise.

November 21 -

Credit unions are paying more for talent and getting more aggressive in lending, as bankers start to doubt whether policymakers will ever strip their foes' tax exemption.

November 13 -

Five Star Credit Union in Dothan, Ala., has agreed to buy Flint River National Bank in Camilla, Ga.

September 3

The number of credit unions buying banks will likely increase next year, along with the size of the deals.

That is the opinion of industry experts and insiders, especially after a recent KPMG survey that found a quarter of banks with assets from $1 billion to $20 billion

Those pressures are greatest at the very small banks, the typical M&A targets of credit unions. The largest bank that has agreed in recent times to sell to a credit union,

"If the KPMG study says 25% of small banks are thinking about selling, then I would say that percentage could double for tiny banks," said Michael Bell, an attorney with Howard & Howard in Royal Oak, Mich., who anticipates deals increasing among banks with assets of $100 million to $500 million.

Bell has worked on four deals involving credit union purchases of banks. "More credit unions are looking at potential bank purchases," he said.

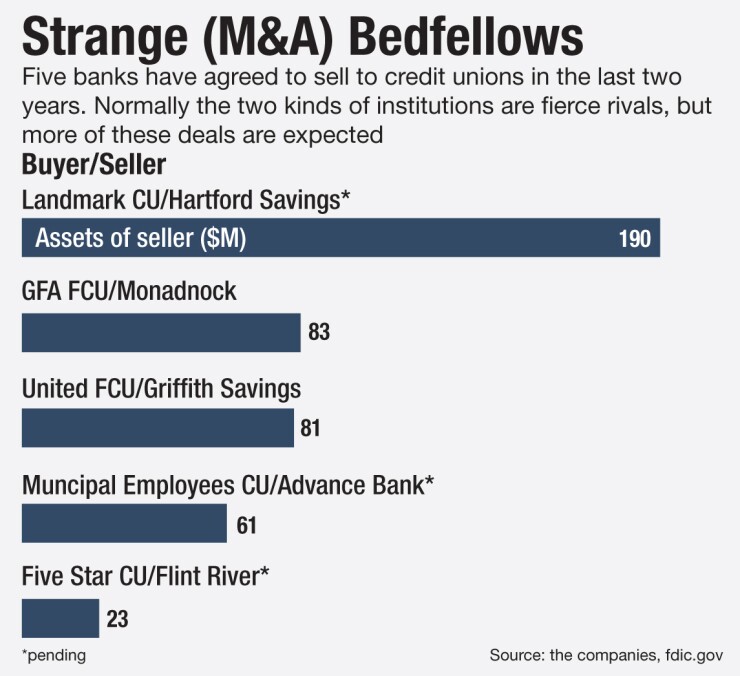

Five deals involving credit unions and banks have been signed in the last two years.

Three are pending: the $260 million-asset Five Star Credit Union has agreed to

The $429 million-asset GFA Frederal Credit Union acquired the $83 million-asset

Richard Garabedian, a partner with the Washington firm of Luse Gorman Pomerenk & Schick, who represented Monadnock in the GFA deal, said he thinks sentiment among smaller banks to sell is similar if not greater than banks reflected in the KPMG survey.

"The increasing regulatory costs, operational costs, compensation costs ... you name it, are really putting pressure on institutions $500 million and less going forward, and many will look for an exit strategy," said Garabedian. "Add to that the results of the mortgage pipeline drying up, and I hear from a number of clients saying they are going to have a hard time going forward."

David Bartoo, president of Merger Solutions Group in Forest Grove, Ore., expects credit union acquisitions of banks to pick up simply because "it's a strategy going forward for large credit unions to expand. The number of small and medium-size credit unions is shrinking, so there are fewer acquisition opportunities than there were years ago for large credit unions to grow."

Bell says that with more banks, and larger ones, looking to sell, it will certainly increase the size of credit union bank purchases. "I have never had more interest from very large credit unions with some real capital to do big deals. I believe next year we will see a credit union buy a $500 million bank, and even higher."

Yet obstacles exist.

Garabedian is skeptical about credit unions' ability to open their pocketbooks a lot wider in the near future. "I think you will see purchase amounts creep up over the next few years, but credit unions face the disadvantage of only offering cash," he said. "So you need to find that right relationship between the size of the bank and the size of the credit union."

Garabedian estimated that a credit union, depending on its capital level, should be about three times the size of the bank it is buying. "Simply because of the amount of cash the credit union would have to come up with, I think instances of credit unions acquiring a billion-dollar bank will be rare, unless the bank being purchased is really stressed," he said.

Dennis Dollar, principal partner at Dollar Associates in Birmingham, Ala., says the KPMG survey supports his prediction that larger financial institutions will scoop up community banks once Troubled Asset Relief Program funds are repaid and banks "can't be accused of using taxpayer money for an acquisition binge. I predict there is going to be a major movement among the big international, national and regional banks." There is more than five years of "pent-up acquisition and sales demand" in the banking industry, said Dollar, a former chairman of the National Credit Union Administration.

"Can credit unions play a role in this coming community bank sales frenzy? Perhaps in a small way," Dollar says. "While there will likely be a small number of larger credit unions doing a purchase and assumption of a smaller community bank's assets, the field of membership issue gets in the way of many such [deals]."

Bell contends that the larger the bank, the easier it will be to get a deal done. "The regulatory issues don't change but the transaction gets easier because [with] the larger the bank the greater likelihood [is] it will not be stressed and will be in a better financial position."

But Bartoo cautions that no matter if the deals get easier or harder, credit unions buying banks gives anyone who wants to take away credit unions' tax exemption more ammunition.

"I see increasing credit union purchases of banks just another step in the process of all financial institutions becoming a bank. By acquiring banks credit unions are proving they are bank-like," he said.

Jackie Stewart contributed to this story.

This story originally