-

The latest Mobile Banking Intensity Index finds that bank customers are continuing to adopt and use mobile banking at a fast clip.

June 28 -

American Banker debuts a monthly gauge of U.S. mobile banking activity among banks and their customers.

May 28

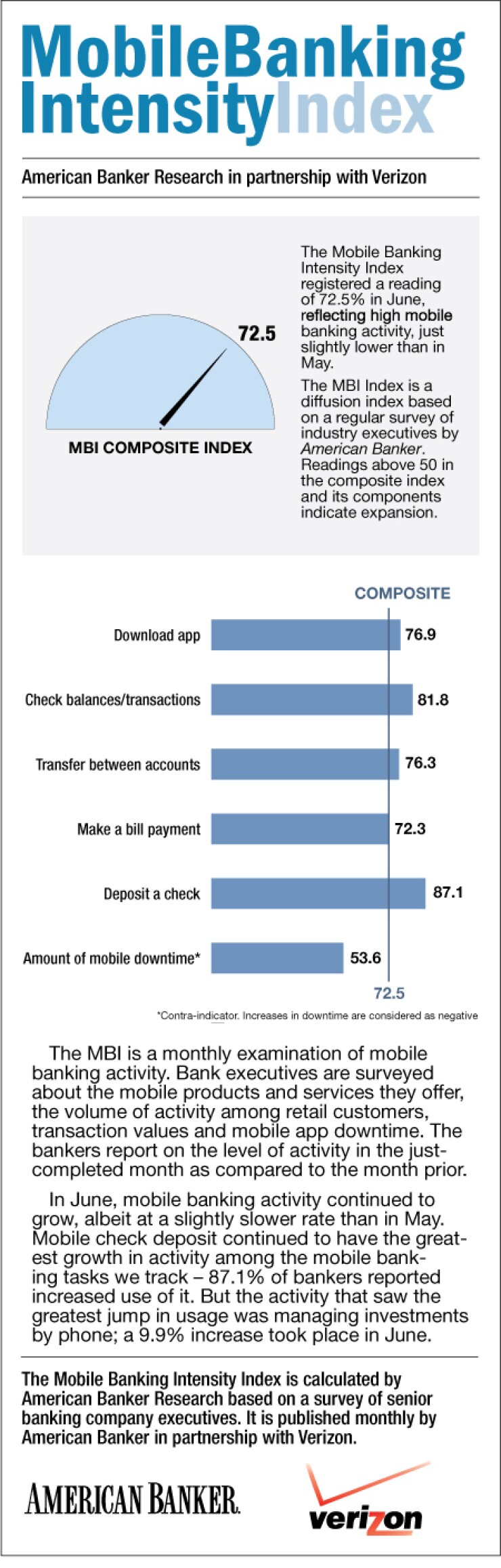

Banks continued to report increases in mobile banking usage in June, according to the latest Mobile Banking Intensity Index. The overall value of the index, 72.5, was roughly in line with the intense growth of last month's reading of 73.8.

Almost all the 336 bankers who shared information about their mobile banking offerings and adoption for the month of June reported steady growth in the service, which for many is relatively new. The overarching theme was fast adoption and growth with fluctuations and the occasional small hiccup.

"Overall, we continue to see increases across the board with mobile banking," one banker said. "The adoption rate continues to exceed our expectations. Mobile deposit capture is just rolling out and is in beta phase, but has been positively received." Another wrote, "Popularity of mobile applications continues to grow in interest and acceptance." "Increased activity and enrollments due to increased awareness," a third stated. A few noted that customer adoption and usage rates vary a bit with marketing efforts. "We get spurts of activity as we run campaigns," one wrote.

The index is a product of American Banker's regular surveys of banking executives and is published in partnership with Verizon. The MBII is a diffusion index. For context, readings above 50 in a diffusion index indicate expansion and readings below 50 point to contraction. The further from 50 a reading is, the stronger the indicated change. A reading of 50 suggests that activity was unchanged month to month. All the data in the index is compiled from a survey of 336 bank executives, all from institutions that offer mobile banking. The index values are calculated based on respondents' answers to questions about customer activity in certain aspects of mobile banking, such as checking account balances, transferring money between accounts and paying bills.

Mobile check deposit continues to be adopted quickly among these banks' customer bases: the index value for mobile deposit was 87 for June. In one component of the index value, 77% of respondents said the volume of activity of retail customers using mobile deposit was higher in June than in May.

Usage of mobile bill payment, while still growing, rose at a decelerated pace, with 49% of bankers saying activity volumes were higher in June than in May. Several bankers noted that they don't offer it yet. Another wrote, "Mobile bill pay including P2P or account to account has not gained a lot of traction at this point."

In a trend we expect to see more of in the future, one banker reported providing a special pared-down site to work with smartphones. "Some customers simply bypass this site in favor of the full site," the respondent said. "This month we implemented a responsive design website that tailors the site to the device being used. This may further reduce the number of users of our pared down site." Responsive design lets a bank create one website that automatically recognizes the type of device a user has and reformats itself to display well on that device. As the use of such sophisticated mobile web sites grows, the use of native mobile banking apps is bound to decline.

Downtime was lower across the board for these bankers in June - most said the amount of retail customer mobile app downtime was the same (52%) or lower (17%) than in May; only 11% saw an increase in downtime. Examples of the few exceptions: "There continues to be network/vendor connectivity issues," one respondent wrote. "Downtime due to enhancements," another shared.