Comerica's strategic review has raised questions about the feasibility of selling a systemically important financial institution.

The $69 billion-asset company, hurt by bad oil loans and low interest rates, hired Boston Consulting Group last month to conduct the review following investor complaints about its underperformance.

Management has since downplayed the likelihood of selling, but the brief thought that a SIFI bank could hit the auction block has launched a conversation on what the process might look like.

-

After another disappointing quarter, Comerica is promising big changes in its ongoing quest to improve returns to shareholders. It appears to be considering all options, including selling off business lines and perhaps even merging with another institution.

April 19 -

Comerica may sell itself one day, but it won't be a very attractive takeover target or fetch top dollar until energy prices rebound and interest rates rise, company officials said at the annual meeting Tuesday.

April 26 -

Green Bancorp's surprise decision to purge all of its oil credits comes at a time when other banks have been gradually paring back exposure.

April 29 -

It didn't take long for Karen Parkhill to re-emerge after her sudden departure from Comerica in Dallas. Parkhill was named chief financial officer at Medtronic, a medical technology company based in Dublin, Ireland.

May 4

One thing is clear: selling a bank of Comerica's size and complexity won't be easy.

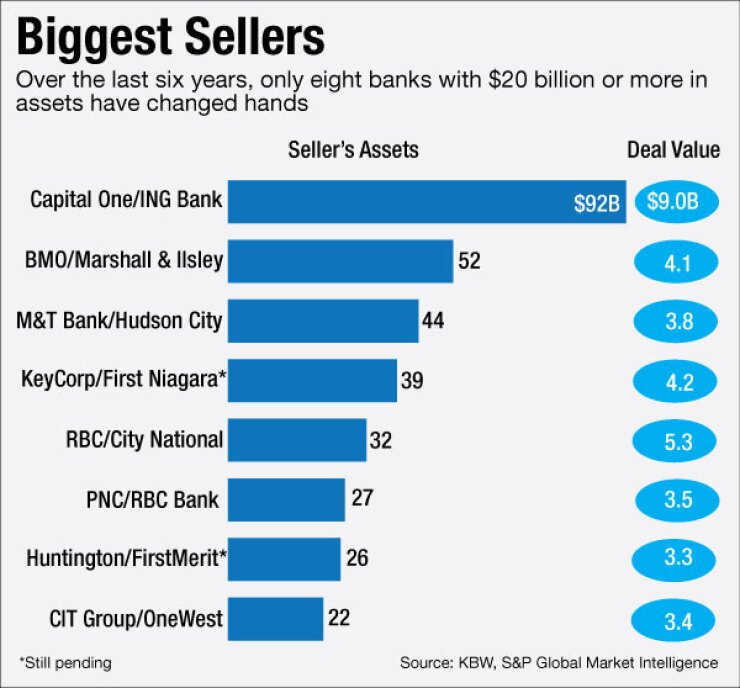

Only one bank deal since the financial crisis — Capital One Financial's 2012 purchase of ING Bank, which had more than $90 billion of assets — involved a bigger seller. Marshall & Ilsley, which sold to Bank of Montreal in 2011, is the only other bank with more than $50 billion in assets to change hands since the crisis.

Selling a bank of Comerica's size could create a host of regulatory headaches, especially since it could push a potential buyer over $500 billion in assets, said Brian Klock, an analyst at Keefe, Bruyette & Woods. "Would the regulators create a 'too big to fail' bank?" he said.

The short list of likely buyers for Comerica could include several regional institutions, including the $429 billion-asset U.S. Bancorp and the $212 billion-asset BB&T, which could take a big leap toward megabank status by buying another SIFI. Foreign-owned banks, such as Bank of Montreal and MUFG Union Bank, have also been floated as possible suitors.

One solution could involve having a SIFI shrink by divesting certain assets. In Comerica's case, the Dallas company could sell its operations in Michigan or California.

Bank breakups can be messy, especially for a bank that is under pressure to boost performance, Klock said, pointing to CIT's costly, yearlong effort to divest its aircraft lending operations. "As we have learned from CIT, the process of separating a line of business into a separate legal entity can take time and be costly in the interim," he said.

Recent bank deals have highlighted the importance of "careful planning" when it comes to assertively addressing sensitive regulatory issues, said David Portilla, an associate in the financial institutions group at Debevoise & Plimpton.

Regulators also tend to use pending mergers as a way of forcing banks to address fair lending, anti-money-laundering or other compliance shortcomings, industry experts said. M&T Bank had to beef up its compliance with the Bank Secrecy Act before it was cleared to buy Hudson City Bancorp in a process that took more than three years.

The Federal Reserve Board, in its 40-page approval for the M&T-Hudson City deal, warned other aspiring acquirers to get their affairs in order before seeking regulatory approval for a deal.

Convincing regulators that operational risk is under control would also be a challenge in such deals, as the Comerica case points out. Depending on the size and mix in its loan portfolio, a Comerica buyer could face questions about its ability to handle troubled oil and gas loans or the threat of excess concentration in energy credits, Klock said.

Regulators would also want to feel comfortable about a buyer's ability to handle expansion into markets where it lacks a "long-standing presence," he said.

Then again, a limited number of institutions have the heft and ability — not to mention a desire — to pursue such a deal, industry experts said.

U.S. Bancorp is working through a BSA-related enforcement order that bars the Minneapolis company from making whole-bank deals. Still, management told investors last month that it has not come across any attractive targets, regardless of the restrictions.

"We haven't found [a deal] we wish we could have had, and there is nothing we have lost that we would have otherwise sought," Richard Davis, U.S. Bancorp's chairman and chief executive, said during the company's quarterly earnings call last month.

BB&T is also unlikely to pull the trigger anytime soon, industry analysts said.

The Winston-Salem. N.C., company recently wrapped up a buying spree in Pennsylvania, absorbing the $19 billion-asset Susquehanna Bancshares and the $10 billion-asset National Penn Bancshares.

Kelly King, BB&T's chairman and CEO, has repeatedly said he wants to take a break from acquisitions to focus on integrating its recent additions, which also included a small bank in Kentucky. Comerica, meanwhile, is more than triple the size of BB&T's biggest acquisition to date.

Comerica, U.S. Bancorp, BB&T and MUFG Union Bank declined to comment for this story. BMO did not respond to a request for comment.

Comerica is expected to report the results of its internal review in July. Until then, speculation over a potential deal will likely continue.

Investors will have to "see how this plays out into the next year," Klock said.