KeyCorp continues to reap the benefits of its decade-old decision to focus on fee businesses.

The $187 billion-asset parent company of KeyBank reported third-quarter noninterest income of $797 million Thursday and told analysts that

Investment banking and debt placement fees of $235 million drove a large share of noninterest income during the period, up from $162 million just two quarters prior. Revenues for that business rose 61% year over year, and executives projected that quarterly profits will continue to exceed pre-pandemic numbers for the foreseeable future.

“I don’t think it’s going back to $160 million,” Chairman and CEO Chris Gorman said during the company’s quarterly earnings call, referring to quarterly fees from investment banking and debt placements. He predicted that double-digit growth in the business will continue.

KeyCorp started investing in fee-based businesses following the 2008-2009 financial crisis. The decision to change the business model was made, in part, to help decrease risk.

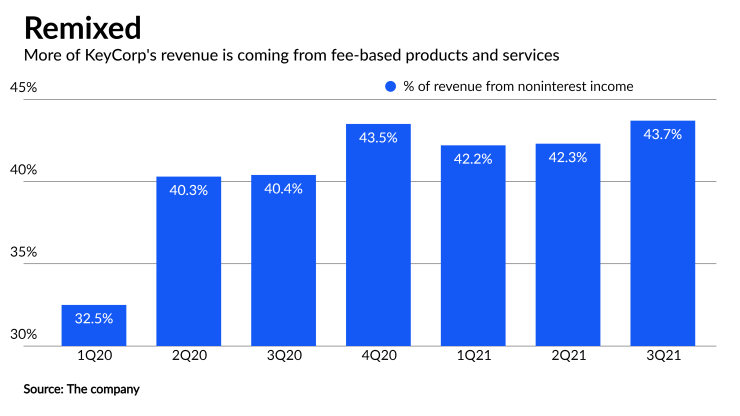

In the third quarter, fee-based businesses comprised 43.7% of total revenue at the company, up from 40.4% in the same quarter last year. In the first quarter of 2020, fee-based businesses accounted for 32.5% of total revenue.

Investment banking, and capital markets businesses in general, have been bright spots for Key and other banks over the last year and a half.

Across the industry, loan growth has been hurt by uncertainty about the pandemic’s trajectory and excess liquidity that was pumped into the market to fend off economic challenges. As a result, banks have increased their reliance on noninterest income.

At Key, part of the formula for driving more fee income involves hiring more bankers. The Cleveland company has increased its banker headcount by 6% this year, and some of those new hires are working in investment banking, Gorman said in an interview after the call

And while the number of bankers has risen by 6%, the number of calls to customers is up by 20%, he said.

In response to a question about the sustainability of growth in investment banking, Gorman said that the compounded annual growth rate over the past decade has been 11%. “We feel really good about the trajectory of this business,” he said.

Key’s quarterly net income totaled $616 million, up 55.2% year over year, but down 11.7% from the second quarter. Aside from investment banking, Key got a boost from commercial mortgage servicing fees, which rose nearly 89% from the year-ago period, and corporate services income, which climbed more than 35% during the same timeframe.

Average loans of $100.1 billion were down 4.6% from the same quarter last year, but they were nearly unchanged from the prior quarter. Commercial and industrial loans tumbled by 12.6%, but consumer loans rose by 9.7% as a result of growth in consumer mortgages and at Laurel Road, the digital banking platform for doctors and dentists that Key acquired in April 2019.

Key plans to open

“That tells me that the notion of targeted scale and a national digital affinity bank really resonates with people,” Gorman said. “This is a relationship-based approach … to understanding the needs and frankly the requirements of medical professionals.”

During the company’s earnings call, Gorman noted that the company’s franchise in Western states such as Washington, Oregon and Idaho is growing at a rate of more than two times the rest of the footprint. Key, which hasn’t purchased a bank

Analysts seemed to react favorably to Key’s results, though there was some caution.

While “Key’s fundamentals largely appear to be in an excellent place,” including a performance in investment banking “that has been quite strong,” there are some areas to watch, Piper Sandler analyst Scott Siefers wrote in a research note.

Those areas include reserves and capital levels that are lower than peer banks, as well as “the inherent volatility and difficulty in forecasting the investment banking business, especially when it has already been such a powerful and favorable driver,” Siefers wrote.