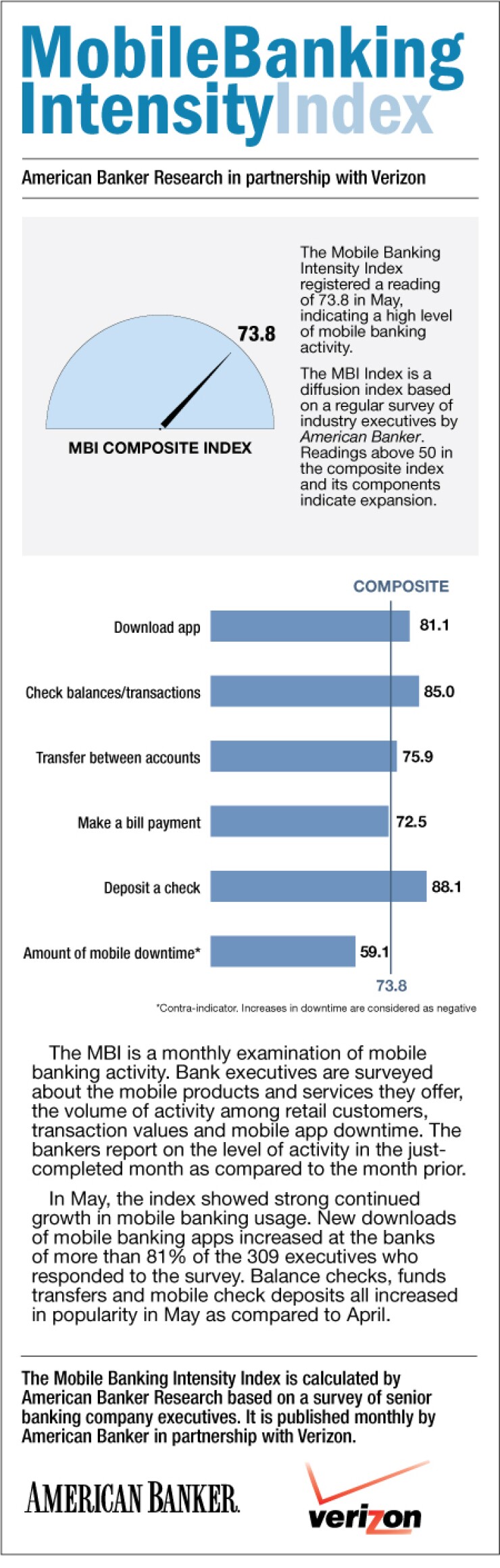

Along with temperatures in most parts of the country, mobile banking activity continued to increase in May. The overall value of American Banker's Mobile Banking Intensity Index was 73.8 for that month, a significant increase over April's value of 70.4.

Many of the bankers surveyed for the index said adoption of mobile banking continues to grow as more customers become comfortable with it. A typical comment was, "Mobile activity across the board has increased each month since implementation 18 months ago." Several respondents also mentioned they had begun advertising the service, which was driving new users to sign up.

The index is a product of American Banker's regular surveys of banking executives and is published in partnership with Verizon. The MBII is a diffusion index. For context, readings above 50 in a diffusion index indicate expansion and readings below 50 point to contraction. The further from 50 a reading is, the stronger the indicated change. A reading of 50 suggests that activity was unchanged month to month. All the data in the index is compiled from a survey of 309 bank executives, all from institutions that offer mobile banking.

Mobile check deposit (snapping a photo of a check to automatically deposit it) was the smartphone-based task users ramped up most in May: almost 80% of the 309 bankers surveyed said their customers used the feature more that month than they did in April. Several of the banks reporting had recently introduced this feature, making adoption growth inevitable.

Checking bank account balances was also a wildly popular activity 71% of bankers surveyed reported an increase among their customers. One respondent commented, "Balance inquiry activity increased as more users signed on to SMS text balance alerts."

The index shows a strong overall improvement in mobile banking downtime for the month of May. While 64% of the bankers said the amount of downtime for their mobile banking apps stayed the same during the month, 27% said it had dropped. Only 9% reported higher downtime. A few bankers mentioned that they had had technical glitches in April that were resolved.

Who is actually building the mobile apps that banks are offering? At slightly more than half (50.3%) of these banks, it's their core banking supplier. About half use a third-party application provider. Only 17.2% reported having an in-house development team doing this work.

Bankers were asked what kind of customer support they provide for their mobile banking users. In some past surveys, users have lamented a lack of clear and simple help when they hit a stumbling-block. Among these providers, 59% provide an online "frequently asked questions" section. About a third (32.6%) offer customer support text messages and almost a third (28.2%) have a click-to-call feature built into their mobile banking apps.

The bankers were also asked this time what technology advancement will improve the retail customer's overall experience. The overwhelming majority of answers were in the category of better security, especially biometric authentication. One banker wrote, "Security probably. Customers who do not use the technology already offered do not believe it is safe." Another technology advancement several cited was mobile payments. As one respondent said, "Mobile wallet: I know it is already out there, but not as widely used."