-

Some high-priced takeover deals in the corporate world have stifled general M&A activity, leaving players in the leveraged-loan market to wonder what will sustain demand for issuances the rest of the year.

August 6 -

Some managers of collateralized loan obligations complain that S&P's ratings of risks behind covenant-lite loans are too harsh and could stifle an growing part of the leveraged-loan market.

July 25 -

Banks are providing less warehouse financing for collateralized loan obligations, so CLO managers have dusted off an old financing tool, delayed draws, to keep pace with demand.

July 8 -

Volatility in other credit markets is starting to spill over into leveraged loans, as more than a dozen companies have pulled refinancings and other deals in the primary loan market this month.

June 25 -

The Central Bank's surprise decision to continue buying mortgage bonds may not spark another refinancing boom, but it could spur more home purchases.

September 18

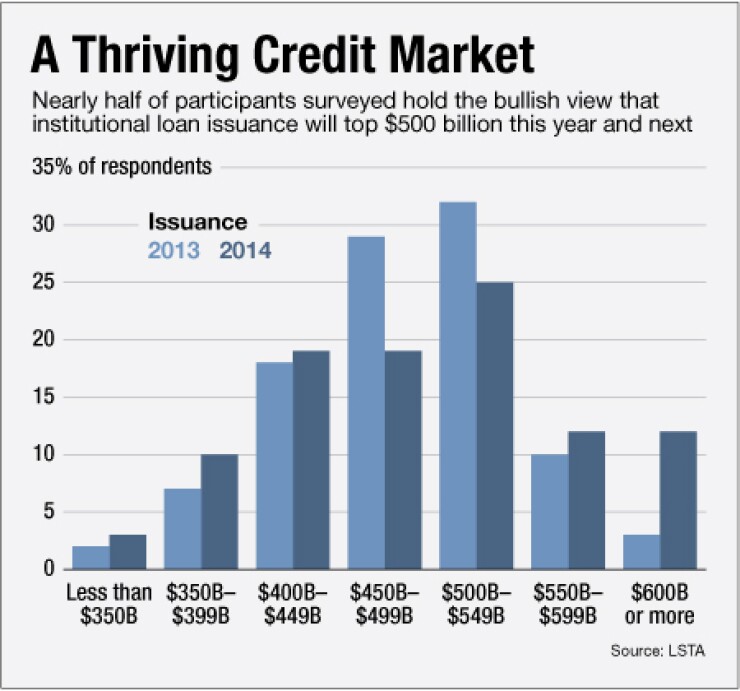

Institutional loan volume will climb this year and next in line with investor demand, according to a new survey of market participants by the Loan Syndications and Trading Association.

Nearly half of survey respondents who are LSTA members including banks, investors and traders forecast annual institutional loan issuance to reach $500 billion or more in coming years, up from $295 billion in 2012. More than half the respondents expect outstanding loan volume in the S&P/LSTA Leveraged Loan Index to exceed $650 billion by the end of 2014. It has already increased from $550 billion in December 2012 to $623 billion in September 2013.

At the same time, over half the respondents also expect assets under management in loan mutual funds to top $150 billion by the end of next year.

"In the face of significant concern over the potential for rising interest rates, investors are increasingly attracted to the loan market because loans offer variable interest rates and significantly better protection in the case of default," said Bram Smith, executive director of the LSTA. "Partly as a result of this increased investor demand, institutional loan volumes are also expected to rise, as borrowers take advantage of better conditions."

Survey respondents also believe issuance of collateralized loan obligations will continue to grow. They anticipate 2013 and 2014 volumes will materially outpace the $55 billion issued in 2012. On the other hand, respondents do not expect the amount of outstanding CLOs to grow much at all.

"These results indicate that a considerable amount of the new CLO issuance may be done to simply refinance existing deals that are out of their reinvestment periods," noted Meredith Coffey, LSTA executive vice president of research and analysis.

Bank lending, in which banks keep loans rather than sell them to institutional investors, is expected to be generally flat. Some survey respondents believe leveraged lending by banks may grow but, at the same time, more respondents see investment grade loan issuance falling rather than rising. The survey was taken over the last three weeks of August.

In both the institutional and bank markets, lender demand could outstrip supply, causing spreads to continue to normalize from their postcrisis levels. Nearly half of all respondents expect spreads to tighten from July's Libor plus 405 basis points seen in the institutional market. Leveraged bank loan spreads are also expected to contract from July's Libor plus 359 basis points.

Additionally, survey respondents expect secondary loan prices to climb on materially higher trading volumes.

"There remains continued strong interest in the loan markets," Coffey said. "In fact, respondents believe that secondary trading volumes could hit record levels."

Survey respondents also answered questions about potential threats to the loan market. In the near term, respondents identified three main issues: the eventual end of the

This story first appeared in Leveraged Finance News.