Want unlimited access to top ideas and insights?

The New York City community bank, which is a unit of Metropolitan Bank Holding Corp., announced in its 2023 annual report that it had decided to exit all banking-as-a-service relationships in early 2024 and expects to complete the process over the course of this year. The annual report was filed on February 28. This news follows the bank's announcement earlier in 2024 that it would exit consumer-facing banking-as-a-service relationships.

"The decision to terminate these financial service partnerships will reduce the Company's exposure to the heightened, and evolving, regulatory standards related to these activities," reads the report. "This decision … reflected recent developments in the payments and non-bank financial service industry, regulations applicable to this business line of the Company, and a strategic assessment of the business case for the Company's further involvement at this time."

It's a decision that other banks in this space have had to consider, as regulators penalize

Nor is it the first time Metropolitan Commercial Bank has reversed course on a risky venture. In 2023, the $7.1 billion-asset bank

"While not specifically noted, we are not entirely surprised by the exit given the enhanced regulatory scrutiny around novel activities," wrote Nick Cucharale, a director in the research department for Hovde Group, in an analyst note.

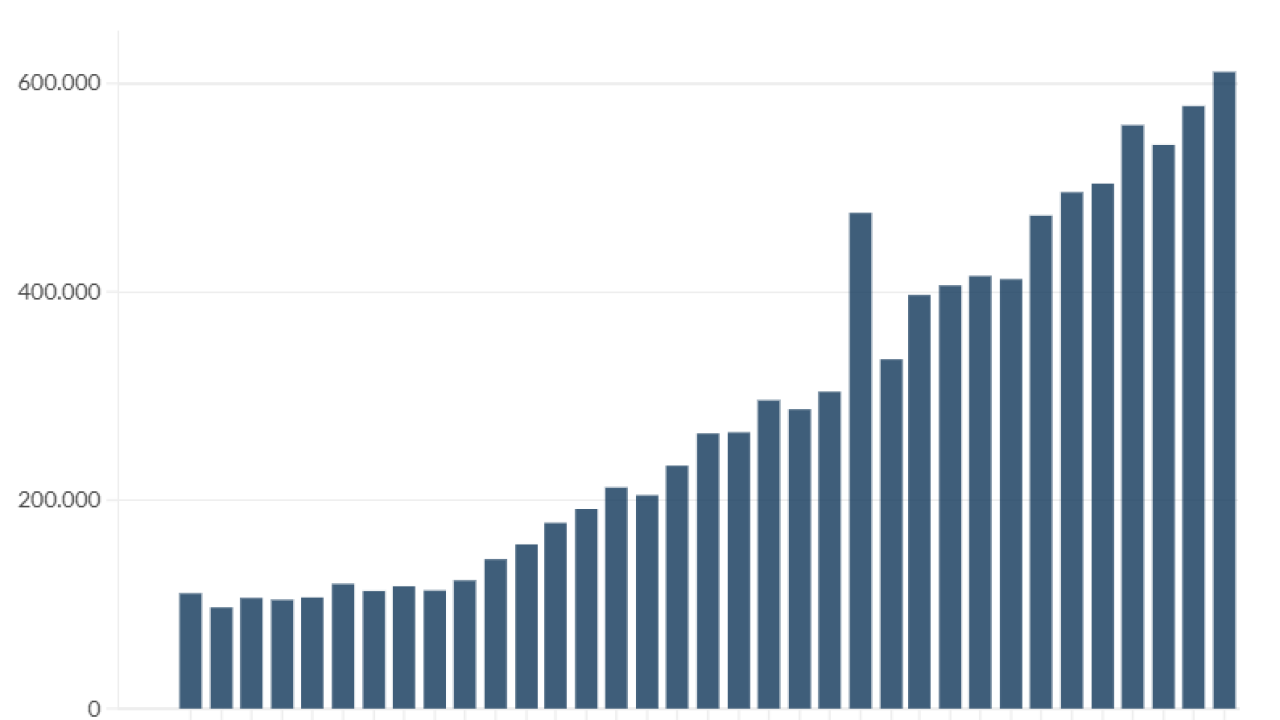

The 10-K noted that the bank would lose $781 million of deposits acquired through these relationships, or 13.6% of total deposits, that it would have to replace through other means — potentially funding sources with higher rates.

But, "The Company expects minimal financial impact from the exit of this business," the report reads.

Mark Fitzgibbon, head of financial strategies group research at Piper Sandler, sees both pros and cons to the decision.

"The good news of exiting the business is that it alleviates any regulatory challenges surrounding this segment and simplifies the story," he wrote in a research note. "The bad news is that it was one of the key differentiating elements of the MCB story and contributed to growth expectations."

In October, Metropolitan Commercial Bank agreed to pay $30 million to the Federal Reserve Board and the New York State Department of Financial Services for

"This was a business where a couple of quarters ago, people were praising them for having gotten into it," said Fitzgibbon in an earlier interview. "Since then, they've paid a huge fine to the government and been slapped on the wrist for this business. They thought by exiting the B2C part of the business, they would get rid of a lot of these issues. But they realized the issues didn't go away."

Polo Rocha contributed to this report.