-

Old Line Bancshares has agreed to buy WSB Holdings in a deal that will combine two banks based in Bowie, Md.

September 10 -

Two Maryland banking companies that announced plans to merge last month need a little more time to work out the specifics of their deal.

May 8 -

In what would be its first acquisition since 2007, Sandy Spring Bancorp Inc. in Olney, Md., announced late Tuesday that it is buying CommerceFirst Bancorp Inc. for $25.4 million in cash and stock.

December 20

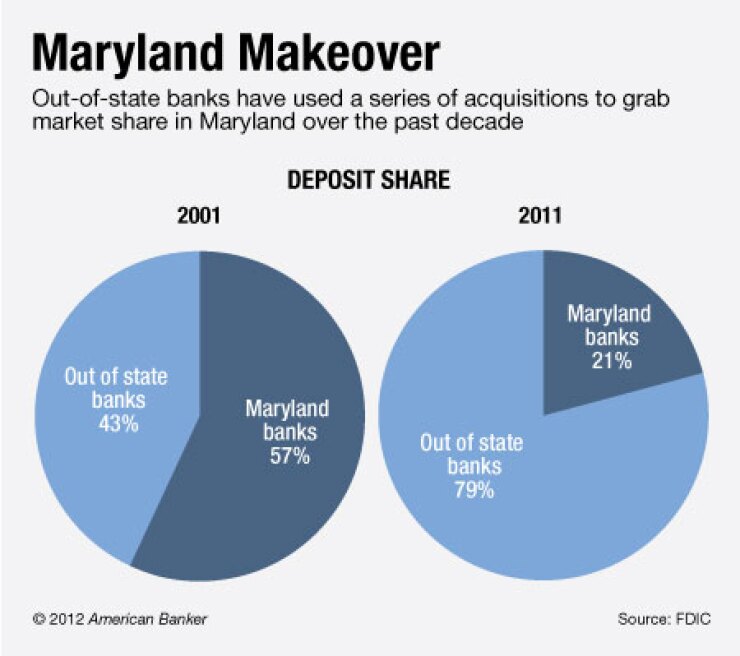

It's a damning statistic for the hometown crowd.

Thanks to takeovers by out-of-state buyers in recent years, banks based in Maryland held 21% of deposits in the state at June 30, 2011, according to the most recent government data. They had nearly three times that, 57%, in 2001.

But James Cornelsen, chief executive of Old Line Bancshares, and other old-school Maryland bankers want to reverse it by merging with each other.

Old Line, a bank in Bowie with assets of $846 million, announced late Monday an agreement to buy a local competitor, WSB Holdings — its second in-state deal in two years. Defense of Maryland banking from outsiders was one of the reasons given for the deal.

"Now's the time for banks such as ourselves, Sandy Spring and Eagle" — two other banks in the state — to expand, Cornelsen said. "Maybe we'll take that statistic back."

The painful truth is that all many of these community banks may have is each other at this point. Big buyers may not be interested in the targets that are left, experts say.

"It's going to be difficult to roll these smaller institutions up," said Gary Townsend, chief executive of Hill-Townsend Capital. "They are not attractive as acquisitions, and the valuation they're going to get are not nearly as close to what we saw prior to the Dodd-Frank Act."

Major deals of recent years involved the biggest community banks selling to larger, out-of-state banks. For example, in 2009, Capital One Financial bought Chevy Chase Bank and M&T Bank bought Baltimore's Provident Bankshares.

More recently Eagle Bancorp (EGBN) in Bethesda and Sandy Spring Bancorp (SASR) in Olney have focused on organic growth or expansion outside of Maryland.

But Cornelsen believes the state is approaching a period where community banks will fortify themselves through in-state consolidation.

In late August Carrollton Bancorp (CRRB) said it received shareholder approval on an amended agreement to acquire Jefferson Bancorp; their initial agreement was announced in April. And Sandy Spring, which has $4 billion of assets, acquired CommerceFirst Bancorp in Annapolis in May.

"It takes a couple notable deals to get the attention of boards" of other local banks, said Anita Newcomb, president of bank consultant firm, A.G. Newcomb & Co. in Columbia. She credited Cornelsen with being "very deliberate and ahead of the pack among a lot of institutions looking to purchase."

Yet only local buyers may be interested in many of the banks that are left — those under $1 billion, or those with problems.

"A larger company will not come into the market if they are only getting five or eight branches," said Kip Weissman, a partner at law firm Luse Gorman Pomerenk & Schick.

The WSB deal brings baggage that underscores the point. Its high nonperforming assets would require $18 million of writedowns, and Old Line added a price-adjustment option in the agreement. Old Line is offering a cash-and-stock deal valued at $49 million, or 89% of WSB's tangible book value.

The way the deal was cautiously structured shows just how difficult pricing, valuations and credit quality issues are, Weissman said.

"I feel like we've been on the cusp [of consolidation] for three years and clearly, I've been wrong," said Ronald Paul, the chairman and CEO of Eagle, which has not bought any banks in its home state. "It seems like every time the market rebounds a bit, everybody's price expectation goes up."

Though Paul says he's always looking for deals, the $3 billion-asset company has found it can grow just as fast organically and without risking overpaying for an acquisition.

"The need for us to buy a $500 million-asset bank isn't critical because we're growing almost by that every year," he said.

Old Line's deal for WSB would take it over $1 billion of assets, which many observers point to as the size necessary to handle the cost of impending regulations. While WSB poses some credit challenges, Cornelsen says he's well prepared after acquiring a bank nearly 70% of its size, Maryland Bankcorp, in September 2010.

Others will follow suit, he says.

M&A activity "is sort of like watching the kettle boil," Cornelsen said. "But there will be a lot of consolidation within our group [under $1 billion in assets]. It's happening in Maryland."