-

Banks are transforming branches, rolling out new products and experimenting with alternative data, in an effort to bring more people into the financial mainstream. Such initiatives might have been a footnote in the past, but they have grown into a serious business strategy lately.

February 24 -

The market for the serving underbanked customers expanded last year, mostly due to a rising demand for subprime auto loans, the Center for Financial Services Innovation said Thursday.

December 11 -

While the Federal Deposit Insurance Corp.'s reporting of growing use of prepaid products among the underserved stokes concerns about high costs, some note they can be a bridge to more traditional accounts.

November 11 -

More banks are competing for underserved customers and working to understand millennials as a group that's full of potential, according to speakers at a recent American Banker conference.

September 29 -

A growing number of Americans frequent payday lenders, check cashers and other firms outside the financial mainstream, and with good reason: they cannot get reliable and affordable service from the country's biggest banks.

November 12

More banks should think about how to attract consumers who rely heavily on alternative financial providers like check cashers and payday lenders, two recent studies suggest.

This underserved market generated $103 billion in revenue in 2013, an increase of 7.1% over the previous year, according to a report by the Center for Financial Services Innovation and Core

Innovation Capital.

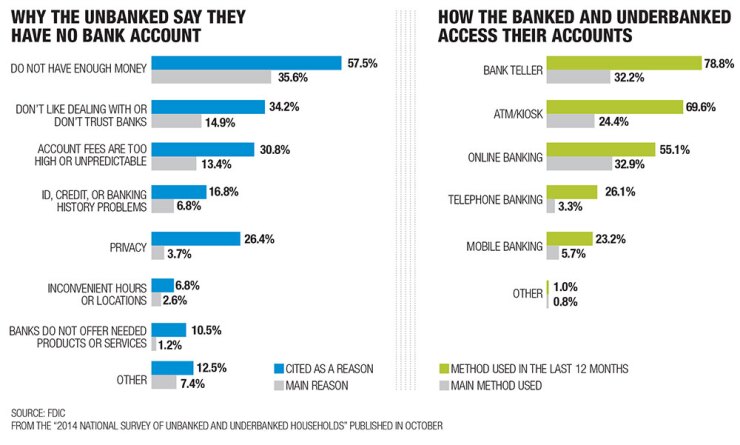

And, importantly, the unbanked and underbanked aren't as opposed to using mainstream financial services as you might think, based on a Federal Deposit Insurance Corp. survey. Nearly half of unbanked households 46% say they have had bank accounts in the past. Of those, 49% say they expect to open an account again within a year, with that jumping to 75% for the ones who recently had an account. A quarter of households that have never been banked also expect to open an account.

Both the CFSI and FDIC research suggests that mobile phones and prepaid cards present opportunities for banks to reach these potential customers. Underbanked households are more likely to use smartphones than bank branches, computers or telephones to access money and accounts and they're much more likely to do so than even fully banked households.

"Since more and more consumers access their bank account through their phone, thinking about your apps for your bank is important," says CFSI research analyst Eva Wolkowitz. "Is it something that is designed primarily to be used through the phone and not just a laptop, with a smaller and different interface? It's important to keep in mind that in many ways, mobile is its own animal and not just the little sibling of the Internet in general."

Prepaid cards had the second highest annual revenue growth of any product targeting the unbanked and underbanked during 2013, according to the CFSI study. Only subprime auto leasing showed more growth.

[Conference Program Note: Join CFSI and American Banker for the10th annual EMERGE Forum , with an agenda featuring the latest insights and strategies to help you meet the needs of underserved consumers responsibly and profitably.]

In addition, prepaid card users are more likely to be interested in opening bank accounts than their counterparts. In the FDIC survey, about half of unbanked households that used prepaid cards 47% indicate they are likely to open a bank account within a year (versus 32.6% for the cardless).

The FDIC survey also found that 0.7% of all U.S. households became unbanked within the last 12 months. "We've seen that the unbanked population is not static in fact, it's quite dynamic," says Keith Ernst, associate director of the FDIC's Division of Depositor and Consumer Protection.

More than one in three households that exited banking in the last year blame a job loss a "striking finding," Ernst says and a third of all recently unbanked households say the reason they initially opened an account was for direct deposit. That's an insight Ernst says bankers might be able to act on. "Maybe instead of waiving the account fee for direct deposit above a threshold, an institution might consider [waiving the fee for those who use] bill pay," because the unemployed still have bills, he says.