Most billion-dollar community banks have skirted the surge of traditional mergers and acquisitions that has engulfed their smaller peers — until now.

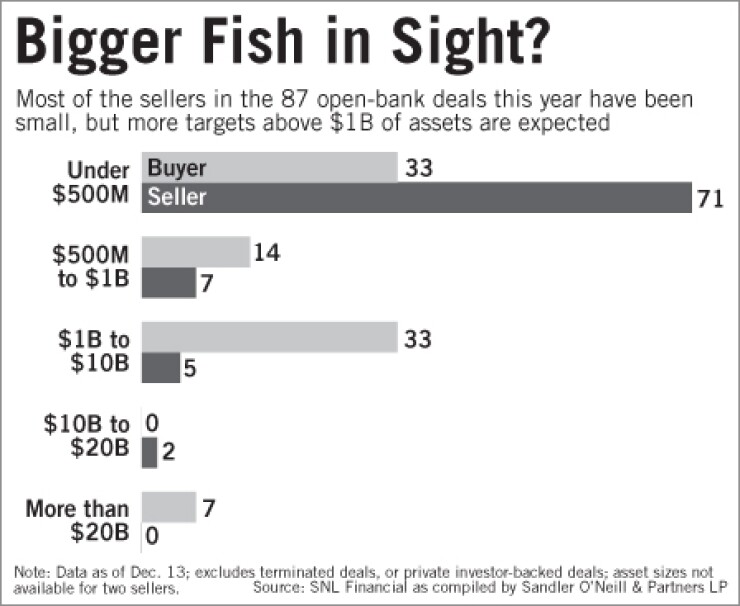

The recently proposed merger between Nara Bancorp Inc. and Center Financial Corp. in Los Angeles marked the second traditional deal this year between community banks that exceeded $1 billion of assets each. The other 80-plus deals announced to date were mostly among banks below the $1 million level, especially on the seller side, according to data from Sandler O'Neill & Partners L.P.

That mix is poised to change because larger community banks will find it harder to resist the economies of scale and earnings growth potential a union could create, experts said. Higher capital and regulatory costs are part of the driver. Bank board members also are more willing to bend after taking a beating from the recession.

"We've been seeing banks in (the $1 billion-$20 billion) asset range shoring up their balance sheets first," said Chris McGratty, an analyst at Keefe, Bruyette & Woods Inc. "That is setting the stage for a cleaner profile that will enable them to get into growth" mode, including through acquisitions.

The transition has developed gradually, experts said.

"The smaller companies that have been sold had a harder time trying to raise capital and didn't want to dilute their shareholders that much, so they resorted to a sale," said Mark Fitzgibbon, an analyst at Sandler O'Neill. Those in the $1 billion to $10 billion tier were "more likely to wait until the markets come back."

Those larger banks had been more able to raise the capital needed to work through the credit crisis without partnering with a competitor. And up until now, the volume of credit issues were hard to peg in this group, making deals dicey to negotiate.

"The problem was, through this environment, the loan marks have been so high that they couldn't make any offer" to buy, said Brett Rabatin, an analyst at Sterne, Agee & Leach Inc. And the interested buyer "is certainly not going to get duped into buying someone else's (nonperforming) portfolio."

The shift will be part of the larger M&A boom foreseen for 2011, Fitzgibbon said. "A year ago, when I called bank CEOs they would talk about how to fix credit problems. Now, all anyone's talking about is whether they can buy a bank down the road."

The deal between the $3 billion-asset Nara and $2.3 billion-asset Center — which would create the largest Korean-American bank — shows that even long-standing impediments can be overcome when greater incentives exist.

"This deal with Nara and Center has been in the works for years and years, and it has finally passed the social issues," Rabatin said. "I'm still not exactly sure what made it work."

Those involved described only vaguely the cultural roadblocks that had existed. "Particularly in the Korean culture, there is a certain way you do business and you really have to observe the protocol and sensitivity that sometimes occurs," Nara's president and chief executive, Alvin Kang, said in a phone interview Friday.

Kang cited several reasons for the successful negotiations, including the creation of a committee at each bank to address the social concerns from the boards. In terms of the timing, Kang said both companies' stock prices were trading more in line with each other, making it easier to negotiate the stock exchange rate, equalling $7.16 per share to Center's shareholders. And being that they already competed on close grounds, they recognized greater efficiencies together rather than operating separately amid a more costly capital and regulatory environment. The companies expect an $11.2 million in cost savings beginning in the fourth quarter of 2011 once they're combined into a $5.3 billion-asset institution.

"We were 100% committed, the time was right and we needed to get it done," Kang said.

Nara's deal valued at $285.7 million was the largest amongst the only two deals announced so far this year involving a buyer and seller within the $1 billion-to $10 billion-asset range.

The other deal involved the $6.6 billion-asset Eastern Bank Corp.'s purchase of Wainwright Bank & Trust, with $1 billion of assets, Nov. 18.

Eastern Bank's spokesman, Joe Bartolotta, said the main reason why the company bought Wainwright for $162.8 million was because it "filled a critical void in their marketplace" in downtown Boston and surrounding areas. And it creates greater potential for growth, he said.

"Earnings pressure is one of the greatest reasons for why a bank might sell," he said.

Likewise, the merger between Nara and Center would create an estimated increase in earnings per share of 21.3% for Nara and 9.7% for Center in 2012 , Kang said in the investor conference call late Thursday. Capital levels would also increase to a pro forma 18.4% total risk-based capital ratio based on third quarter financials, ultimately protecting it from credit or regulatory threats.

"It's becoming harder and harder to do business because of additional regulatory burdens and higher capital requirements," Fitzgibbon said. "Mergers are arguably the last and best way to do that and as a result, there will be consolidation at all levels."