JPMorgan Chase spent more than a year researching what millennials (and clients wanting to bank like them) desire in a financial relationship. The result is a new mobile-only app that lets people sign up for a bank account within minutes and also helps manage their spending.

The megabank made a splash on Monday debuting Finn by Chase, an app that includes a checking and savings account and a physical debit card. The app includes various personal financial management tools and some novel features, including the ability to let customers rate transactions with an emoji, which tells the app whether the user is happy about the purchase.

As incumbent banks and young fintechs jockey for millennial clients, their competing products reflect insight gained into the banking choices among young people. Finn was designed to feel helpful and advice-driven because Chase’s research showed many millennials “felt judged by a lot of their other financial experiences,” said Matt Gromada, the product lead for Finn.

For this fickle demographic, a small gesture does matter: FICO researchers note that almost half of the millennials they surveyed don't think that their banks communicate to them through their preferred channels, or send them marketing material relevant to their future plans.

“We did 15 months of research, and really tried to co-create a product with our customers,” Gromada said.

For instance, Finn will let users set up savings rules: the app will automatically save $5 every time someone goes shopping — a feature reminiscent of

Initially, the account is open only to iOS users in St. Louis, Mo. — a state where the bank has zero branches. Next year, Chase said, it will roll out the app to additional cities and to Android users. Notably, customers have to enroll in mobile bill pay, according to the

JPMorgan Chase follows a few other banks that have started mobile-only units, which has become a burgeoning trend. These include

It’s not just banks; some fintechs too have launched bank accounts tied to a value-added service they already offer, such a micro investing and money management. One recent example is Stash Invest, a microinvestor

For Chase, one of the goals of Finn is to offer customers many of these services all in one location with a more personal touch, Gromada said. “We wanted to create something that felt human and make them feel like they’re speaking to a close friend rather than a big institution,” he added.

Having a mobile-first offering integrated with PFM tools is a good strategy for Chase at a time when more banks are starting to look at this model, said Sam Kilmer, senior director for Cornerstone Advisors.

-

There is seemingly endless research on the attitudes of millennials toward banks, but the major takeaway from all of it is that banks can't expect millennials to want to bank only one way.

March 16 -

Millennials care about more than money. So it's important for recruiting efforts to show what bankers do for their communities.

October 10 -

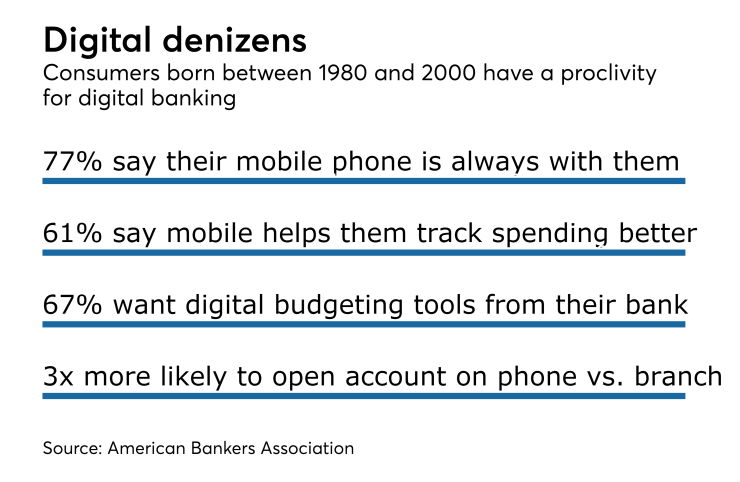

Just how digital are Millennials?

October 31

“The money management, reminder, and autosave options seem helpful,” he said. “From the experience of earlier limited adoption of PFM and other money management tools over the years in the market, the key in early stages will be whether Finn is perceived as a gentle helpful ‘nudge’ or a merciless ‘nag.’ Even more than the money management tools, the 24/7 service option — if well-executed — could really raise expectations on what the market expects of service from any bank, much less a mobile-only one.”

Kilmer added that Finn “appears to be an attempt to reach beyond the normal Chase and general bank reach — ‘bank’ is not in the app name. On the other hand, will it really accomplish that with ‘Finn by Chase,’ which seems like more of a product brand?”

Gromada said Finn is not about creating a separate entity for the sake of it, rather to give customers another option of how they bank. Many customers still like to use the branch network along with the regular Chase mobile app for some tasks, but may not want all the features Finn has to offer.

“We have many customers who love the branch — 75% of our deposit growth comes from the branch network — and we have products that are great for those customers,” he said. “Our goal is to offer customers the products that allow them to interact with the bank how they want to.”

Mary Wisniewski contributed to this report.