-

Because of the conflicting messages from providers of mobile payments, consumers are not yet sold on the possibility that they can use apps to replace their plastic cards.

October 29 -

Even though Apple has more than 500 banks lined up to support Apple Pay, including heavyweights like Bank of America and JPMorgan Chase, some bank executives are taking a decidedly defensive stance.

October 22 -

The Fed's hotly-anticipated road map outlining plans to speed up the U.S. payment system will call for the creation of several industry-led task forces and recommend building a new infrastructure to facilitate real-time payments.

October 23 -

Apple Pay is a watershed moment that will do more to stimulate mobile commerce than the sum of all previous efforts. But it also has an impact on branding that should make it part of a broader mobile menu for banks and retailers.

October 22

This could be one of the few instances when banks are hipper than their customers.

Mobile technology has taken hold in everything from media to food service to dating. Yet while banks almost universally offer mobile services, such as smartphone apps or mobile-friendly websites, their customers have been slow to use them.

According to the newest American Banker/SourceMedia Research

That roughly jibes with a Federal Reserve

"Unless the mobile app has been designed in a way that makes it significantly easier to use, people will tend to fall back on habit" when banking, said Teresa Epperson, managing director of AlixPartners.

As potential disruptors like Apple Pay loom, banks must weigh decisions like how much to invest in mobile; what features to offer; how to gauge return on investment; whether to charge for services; and how much if so.

Nearly 300 executives participated in American Banker's benchmark study, entitled Moving Targets, Hidden Metrics: The State of Mobile."

Further complicating the mobile picture: A third of banks surveyed simply didn't know if their customers had downloaded apps, possibly because their outside vendors do not provide that information.

"Every bank's mobile platform is going to be a little different," Epperson said. Apps developed in-house typically allow more consumer data collection, while third party apps might not allow for it. Knowing usage rates depends on where that data resides, and how easily banks can access it.

The survey found that banks have significantly expanded in mobile payments, with more than 80% saying they offer essential functions, such as the ability to pay regular bills through their mobile apps. A previous SourceMedia survey conducted two years ago found that only 20% of banks even offered even rudimentary ATM location via phone, much less mobile bill pay. About 50% of banks with apps said they either already provide or plan to soon add features like peer-to-peer payments or adding new billers directly into a smartphone.

Further on the horizon, lending may be the next area of expansion for mobile banking. Only 13% of respondents with mobile apps said their apps allow for loan applications, but that number will soon be near half, at 40%. (Another American Banker/SourceMedia Research

Most banks surveyed intend to increase their mobile investment in the coming year, with close to 40% of respondents saying additional spending would pay for new features, remote deposit capture through smartphone cameras being one target of investment. Security also ranks highly among priorities, as 54% of respondents said they plan to spend on mobile security improvements.

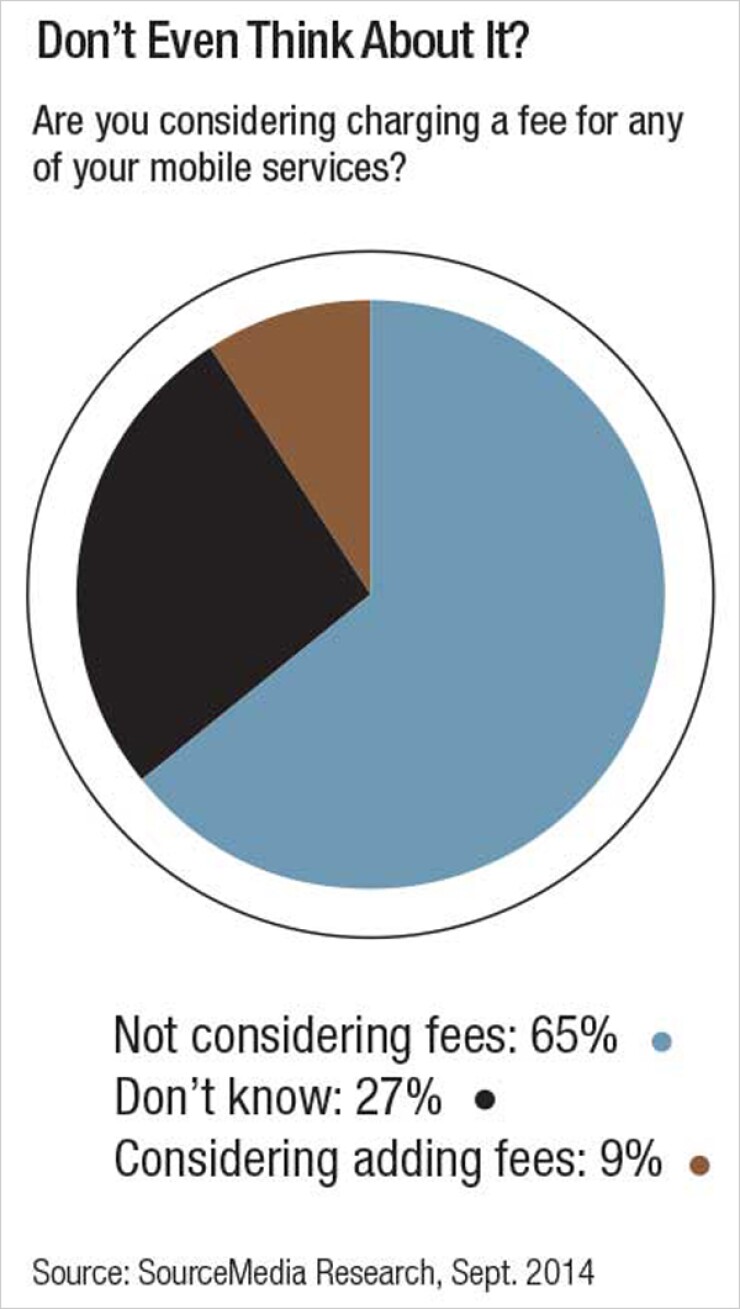

There exists a split among bankers over how else to measure the success of these often sizable mobile investments. Of those polled, 90% said that customer loyalty was very important to their mobile strategy, while only about half identified revenue from merchants and customers as key to their mobile offerings. Of those responding, 86% said they do not currently charge for mobile services, and 65% said they didnt anticipate doing so in the future.