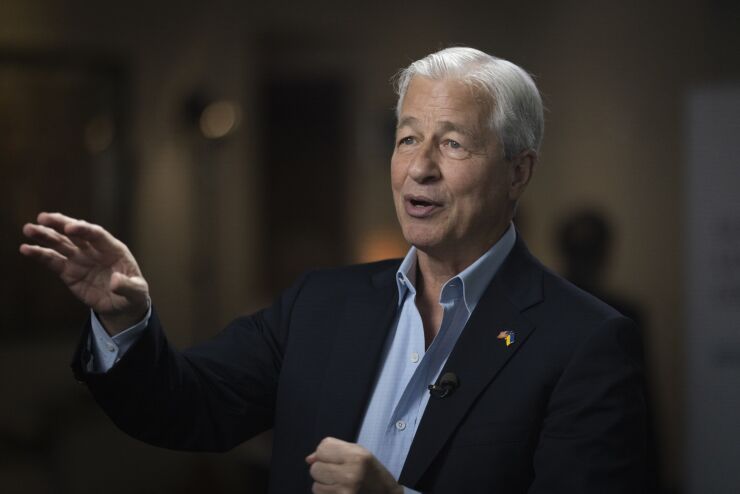

Modifying specific rules — such as excluding Treasuries from certain capital requirements — will not only help banks, but also ease pressure on the markets, Dimon said during

"I believe you can have a safer system, lend more money, have more liquidity, eliminate bank runs, eliminate what happened to First Republic and Silicon Valley," Dimon said, referring to two banks that failed in 2023. "And you could accomplish all of that with completely rational and thoughtful regulations."

Last quarter,

The leader of America's largest bank has often lambasted current regulations. But after a stir in the Treasuries market this week, Dimon's prescriptions for capital rules seem especially prescient, Piper Sandler analyst Scott Siefers told American Banker.

"It seems like there's a lot of capital that's just trapped in the system," Siefers said Friday. "Presumably for us to have a more robust macroeconomic recovery, we're going to need that capital to get utilized more productively."

As

Broad regulatory changes likely wouldn't lead to an expense decrease that shows up in

Dimon's latest comments on the regulatory landscape came after the bank announced solid quarterly results, with revenue from its markets business buoying still-tepid net interest income. Earnings per share of $5.07 blew past consensus analyst estimates of $4.64, according to S&P. The bank reported profits in the first quarter of $14.6 billion, up 9% year over year.

Trump administration tariff policies that rattled Wall Street in the first few weeks of April haven't yet caused big hits to

Dimon said that he doesn't think all the uncertainty that's been putting clients on edge will be resolved in the next few months. But solidifying trade policy would be the best way to quell fears, he said.

JPMorgan Chase's CEO emphasized his concerns about geopolitical conflict and brought up recent culture shifts at the bank in his annual letter to shareholders.

SLR specifics

The disturbance in the bond market earlier this week — apparently one of the main factors that led President Donald Trump to walk back some of his tariffs — has revived arguments in favor of changing a capital requirement called the supplementary leverage ratio.

Dimon said in his recent letter to shareholders that the SLR and capital rules for global systematically important banks treat Treasuries as "far riskier than they are."

"

Piper Sandler's Siefers affirmed that the SLR isn't a binding constraint for megabanks like

Federal Reserve Chair Jerome Powell

The last major disruption in the Treasuries market came at the beginning of the pandemic, and the Fed responded by temporarily allowing banks to nix Treasuries from SLR formulas amid massive amounts of U.S. debt issuance and stimulus programs. The exemption ended in 2021.